ThinkTV has revealed the total TV advertising revenue figures for the six and 12 months to 31 December 2021. The announcement comes just days after SMI revealed a record ad spend for calendar 2021.

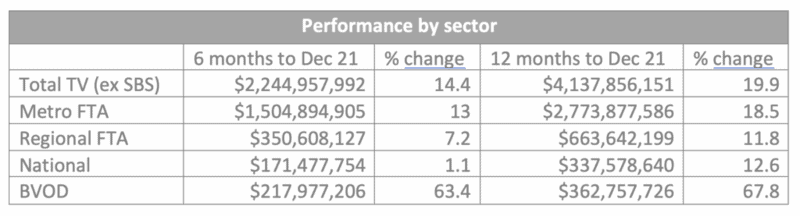

The total TV advertising market, which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) and excludes SBS, recorded combined revenue of $4.1b for the year to December 2021, which was up 19.9% compared to the same period ending December 2020.

In the December half, TV advertising revenue was $2.2b, an increase of 14.4% when compared to the same period ending December 2020.

The total revenue for the metropolitan free-to-air networks was $1.5b for the six months to December 2021, up 13% compared to the same period last year. For the 12-months, metropolitan free-to-air advertising revenue was $2.8 billion, up 18.5%.

ThinkTV CEO Kim Portrate said: “TV is part of the fabric of our lives and these results show how important Total TV is to advertisers looking to connect with Aussies every day. The impressive growth in the past 12 months is evidence that advertisers looking to build and grow their brands understand Total TV needs to be the cornerstone of their media plans.”

ThinkTV’s Kim Portrate

Investment in BVOD platforms 7plus, 9Now, 10 Play, Foxtel Go, Foxtel Now and Kayo continues to accelerate with BVOD revenue up 63.4% to $218 million for the six months to December 30, 2021. BVOD revenue for the total financial year was $363 million, up 67.8% year-on-year.

Portrate added: “BVOD audiences and revenue continue to increase exponentially, testament to the power of the offering. Once considered a smaller sibling of linear TV, BVOD has truly come into its own. And when the two combine to form Total TV, they make for an unbeatable package.”

Seven’s Kurt Burnette

Seven West Media’s chief revenue officer Kurt Burnette told Mediaweek:

“The total TV market had an outstanding 2021 and delivered good growth in the July to December half, with BVOD again emerging the fastest growing sector. This clearly reflects the strength of the TV medium and advertiser confidence in its ability to deliver audiences and value across both broadcast and BVOD.

“Seven had an excellent 2021 and has strong audience, data and revenue momentum heading into 2022, with a fully integrated and leading national audience. Our year will be spearheaded by the Winter Olympics and the launch of more new and fresh content in the front half, and the return of many of Australia’s Tokyo Olympics superstars to the Commonwealth Games to launch our back half. It’s going to another huge year ahead for Seven and for total TV in general.”

Nine’s Michael Stephenson

Nine Entertainment’s Michael Stephenson told Mediaweek:

“Television has always been, is and will continue to be the most powerful advertising platform for marketers. It builds brands and delivers better sales results.

“The future of television is total television, the combination of FTA TV, live streaming and on demand television. We expect total television to be in growth through the cycle and for Nine and 9Now to continue to be the market leaders.”

Zenith recently forecast that it expects ad spend to increase overall by 5% in Australia in 2022. Noting the power of television, it also cautioned the industry that it will be costing advertisers more in 2022.