The Australian entertainment subscription market, which includes video, music and gaming services, grew by 5 per cent to 52.3 million services in the 12 months to June 2024, despite cost-of-living pressures and services’ increasing focus on profitability, according to new research by emerging technology analyst firm Telsyte. The research is contained in the new Telsyte Australian Subscription Entertainment Study 2024.

The study indicates the market is maturing, particularly in Subscription Video-on-demand (SVOD) services, where most (over 70%) subscribers now have more than one service. We will focus on the results for the SVOD sector in this summary of the report.

Growth rates are in single digits: SVOD (4%), streaming music (9%), and games-related subscriptions (6%). Streaming music’s higher growth was boosted by the launch of TikTok Music during this period.

Ad-supported plans driving SVOD growth

SVOD continues to grow in a mature market and the total number of (SVOD) services grew by 4% year-on-year, reaching 25.3 million in June 2024.

Subscriber growth is attributed to a population increase, the introduction of more affordable ad-supported plans, and strong consumer interest in diverse content across multiple services. Revenue growth was driven by subscription cost increases and increased service adoption.

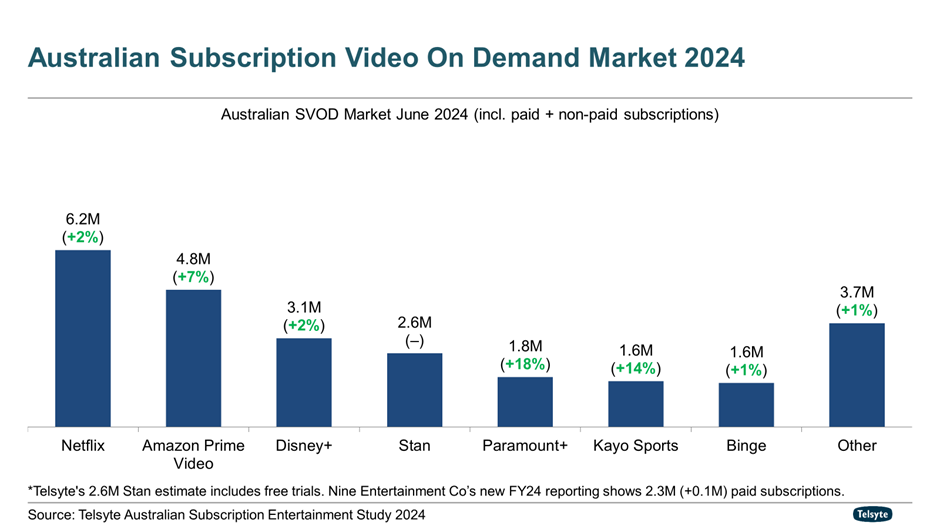

Netflix remains the clear leader with 6.2 million subscriptions at the end of June 24, followed by Amazon Prime Video (4.8 million); Disney+ (3.1 million); Stan (2.6 million); Paramount+ (1.8 million); Binge (1.6 million); Kayo Sports (1.6 million); and YouTube Premium (1.0 million).

The long tail of smaller services (below 1 million subscriptions) collectively increased by 1 per cent, driven by consumer interest in diversified content at affordable price points, sometimes under $10 per month.

Among all services above 100,000 subscriptions, Britbox saw the fastest growth in FY2024. Anime-focused Crunchyroll and reality TV-focused Hayu also showed strong performance.

SVOD ad-supported subs grow from 1m to 2.5m

Excluding dedicated sports services that serve ads during live sports broadcasts, Telsyte’s research found there are some 2.5 million SVOD subscriptions subsidised by advertisements (June 2024), up from around million a year ago. Ad-supported subscriptions now account for 11% of the total SVOD services.

Ad-supported plans offered by Netflix, Binge and Paramount+ are the most affordable base tier and come at a time when consumers are increasingly tightening their wallets.

This growth is set to continue as the study found consumers are increasingly receptive towards having advertisements on their SVOD services if it can help subsidise the subscription cost. Close to 1 in 2 (45%) of SVOD users are interested in such a plan, a sharp 9% increase from a year ago.

Telsyte estimates the introduction of more ad-supported plans could potentially lift the average number of subscriptions per household closer to 3.7 (currently 3.5) by 2028.

Average monthly budget for SVOD is just $36

SVOD services remain an important part of Australians’ video entertainment mix with over half (53%) of SVOD subscribers Telsyte surveyed indicating they continue to discover interesting new content and 45% are comfortable paying for multiple services.

However, the study among those willing to pay for streaming video services, the average monthly budget has marginally declined by 2 per cent to just under $36, adding to last year’s 7% increase. The hardest-hit consumer segments that saw their SVOD budgets reduced the most are young families and individuals with a medium income.

The study found the SVOD market revenue (excluding advertisements) reached an estimated $3.5b for FY2024, a 15% year-on-year increase driven by cost rises and increased service adoption.

Anna Torv in the forthcoming Netflix drama Territory

Price rises bite: When will bundling be a thing?

Depending on the plan, the retail costs of top SVOD services have increased between 10% and 67% since June 2020, impacting the affordability of accessing services.

The increasing costs highlight the potential interest in bundling multiple services to save costs, with nearly half of SVOD users claiming they will consider subscribing to new services if they come with a bundled discount with services they are already paying for.

According to Telsyte’s research, the average total weekly video entertainment consumption increased by 4% year-on-year to 47 hours, driven by free sources such as BVOD, YouTube and videos on social media.

Social media video platforms such as YouTube and Tiktok continue to be popular. Telsyte estimates over a million are subscribed to YouTube Premium, the paid version of YouTube, highlighting the demand for niche and user-generated content.

Broadcasting Video On Demand services (BVOD, incl. 7Plus, 9Now, 10Play, ABC iView and SBS On Demand) remained popular and most BVOD platforms had more than 11m viewers during FY2024. The research also highlighted the increased usage of 9Now during the 2024 Paris Olympics.

Nearly 5m Australians claim they have used Free and Ad-supported streaming TV (FAST) services or services that offer FAST channels in the last 12 months.

The FAST market has quickly expanded over the last 24 months, with services such as Samsung TV Plus, LG Channels and Plex. Dedicated fast channels can also now be found on all of the BVOD services and Fetch’s platform.

What’s key to growing customer base?

Telsyte estimates the total number of SVOD subscriptions could reach over 30 million by June 2028, driven by robust content piepline; potential new market entrants such as HBO Max; increasing availability of ad-supported plans across numerous services; and more immersive video experiences.

The study highlighted significant interest in Australian content on SVOD platforms in the past year, and two in three (64%) Australians claim they have watched Australian-related content on SVOD during that time.

Drama, documentaries and comedy content were among the most popular categories, with more than half (56%) say they want to see more on these platforms.

Half of subscribers still believe it is important to have content that has Australian stories, voices, culture and values on SVOD services. Additionally, 37% of Australians say they are more likely to tune in if the video content is about Australia or is an Australian production.

See also: Telsyte streaming report 2023 – Paramount+ fastest growing, Netflix reports first YOY drop

For details of purchasing The Telsyte Australian Subscription Entertainment Study 2024 go to [email protected]