ThinkTV has announced the TV advertising revenue figures for the six and 12 months to 31 December 2020.

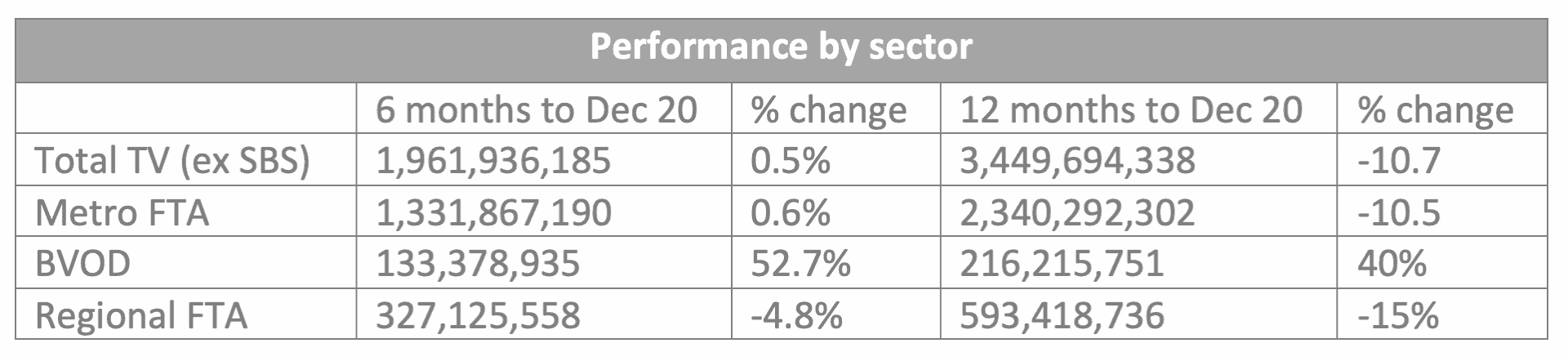

Faced with difficult trading and economic conditions, for the first half of FY21, the total TV market – which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) – recorded combined revenue growth of 0.5% compared to the same period the year prior.

ThinkTV CEO Kim Portrate said: “The effect of the pandemic was felt keenly in the September quarter before the TV market finished the calendar year on a very promising note. Despite COVID-led market volatility, TV has, and continues to, play a pivotal role in communicating brand messages at scale driving business results in both the short and the long term for advertisers. Advertiser support for TV remains strong because brands know TV delivers the impact needed to drive growth.”

Kim Portrate

Seven West Media chief revenue officer Kurt Burnette told Mediaweek: “It was an incredibly tough year for Australians, Australian business and the media sector. These TV and BVOD numbers are a shining light in what has been a dark time for the sector. With TV in growth and BVOD at over 50% it surprised many, but it’s also the first time in many years that TV has outgrown the market. A healthy signal that there is a path to recovery across the board, albeit cautious.”

Kurt Burnette

10 ViacomCBS chief sales officer Rod Prosser said: “The last 12 months have demonstrated again the power of television and the impact it has to shift product, promote a message, to build a brand and most importantly, to deliver a strong return on investment.”

Growing consumption of content across BVOD platforms 7Plus, 9Now, 10 Play, Kayo and Foxtel Now has been matched by continued revenue increases with BVOD up 52.7% for the six months to 31 December 2020.

While Nine had the biggest FTA ad shares across the year just ahead of Seven, 7plus has the edge in the growing BVOD space. 10 was able to report revenue growth year-on-year.

Burnette: “The total TV numbers also clearly show that in the absence of other mediums, TV and BVOD is categorically proven to deliver results. Those that were able to advertise and then use TV and BVOD saw incredible results and returns.”

Portrate added: “BVOD revenue is performing exceptionally, in line with incredible audience growth. Post COVID, the medium has established a new baseline for viewership with more than 1.6 million hours of BVOD content being consumed every week with more and more Australians – advertisers and consumers alike – embracing the platform.”

For the 12 months to December 2020, the TV market recorded $3.45 billion in advertising revenue, down 10.7% compared to the 12 months to December 2019. For this period, BVOD saw an increase of 40%.

TV and BVOD ‘go-to medium when it matters’

“Total TV not only drove advertising results but delivered critical messaging for the community by using the fastest, largest and most engaging environment to get Covid messages and live updates through a trusted environment in TV,” said Burnette.

“That included Federal and State messages each day to update the country live, along with important support for businesses large and small and local communities. Proving again, TV and now BVOD to be the go-to medium when it matters.”

Sponsorships and BVOD drive 10’s revenue growth

10’s Rod Prosser also told Mediaweek: “For Network 10, our year-on-year movement for December and January out-performed the market, continuing our strength and momentum of 2020 into 2021. Armed with a strong audience on broadcast and video on demand, and incredible sponsorships, we are well placed to continue our revenue growth this year.”

Rod Prosser

10 ViacomCBS national sales director Lisa Squillace added: “Leading the comeback and out-performing the market just goes to show that TV works. At 10 ViacomCBS, our content, across all distribution channels, sets the bar for audience engagement and action, leading to fantastic outcomes for our clients.”

Lisa Squillace

How Seven delivered for clients

Burnette: “For Seven we are delighted how we ended and delivered the 2020 calendar year for customers. We launched three new successful tentpole shows in Big Brother, Farmer Wants a Wife and SAS all growing by double digits on key demos and returning in 2021 to deliver more growth.

“News and Sunrise was the most-watched and trusted news services in a year that those services have never been more important. Also growing audience in a historic year was the AFL audience. The 7plus numbers outgrew the market in viewing and revenue. As a result of a dedicated focus on growing users through strategic content acquisition and improved user and advertising experience. Accelerating addressability and our DATA road maps. This combined strategy is driving record growth and market leadership. All of that will continue into the new year.

“The new year has started with a bang in delivering significant year on year growth. Our objective is to deliver effective reach and growth for brands to be able to buy in and integrate within. This week we saw Holey Moley launch with increases year on year of 33% on 25-54. The return of Home and Away and the consistent performance of the most-watched and trusted News and sunrise has seen 25-54 primetime growth for the week of 12% and outgrowing the market on BVOD.”

Total TV and Seven in strong position for 2021

Burnette: “The response to our 2021 that includes Ultimate Tag plus Dancing with the Stars and an Olympics Games to launch The Voice and SAS has been strong. There has also been huge uptake in a much-anticipated AFL season, Supercars and Horseracing across the year.

“TV and BVOD market growth for the quarter is expected to be and is trending to be, double-digit.

“That said, no one is getting carried away. It’s a long year and we’ve learned and planned to be ready for anything. It’s just great to see total TV be in such a strong position and for Seven, to be able to deliver what we said for our advertising partners and the broader financial market. Which is to deliver growth and value that can only lead to great business results.”