WARC has released the 2023 Consumer Trends Report, exploring key issues that will influence consumer purchase decisions across brands and categories globally with regional highlights for APAC, Europe and North America.

Key issues that are influencing consumer purchase decisions across brands and categories highlighted in the report are: new spending habits driven by inflation, sustainable living, Gen Z’s mental health crisis, the rise of social commerce and a shift between privacy and convenience.

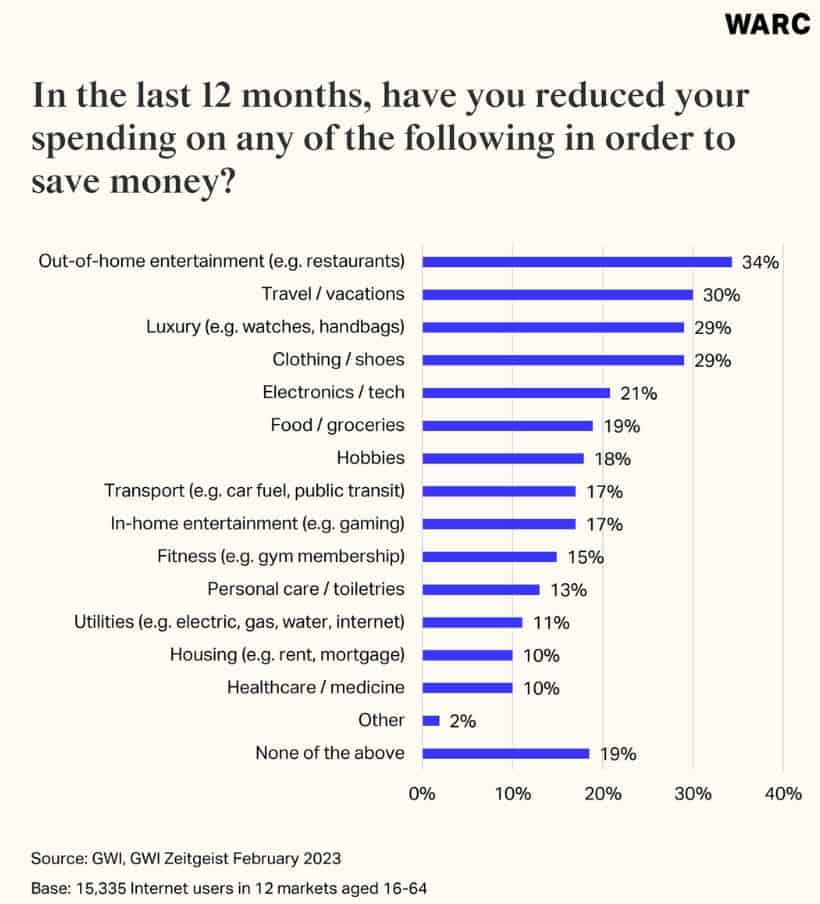

Consumer spending is shrinking: Two in five (40%) of consumers are spending less now compared to 2022. Over a third (34%) have cut spend on out-of home entertainment

Data from GWI shows that globally two in five (40%) consumers are spending less money now compared to 2022 and price-conscious consumers are forced to make tradeoffs as their purchasing power shrinks.

Over a third (34%) have pared back on out-of-home entertainment in the last 12 months. Notably, with over 3 billion gamers worldwide, consumers are only half as likely to cut down on in-home entertainment (17%).

Other areas seeing reduced spend include travel (cited by 30% of consumers), luxury purchases (29%), and clothing (29%). However, consumers are still finding ways to enjoy life through treats. Two in five (39%) dined out in the past six months – up 11pp from August 2022.

Dr Grace Kite, founder and economist, Magic Numbers, advises: “Marketers that want to survive the coming shakedown need to look through their toolkits with a new lens and prioritise strategies that convince consumers their product is worth paying for.”

Sustainability matters, but price matters more: 74% of consumers perceive price as a major influence on purchase decisions compared to a brand’s commitment to sustainability (47%)

The WARC report found consumers still care about brands’ commitment to sustainability and social responsibility, but the high cost-of-living is pushing them to balance these issues against price concerns.

Three-quarters of consumers worldwide (74%) perceive price as a major influence on purchase decisions, compared to 47% who cited a brand’s commitment to sustainability as a purchase factor.

Bill Alberti, managing partner, Interbrand, said: “In many cases, being ‘green’ is used by brands as a vehicle to drive premium pricing. But, with cost of living a pressing priority for many, consumers will choose less expensive options as prices increase. Because they will have to, and because they can.”

Gen Z is facing a mental health crisis: Personal finances (36%) is their greatest concern, followed by prices of products (34%) and climate change (34%)

Gen Z’s mental health struggles are on the rise but growing awareness around the issue has led this generation to take action and prioritise their wellbeing.

According to GWI data, their biggest concerns revolve around their personal finances (36%), prices of products or services (34%), and climate change (34%).

While nearly 3 in 10 (29%) Gen Z say they are prone to anxiety – a higher proportion than any other generation, they are more likely to take steps to manage their mental wellbeing such as doing hobbies / activities they enjoy (55%) and spending less time on social media (37%).

Abhimanyu Kumta, lead – digital listening, Quantum Consumer Solutions, said: “Platforms like Discord have seen drastic growth amongst the youth as well as other audiences, where it helps people casually hang out with friends, connect with strangers over common interests, play games and so much more.”

Social commerce is on the rise: it is forecast to reach USD$2tn by 2025, representing a quarter of all online retail sales that year

The social commerce market shows no signs of slowing down, driven by increasing social media usage and effective influencer marketing, according to the WARC report.

Analysis by Kepios shows that in April 2023, the number of social media users worldwide was estimated to be 4.8 billion – nearly 60% of the global population. Users spend on average over 2 hours per day on these platforms.

Mirroring this increase in consumption, the social commerce market is expected to expand, reaching approximately USD$2tn by 2025 per Deloitte, (representing roughly a quarter of all online retail sales that year).

Nearly half of Gen Z and millennials follow influencers who regularly promote products or brands (44%) and are likely to purchase a product recommended by influencers (45%). For approximately half of these cohorts, influencer recommendations are more engaging than regular ads.

Wendy Wang, head of influencer marketing APAC, Media.Monks, said: “Businesses that devote themselves to producing authenticity-focused content have a higher chance of succeeding within the competitive social realm since customers currently crave tailor-made, bona fide experiences.”

Shifting the balance between privacy and convenience: 53% of consumers perceive ad targeting as intrusive. 62% find personalised recommendations helpful

The contradiction in consumer attitudes towards personalised marketing highlights the fine line that brands must tread between convenient and intrusive.

Over half (53%) of internet users find ads specifically targeting them to be intrusive. A slightly larger proportion (62%) think personalised product recommendations are helpful. Notably, more than a third (34%) agree with both statements.

While consumers express concerns about data privacy, protecting their online experience takes clear precedence, the WARC report noted. More than half of ad-blocker users cited ‘too many ads’ (61%) and ‘ads getting in the way’ (54%) as reasons for using the software.

Brian Kane, founder, Sourcepoint, said: “Most customers are happy to hand over data in exchange for personalised experiences. By using data respectfully, brands create more loyal customers, improving lifetime value along the way. This is a balancing act worth figuring out.”

Summing up, Stephanie Siew, research executive, WARC, said: “Behaviours are shifting as consumers learn to live with long-term unknowns, from uncertainty around the future of the economy to rapid advancements in technology. Our 2023 Consumer Trends reports will help marketers respond to the macro trends that will impact consumers’ spending choices in the coming months.”

See also: WARC & Amazon Ads release report focusing on how MMM can asses retail media performance