ThinkTV has announced the total TV ad market revenue figures for the six and 12 months to 30 June 2021.

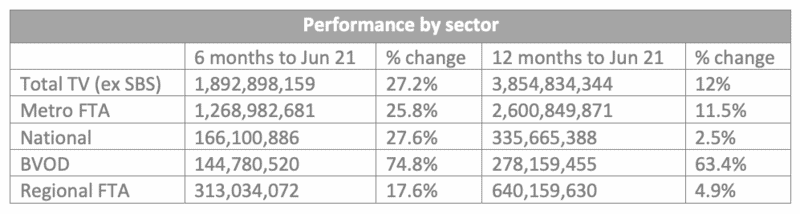

The total TV market, which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) and excludes SBS, recorded combined revenue of $3.85 billion for the year to June 2021, which was up 12% compared to the same period ending June 2020.

In the June half, TV advertising revenues were $1.9 billion, an increase of 27.2% when compared to the same period ending June 2020.

The combined TV ad market revenue for the metropolitan free-to-air networks was $1.3 billion for the six months to June 2021, up 25.8% compared to the same period last year. For the 12-months, metropolitan free-to-air advertising revenue was $2.6 billion, up 11.5%.

ThinkTV CEO Kim Portrate said: “Australians have turned to TV through all the twists and turns of this horrible health crisis. Whether to watch trusted, timely news or, when it all gets a bit overwhelming, for light relief, entertainment or to cheer on their favourite sports teams. The resulting increase in viewing is reflected in the growth of Total TV revenues for both the half and the full year.”

The record-breaking performance of BVOD platforms 7plus, 9Now, 10 Play, Foxtel Go, Foxtel Now and Kayo has also continued with BVOD revenue up 74.8% to $145 million for the six months to June 30, 2021. BVOD revenue for the total financial year was $278 million, up 63.4% year-on-year.

Portrate added: “BVOD continues its impressive run as Australia’s fastest-growing media channel with a growth rate exceeding all expectations and the same period last year when BVOD shot up 32%.”

Rod Prosser, 10 ViacomCBS’ chief of sales told Mediaweek: “The last 12 months have demonstrated once again the power of television. This, coupled with the record-breaking performance of BVOD platforms, has provided advertisers and clients with incredible results and returns. Our content across TV and BVOD is proven to shift product, promote a message, build a brand and most importantly, to deliver a strong return on investment. Armed with a strong audience on our platforms, a robust and consistent programming slate and incredible sponsorships, we are well placed to continue our revenue growth this year.”

TV ad market: Advertisers spend to after Covid-impacted 2019/20

The new data is a big vote of confidence in the sector from advertisers. Last year at this time ThinkTV reported combined revenue of $3.4 billion for the year to June 2020, which was down 13.7% compared to the same period to June 2019.

In the June half of 2019/20, TV advertising revenues were $1.49 billion, a decrease of 22.1% when compared to the same period ending June 2019.

See: TV ad market worth $3.4b in 2019-20, -13.7% YOY, Last six months -22%