Ten Network has announced its results for the six months to February 28, 2015. The results included:

• Television earnings before interest, tax, depreciation and amortisation of $7.5 million (2014: $10.1 million)

• Television revenue of $309.8 million (2014: $315.0 million)

• Television costs (ex-selling costs) decrease of 2.1%

• Television licence impairment of $251.2 million

• Loss for the period attributable to members of $264.4 million

• Net debt of $92.3 million

Primary TEN channel: best start to a ratings year since 2012

Ten Network Holdings’ executive chairman and chief executive officer Hamish McLennan said the results reflected the restructuring the business had undertaken in 2014 in order to reduce costs and invest in prime time programming. The successful launch of three new shows so far in 2015 has contributed to improved consistency in ratings and an improving share of the television advertising revenue market in recent months.

“Network Ten was the only commercial network to increase its people 25 to 54 and total people audiences during the 2014-15 summer and achieved a 24.7% revenue share in January 2015,” he said.

“Since the start of the 2015 ratings year on February 8, Network Ten is the only commercial network to increase its 25 to 54s and total people audiences, with growth of 25% in 25 to 54s and 22% in total people.

“The primary TEN channel has also had its best start to a ratings year since 2012,” he said.

McLennan said TEN remained committed to the key elements of the strategic plan outlined to the market in November 2013, including the development of event television content aimed at 25 to 54s (including premium live sport), the development of new formats and a strict cost control program.

“We are on strategy and we have also given viewers and advertisers greater consistency in how we schedule our content across three channels, and we continue to focus on the expansion of the tenplay digital platform,” he said.

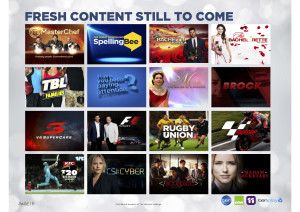

Key new formats successfully developed and launched by TEN since late 2013 include Family Feud, I’m A Celebrity… Get Me Out Of Here!, Shark Tank, Gogglebox Australia, Gold Coast Cops and Studio 10. New formats that will launch later this year include The Great Australian Spelling Bee and The Bachelorette.

McLennan said TEN’s share of the capital-city television advertising market was trending higher, with 20.9% achieved in the six months to February 28, 2015, and a 21.8% share in March 2015.

“We saw strong revenue growth from the KFC T20 Big Bash League during the 2014-15 summer and our focus on other premium live sport properties is generating incremental revenues from V8 Supercars, Formula One and Rugby Union,” he said.

“Sponsorship revenue for key series to come across the rest of 2015 – including MasterChef Australia, The Bachelor and TBL Families – is also very encouraging.”

TEN’s catch-up and streaming service, tenplay, has continued to increase its audience and advertising revenue.

More than two million tenplay mobile apps have been downloaded since its launch in September 2013.

In the six months to February 28, 2015, tenplay recorded 14.6 million unique visitors – up 23% on the previous corresponding period – 134.6 million page views (up 64%) and 66.3 million video views (up 52%). Advertising revenue from tenplay increased 29% during the period.

Costs and Cost Guidance

Television costs (ex-selling costs) were reduced by 2.1% during the first half of the 2015 financial year, reflecting the ongoing management of costs and the restructuring of News, Operations and other departments in 2014.

Cost management across the Group remains a key focus in order to reinvest in the primetime program schedule. However, leverage in managing the cost of programming remains limited by fixed output deals and the proportion of overall programming spend which they represent.Television costs (ex-selling costs) for the full 2015 financial year are expected to reduce by 8% in line with the guidance provided in October 2014.

Non-Recurring Items and Debt

The reported non-recurring item of $251.2 million for the first half of the 2015 financial year related to a television licence impairment charge.

TEN’s net debt at February 28, 2015, was $92.3 million.

Strategic Review Process

The strategic review process continues and may or may not result in a transaction which is acceptable to TEN. TEN will update the ASX when required to do so under its continuous disclosure obligations. In the meantime,

TEN urges caution in dealing in its shares on the basis of media speculation about potential transactions involving the company.

Outlook

The television advertising market remains “short” in terms of forward bookings and is difficult to predict.

McLennan said: “There has been a lot of commentary recently about the future of the free-to-air television industry and the outlook for the television advertising market.

“The fact is that no medium can match free-to-air television’s ability to reach large audiences every day and night of the week. Of course, some other media’s share of consumers’ time and the total advertising market has increased in recent years, but the vast majority of marketers know television advertising works better than any other form of advertising.

“TEN is constantly finding new ways for advertisers to deepen their engagement with our viewers. We are also taking our content to where people want to view it, via tenplay and other digital media initiatives,” he said.

Media Reform

McLennan welcomed the Federal Government’s recognition that television licence fees need to be reviewed.

“Australia’s licence fee regime remains by far the most punitive in the world. Paying licence fees on top of corporate tax and increasingly onerous Australian content obligations is unreasonable. Every dollar we pay in licence fees is a dollar we cannot spend on local content,” he said.

McLennan also called on the Government to urgently consider proposals to reform media ownership rules.

“The two-out-of-three rule and the audience ‘reach’ rule are hurting Australian media companies by inhibiting our ability to grow and compete. However, piecemeal reform, such as only removing the ‘reach’ rule, will make the situation worse. Allowing some companies the opportunity to pursue consolidation while continuing to restrain others will exacerbate the damaging impact of the remaining rules,” he said.

Source: Network Ten