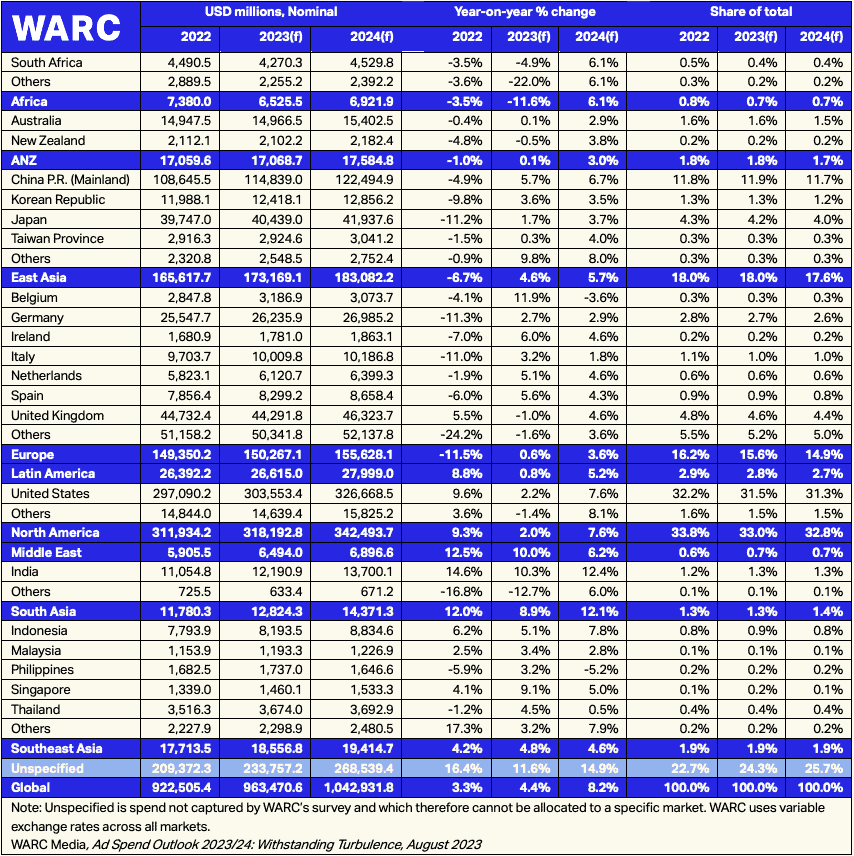

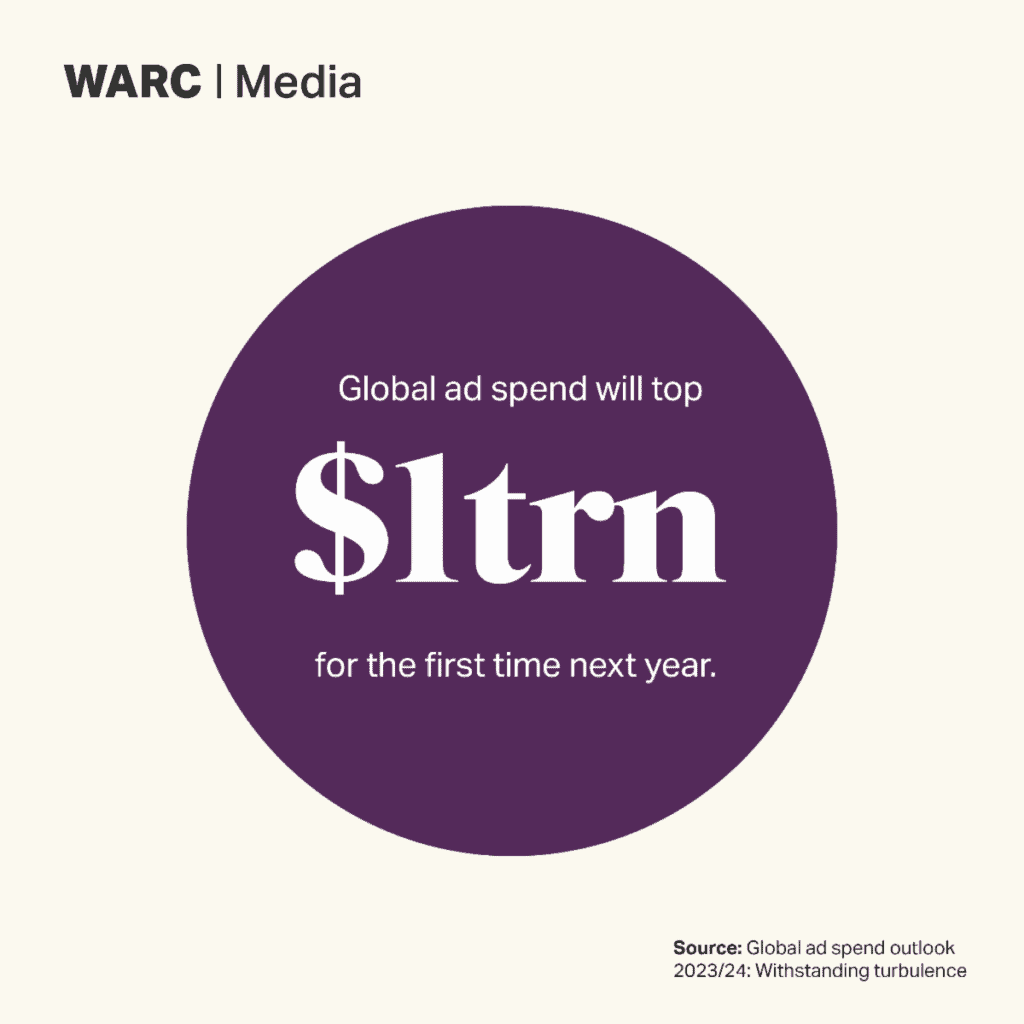

WARC has released a new study that has found that global advertising spend is on course to grow 4.4% this year and a further 8.2% in 2024, by when expenditure will have topped $1 trillion for the first time.

The new analysis for the first time combines data from WARC’s proprietary survey of media owners, industry bodies, ad agencies and research organisations in 100 markets worldwide with advertising revenue data from 40 of the largest media owners to offer a complete picture of advertising trade.

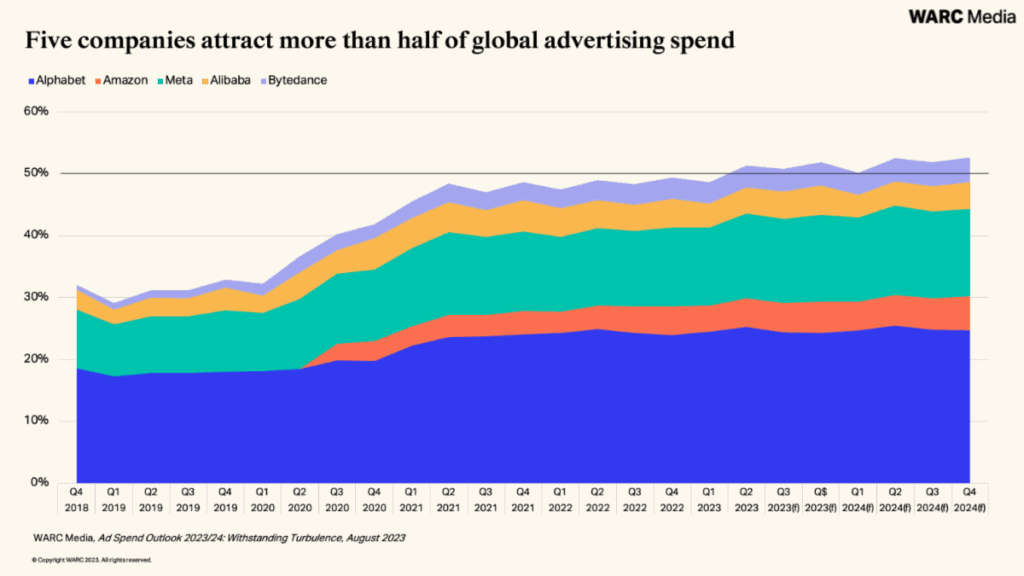

The data shows that just five companies – Alibaba, Alphabet, Amazon, Bytedance and Meta – will attract over half (50.7%) of global spend this year and will consolidate that position into 2024 with a share of 51.9%. Advertising revenue among this group is expected to rise 9.1% this year and 10.7% next year, while ad revenue among all other media owners combined will be flat this year.

A resurgent social media market – a fifth of all spend – will drive growth into 2024, though emerging channels such as retail media and connected TV (CTV) – measured for the first time in this WARC study – are also poised to see increased investment from brands over the coming 18 months.

James McDonald, director of data, Intelligence and Forecasting, WARC, and author of the research, said: “High interest rates, spiralling inflation, military conflict and natural disasters have made for a bitter cocktail over the preceding 12 months, but the latest earnings season shows that the ad market has withstood this turbulence and has now turned a corner. Our new measurements show how the fortunes of just five companies have a major bearing on the prospects of the industry at large, and that these companies are on course to record oversized gains in the coming months.

“With the establishment of retail media as an effective advertising channel, the advent of connected TV as the next evolution of conventional video consumption, and the continued growth of social media and search, we are seeing once again the value advertisers place in leveraging first party data to target the right message to the right person at the right time.”

Key findings outlined in WARC’s Global Ad Spend Outlook 2023/24: Withstanding Turbulence are:

• Global ad spend is forecast to rise 4.4% this year to a total of $963.5bn and then 8.2% in 2024 to a total of $1.04trn; social, retail media and CTV are set to lead growth

Market growth in 2024 will be boosted by the US Presidential campaign (political spend is estimated to reach $15.5bn globally next year), sporting events such as the Olympics and UEFA Men’s Euros, and improved trading conditions – particularly in China.

The forecasts suggest Social Media will be the fastest-growing medium, with spend rising to a total of $227.2bn next year – a fifth (21.8%) of total spend. Meta – owner of Instagram, Facebook and Whatsapp – controls almost two-thirds (64.4%) of the social media market, with expected ad revenue of $146.3bn next year. TikTok owner Bytedance then follows, though estimated ad revenue of $39.9bn in 2024 equates to a 17.6% share, some 3.5 times smaller than Meta.

Retail Media will also be among the fastest-growing advertising channels over the forecast period; here spend is set to rise 10.2% this year and 10.5% next year to a total of $141.7bn – 13.6% of all spend. Within this, Amazon is the dominant player with an expected share of 37.2% of all retail media spend equating to $52.7bn next year. While Amazon grows its share, Alibaba, the Chinese incumbent, is losing ground to Pindoudou (14.4% of global retail media spend next year), JD.com (9.9%) and Meitaun (3.7%) in an increasingly competitive Chinese market.

Connected TV (CTV) is also projected to grow well this year (+11.4%) and next year (+12.1%), reaching a total of $33.0bn – only 3.2% of all spend but 16.2% of premium video spend (CTV and linear TV combined). CTV media owners are mostly competing for existing TV budgets rather than winning share of spend from digital channels like social, or accessing new budgets such as retail media. It only took retail media 10 years to grow tenfold, and in the same time the size of the CTV ad market has only grown three-fold, according to WARC Media’s latest Global Ad Trends report.

Increased spend on CTV will not be enough to offset declining spend on Linear TV (-5.4%) this year, though political and sporting events are set to boost linear TV spend by 3.5% in 2024. Linear TV is still the world’s third-largest advertising medium, with an expected share of 15.6% equating to advertiser spend of $163.0bn in 2024.

Elsewhere, Search is on course to grow to a total of $229.2bn in 2024, equivalent to 22.0% of all advertising spend at that time. Google will remain the dominant player with an 83.1% share of the search market in 2024, up from 82.6% in 2023 and equal to $190.5bn in ad revenue. China’s Baidu will see its ad revenue rise modestly but its share dip to 6.5% next year, while Bing’s share of the search market is set to hold at 6% despite revenue growing to $13.6bn next year.

Outdoor (+7.3%), Cinema (+5.2%), and Audio (+3.3%) are also set to see advertiser spend increase next year, though losses are expected among publishing media (-1.9%), including a 1.6% dip for Newsbrands and 2.5% fall for Magazine Brands.

• Financial Services (+11.5%), Technology & Electronics (+11.3%) and Pharma & Healthcare (+11.0%) the fastest-growing consumer sectors next year. Political spend is expected to reach at least $15.5bn in 2024.

An analysis of spend by product sector shows that Financial Services (+11.5%) is on course to be the fastest growing sector in 2024, followed by Technology & Electronics (+11.3%) and Pharma & Healthcare (+11.0%) – a TV stalwart but for which digital formats now attract over half of spend.

Products within consumables sectors are expected to record solid growth into 2024, with most now focusing more dollars on retail media platforms. Food (+7.5% in 2024), Household & Domestic (+7.8%), Nicotine (+9.3%) and Soft Drinks (+8.1%) are all anticipated to record increased advertising investment. While less prevalent in retail media settings, Clothing & Accessories products should still see a 7.4% rise in advertising investment next year.

More muted growth is expected among the largest grouping – Retail – this year and next, proportional to the pressure consumers are facing in North America and Europe through high inflation. The Business & Industrial sector – the second-largest monitored by WARC – is forecast to record an increase (+6.9%) next year however as trading conditions become more favourable, while the Automotive sector is also poised to grow well (+4.7% in 2024) after a period of decline due to supply-side issues.

Within service sectors, rises in advertising spend are expected next year within the Media & Publishing sector (+3.3%) – which includes companies such as Netflix – as well as Leisure & Entertainment (+3.9%) and Telecoms & Utilities (+10.4%).

Finally, the WARC report noted that Political spend is already tracking well ahead of the 2020 cycle and should reach a new high of at least $15.5bn next year, owing mostly to US Presidential campaigns.

• US to account for almost a third (31.3%) of global spend; the US market is forecast to rise 2.2% to $303.6bn this year then a further 7.6% to $326.7bn in 2024.

Taken together, advertiser spend across North America is forecast to rise 2.0% this year and 7.6% next year, in line with the largest market – the US.

Advertising spend in Europe is set to rise just 0.6% this year, before the rate of growth increases to 3.6% in 2024 as economic headwinds ease. Prospects are more challenging in central and eastern Europe though, while the UK – the largest single ad market in the region with a 4.6% share – is set to see a dip of 1.0% this year when measured in US dollars. Spain (+5.6% in 2023), Italy (+3.2%) and Germany (+2.7%) are all expected to record growth this year and next.

The Middle East is among the smallest regions (just 0.7% of global spend) but is anticipated to be the fastest-growing over the forecast period, with spend up 10.0% in 2023 and 6.2% in 2024, by when the ad market will be worth $6.9bn.

Spend in South Asia is also growing rapidly (+8.9% this year, +12.1% next year), buoyed by a strong Indian market. Ad spend in India is forecast to grow by double digits over the next 18 months to reach a total of $13.7bn in 2024 – 1.3% of global spend.

Southeast Asia is forecast to grow 4.8% this year and 4.6% in 2024, with Singapore (+9.1% in 2023 and +5.0% in 2024) and Indonesia (+5.1% and +7.8%, respectively) growing faster than the wider region and consequently gaining share. Growth will be recorded across all major markets in the region, including Thailand (+4.5% in 2023), Malaysia (+3.4%) and the Philippines (+3.2%).

Conversely, Africa is enduring a difficult year, with spend set to be down 11.6%. Growth should return in 2024, however, buoyed by a 6.1% rise in South Africa next year. Growth is also set to be muted in Latin America this year (+0.8%) before the rate of expansion increases in 2024 (+5.2%).