Two-thirds of all the growth in global advertising expenditure between 2017 and 2020 will come from paid search and social media ads.

Zenith’s Advertising Expenditure Forecasts, released this week, shows total spending will increase from US$86bn to US$109bn on paid search, and from US$48bn to US$76bn on social media. Paid search will grow by US$22bn over this period, while social media will grow by US$28bn, making it the single biggest contributor to growth.

In Australia, search (including directories) spend will grow an average 4% per year over the next three years. With search accounting for +45% of the annual AU$8bn digital ad market, this growth is substantial versus the market average. However, once Amazon allows for advertising on its website in Australia, Zenith would look to increase this forecast.

Paid search has undergone constant development in recent years. Search platforms, agencies and brands are applying ever more sophisticated artificial intelligence techniques to improve targeting, messaging and conversion. Search is becoming more integrated with commerce, both online – as brands shift budgets to e-commerce platforms – and offline, as retailers use location and store inventory data to match active shoppers directly with the products they’re searching for.

All these developments are attracting higher performance budgets from brands, often new expenditure rather than being diverted from brand awareness activity. Overall Zenith expects them to drive an average of 8% annual growth in paid search ad spend between 2017 and 2020.

The next step in the evolution of search is voice search, but so far there has been little direct advertising through voice assistants. When users make a voice search on a smart speaker, they will normally only be presented with the first organic result. Voice searches on smartphones may present more results, but not as many as manual searches. The rise of voice search therefore makes it more important for brands to identify the keywords they absolutely need to own, and to build content that sends them to the top of organic results.

“Search’s nature as a ‘pull medium’ and the fact it already makes up almost 50% of digital investment, will see ad spend continue to grow as usage increases,” said Zenith head of investment for Sydney, Elizabeth Baker.

Much of the recent rapid growth in social media advertising has come as platforms have replaced static ads with more engaging video ads. So far these social video ads have acted more as complements to television ads than competitors, but the platforms are now competing with television more directly by hosting long-form content like sport, drama and comedy, and inserting mid-roll ads like those seen in television breaks. Overall Zenith forecasts social media global ad spend to grow by an average of 16% a year to 2020, twice the rate of paid search.

“In Australia, the growth of social we see as being driven by not only by the increasing number of platforms and consumer usage, but also the diversification of ad units within the platforms. From users consuming more video content, shopping straight from an image in Instagram and to the increasing use of bots, this drives incremental spend in the channel,” Baker said.

The fastest-growing traditional medium is cinema, which Zenith forecasts to grow by 16% a year thanks to rapidly rising admissions in China. It is a tiny medium, though, representing just 0.8% of total ad spend this year. Otherwise outdoor is the strongest performer, with 3% annual growth. Outdoor is benefiting from its wide reach and ability to create mass awareness, which allows it to complement highly targeted online advertising for premium brands.

Global ad spend forecast remains stable

Zenith has held its forecast for global ad spend growth this year at 4.5%. In Australia, it is anticipated that ad spend will increase by 3.3% in 2018, which is an upgrade from the previous forecast.

Growth of advertising expenditure and GDP 2017-2020 (%)

“All media in Australia, with the exception of print, is likely to be stable to up in 2018 with the outdoor and internet categories out-performing the total media spend trend. Video and mobile are driving internet growth. However, total internet growth is slowing,” Baker said.

Sectors contributing most to market growth in Australia include government (+26%), gambling (+24%) and domestic banks (+30%). The largest year-to-date decline has been reported by the Movies / Cinema / Theme Parks category.

“The banks’ advertising investments continue to climb in the wake of the Royal Commission into the banking and financial services industry. There have also been a number of elections and by-elections that have resulted in an increase in Government spend. Our forecast assumes that the next Federal Election will occur in 2019. Although technically it could be called this year, many believe this is unlikely due to the recent change in prime ministership,” Baker said.

“More recently, the media sector has ramped up spend due to increased investment by digital companies on brand-building campaigns.”

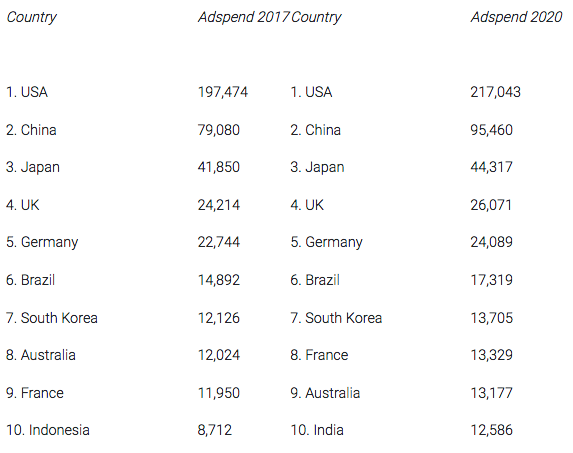

Top 10 ad markets

US$m, current prices. Currency conversion at 2016 average rates.