ARN Media held its AGM at its new North Sydney HQ this morning. The meeting came just one day after it flagged the exit of Anchorage Capital from its proposed SCA acquisition.

Both ARN chair Hamish McLennan and CEO Ciaran Davis addressed what happens next. As Mediaweek reported yesterday, the company still wants the Triple M network. In the comments below, ARN has branded what would be left of SCA, after the acquisition of Triple M and Listnr, as NewSCA.

ARN Media board members joining McLennan and Davis at the AGM were Belinda Rowe, Brent Cubis, Alison Cameron and Paul Connolly.

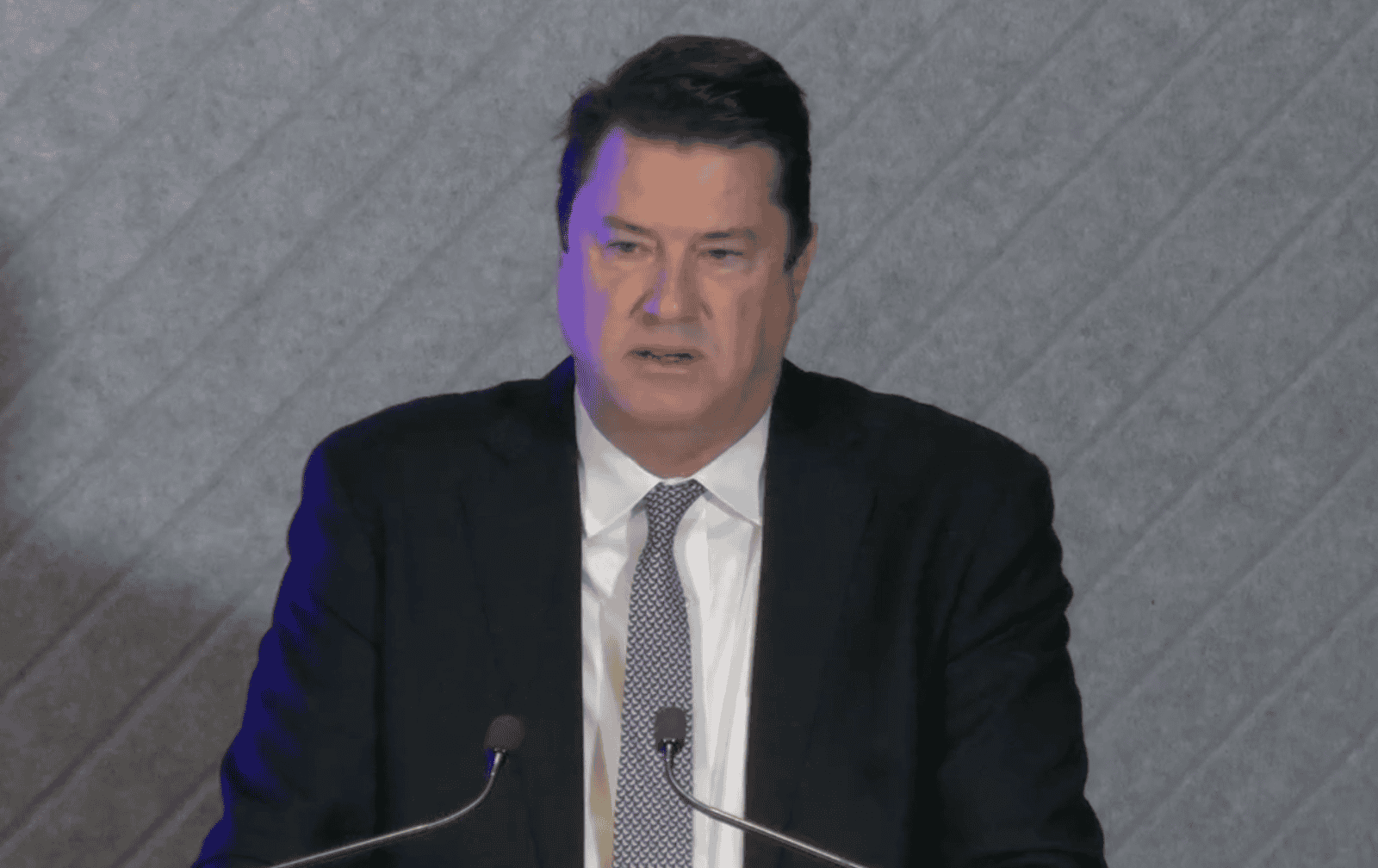

ARN chair Hamish McLennan

McLennan commented: “We are focused on progressing the proposal with SCA, and while market restructuring has been talked about for a long time, the fact remains that today’s regulatory environment is not reflective of the market in which Australian media operates and urgently needs government action.”

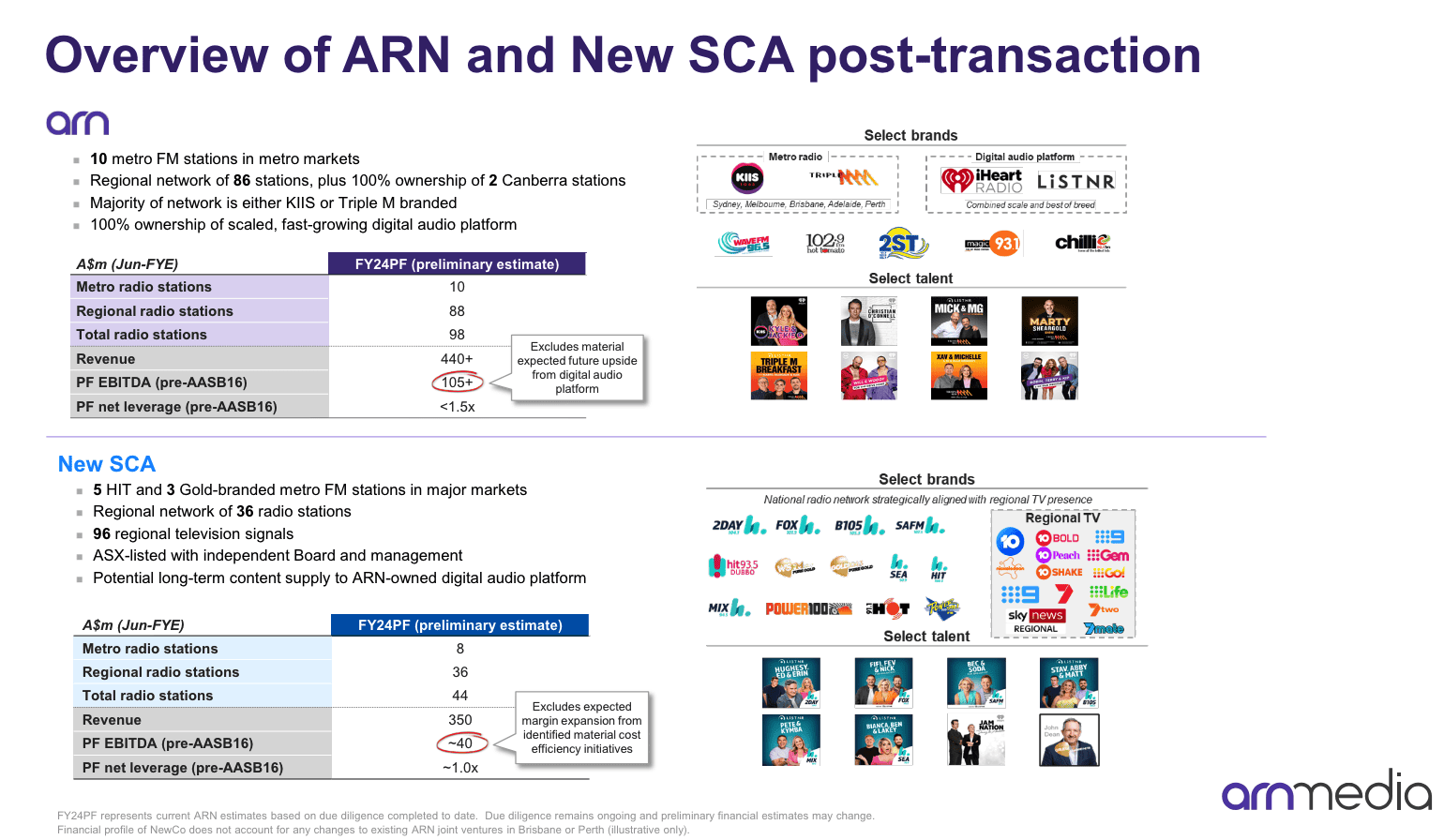

In his AGM address, Davis started with: “I would like to expand on the indicative proposal outlined by the chairman earlier and one we are submitting to SCA.

“ARN would become a focused metro radio network with 10 quality stations across five capital cities, anchored by the KIIS and Triple M brands in each location. It will have a significantly larger, growing and profitable regional radio footprint connected with local communities and benefit from ARN learnings from the successful acquisition of stations from Grant Broadcasting.

“Revenues would be $440m+ with EBITDA of $105m+ excluding the opportunity for accelerated growth via 100% ownership in a scaled digital audio business that is expected to contribute meaningfully to profit and cash flow in the near term.”

See also: Anchorage pulls pin on ARN and SCA deal due to regional TV decline

Ciaran Davis on NewSCA

“NewSCA would own a national network of 44 radio stations, comprised of 5 HIT branded and 3 Gold branded metro stations and 36 regional markets and 96 regional television signals.

“It would be ASX listed with an independent board and management and is expected to have approximately $350m of FY24F revenue and $40m of combined FY24F radio and television EBITDA on a stand-alone basis before adjusting for expected margin expansion from identified material cost efficiency initiatives.

“NewSCA would operate with a conservative capital structure of approximately 1x. NewSCA would enter into a long-term content supply agreement with the ARN-owned digital audio platform unlocking a new revenue stream and enabling both parties to benefit from the combined scale and efficiency of investment in digital audio.

“In addition, it will have full optionality to participate in expected future media market restructuring of radio and TV assets, in whole or on a separated basis.

“ARN continues to considers the acquisition of certain SCA radio assets and the combination of ARN and SCA digital audio assets as a unique and actionable opportunity.

“This highly strategic proposal proactively positions both businesses for the future as the Australian media sector evolves. The commercial rationale is well understood. It aims to unlock both immediate and long-term value creation for both sets of shareholders.

“After many months of diligence, the transaction is actionable now and able to be undertaken efficiently without undue execution risk.

“To reiterate, ARN remains committed to delivering an attractive and certain outcome to SCA shareholders at the earliest possible date and we are prepared to work with SCA to review the ARN and NewSCA transaction perimeters optimising the strategic and value outcome for both sets of shareholders.”

ARN board at 2024 AGM