ThinkTV has launched the Media Engine, a planning aid for advertisers that draws on sales and campaign data from 60 Australian brands across 10 categories with collective annual advertising spend of $450 million and turnover of $23 billion.

ThinkTV CEO Kim Portrate told Mediaweek: “Great results come from great campaigns and great campaigns begin with great briefs. The Media Engine will help you power up your revenue with all three.

“We partnered with GroupM to get data from a large number of econometric models. We aggregated that in a way we were able to optimise media for a sales outcome. A lot of media optimisation looks for efficiency, we are really interested in optimising for effectiveness, quite specifically a sales outcome.”

ThinkTV said the robust, real-life, free tool, democratises the data marketers need for designing campaigns. Built with Australian marketers and their agency partners in mind, the Media Engine shows how media can be used to generate significant returns.

The launch follows research conducted by the BetterBriefs Project which found 90% of marketers fail to brief agencies effectively with a third of marketing budgets being wasted by bad briefs, equating to more than $200 billion in global ad spend.

Portrate said ThinkTV started to see lots of conversations in the market about briefs. “Specifically the quality of briefs and how they could be better. Our team sat down and asked was there anything we could contribute to that conversation. Great outcomes are a result of great campaigns and great campaigns start with great briefs. And great briefs start with great data. We have some pretty powerful data and we wanted to work out how we could put it into the hands of people so they could use it when doing their campaigns and planning so it might make a difference.”

Portrate added: “There’s nothing more powerful than econometric modelling to demonstrate how media investment can generate business results. Not all brands have access to wide-scale modelling. We reckon everyone should have this information at their fingertips to help grow their business so we built the Media Engine to level the playing field.”

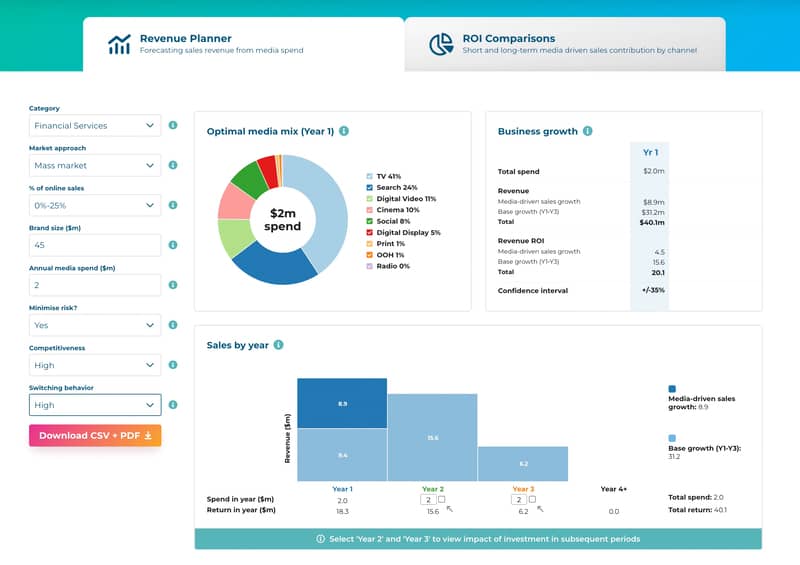

Marketers can select from eight inputs to customise the tool’s recommendation:

• Category

• Market approach (e.g., mass-market or niche)

• Percentage of sales that come from online

• Brand size

• Annual media spend

• Risk profile – appetite for the variability of the sale outcome

• Competitiveness of the category

• Consumer switching behaviour in the category

Based on these key variables, the Media Engine outlines the ideal media investment to generate revenue returns.

ThinkTV noted Media Engine uses aggregated unidentifiable campaign data. “It is both commercially and consumer privacy compliant,” said Portrate.

Media Engine is also not tricked up to recommend TV as the first investment consideration in all scenarios. “Every campaign is different. When the data arrived we didn’t screen for TV clients and we haven’t manipulated any of the results. You will find examples on the site where search might be better than TV,” added the ThinkTV chief.

The engine is fuelled by analysed data from The Payback Series research, conducted by ThinkTV in conjunction with Professor Peter Danaher, Head of the Monash University Department of Marketing and Professor of Marketing and Econometrics, GroupM and global marketing effectiveness consultancy Gain Theory.