Stronger-than-expected internet advertising will drive 4.7% growth in total global adspend in 2019, according to Zenith’s latest Advertising Expenditure Forecasts. That’s substantially ahead of the 4.0% forecast made in the previous edition of the report, published in December 2018. Zenith forecasts 4.6% growth in both 2020 and 2021, ahead of previous forecasts of 4.2% and 4.1% growth respectively.

Highlights from the latest forecast:

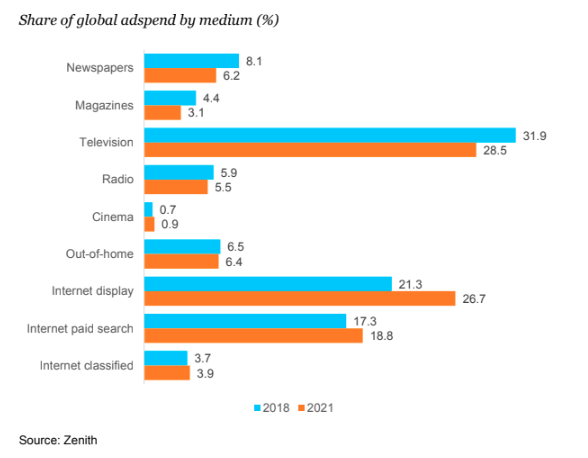

We have upgraded our forecasts after internet adspend markedly exceeded our expectations in 2018. We now estimate that internet advertising grew 16% last year, up from our previous forecast of 12%. In dollar terms, we have upped our estimate of the internet adspend total in 2018 from US$231bn to US$246bn. This leads us to expect faster growth for the next few years – an average of 10% growth a year to 2021, up from our previous forecast of 9%. We now expect internet advertising to reach US$329bn in 2021, and account for 49% of all global adspend, up from our 47% forecast in December.

This growth is being driven by the overlapping channels of online video and social media, which we expect to grow by 19% and 14% a year to 2021 respectively. We forecast display advertising as a whole – which encompasses video and social, as well as banners – to grow by 13% a year, while paid search and classified lag behind, growing at an average of 7% a year each.

In Australia, Zenith forecasts that by 2021, digital’s share of the adspend pie will exceed 60%. Although a degree of slow-down is anticipated, particularly across search, display advertising is still expected to witness strong growth. According to the IAB’s 2018 report, display adspend increased 15.8% in 2018, a clear signal of the health of the medium.

The US leads global growth

We have made the biggest increases in our internet forecasts in the US, Russia and France. We have increased our overall growth forecasts for 2019 from 2.9% to 5.0% in the US, from 7.1% to 8.2% in Russia, and from 3.7% to 4.7% in France. The US accounts for 37% of all global adspend, so any upgrade here has a great effect on the global total. We expect the US to be by far the largest contributor to global adspend growth between 2018 and 2021, adding US$32bn to the market. China will be in second place, adding US$16bn, and India in third, adding US$5bn.

Small businesses target narrowly, while digital challengers target widely and often

A large proportion of the growth in internet advertising – and therefore the ad market as a whole – is currently coming from small businesses, such as local shops, restaurants, and hobby stores. Platforms like Google and Facebook have opened the ad market up to many small businesses for the first time, by offering simple self-serve tools to create ads and manage campaigns, and provide the localisation and targeting they need to reach their limited potential customer base, converting customers effectively. Small business advertising is rising from a very low base, towards a share of the ad market that better reflects their contribution to the economy: in most countries small businesses contribute half or more of GDP and a larger share of employment. These businesses don’t need to use mass media to create wide awareness – indeed, their customer base is often so limited, by geography or special interest, that using mass media would be too wasteful.

Digital challenger brands are supporting offline media

Challenger brands do not rely on digital advertising alone, and are establishing themselves as prominent advertisers in offline media, particularly television and out-of-home. Spending by these digital-native brands is helping to prop up global television adspend, which is roughly stable despite rapid declines in traditional television viewing in key markets like the US and China. We forecast television advertising to grow by 0.7% a year to 2021. Note that this includes only traditional, linear television; television-like services delivered over the internet are included in our internet adspend totals.

Out-of-home advertising is the fastest-growing traditional medium in dollar terms – we expect it to grow by US$4.4bn between 2018 and 2021, ahead of television’s US$3.7bn.

Print advertising continues to decline. We forecast magazine adspend to shrink by US$5.0bn between 2018 and 2021, and newspaper adspend to shrink by US$6.3bn, with no end to either decline in sight. Between 2013 and 2018 their combined share of global adspend fell from 24% to 13%, and we expect this share to fall further to 9% by 2021. Again, these figures only include advertising in printed publications – any advertising on publishers’ websites or other online brand extensions is included in the internet advertising total.

In Australia, for a variety of reasons 2019 is looking to be a difficult year for businesses. The country has entered a “per capita recession” as consumer confidence dropped to its lowest level since September 2017. Retail sales fell below expectations in December and January, and the threat of Amazon continues to loom large. At the same time, the financial services sector is still reeling from the findings of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, released in February. To complicate matters, both NSW and Federal elections will also be taking place in the first half of the year.

Elizabeth Baker, Sydney head of investment, Zenith said: “All things considered, from an advertiser perspective we anticipate any potential leap towards austerity being countered by the fight to maintain market share, particularly in the retail and auto sectors. Government advertising has also started to enter the market and will be felt across TV and radio in particular.

“Similarly, domestic banks will have to re-enter the advertising market later in the year as they seek to regain trust and mitigate customer switching in the wake of the Royal Commission. Overall, Australian adspend is likely to grow to the tune of around three per cent every year until 2021.”

Zenith’s global commentary

“Internet advertising will exceed a quarter of a trillion dollars for the first time this year,” said Jonathan Barnard, Zenith’s head of forecasting and director of global intelligence. “The speed of internet adspend growth continues to surprise us, as small businesses and digital challengers provoke established brands to up their game.”

“Brands with more than a niche market share still need interruptive advertising at scale to acquire new customers,” said Ben Lukawski, Zenith’s global head of strategy. “As more communication takes place online, the challenge for brands is to build distinctiveness through frequent short-term exposure, rather than the occasional but longer exposures common to traditional media.”

—

Top Photo: Elizabeth Baker