Foxtel has been working on new SVOD products, which it expects to launch into market soon.

Two new SVOD market surveys in the past week – from Roy Morgan and Telsyte – have detailed the size of the growing audience demand in Australia.

Roy Morgan reported:

Subscription Video On Demand (SVOD) juggernaut Netflix has continued its impressive growth over the last year with over 9.8 million Australians in the June 2018 quarter now having a Netflix subscription in their household – up nearly 30% on a year ago.

If the growth trend continues, over 10 million Australians will have access to Netflix content during the current September 2018 quarter based on the growth shown by Roy Morgan Single Source interviews with more than 50,000 Australians over the last 12 months.

Now over 13 million Australians have access to some form of pay TV/subscription TV, up 11.7% on a year ago, and it’s not just Netflix driving the increase.

Over 2 million Australians can now view content via Stan, up 39.2% on a year ago, and growing at a faster rate than Netflix over the last year. Stan is set to be fully owned by the Nine Entertainment Company following its merger with Fairfax.

There were other big increases including for the rebranded YouTube Premium (formerly YouTube Red), now with over 1 million users, up 38.5% on a year ago, while the biggest percentage increases were for Fetch, up 40.5% to 710,000 users, and Amazon Prime Video, up 87.7% to 273,000 users.

Telsyte reported:

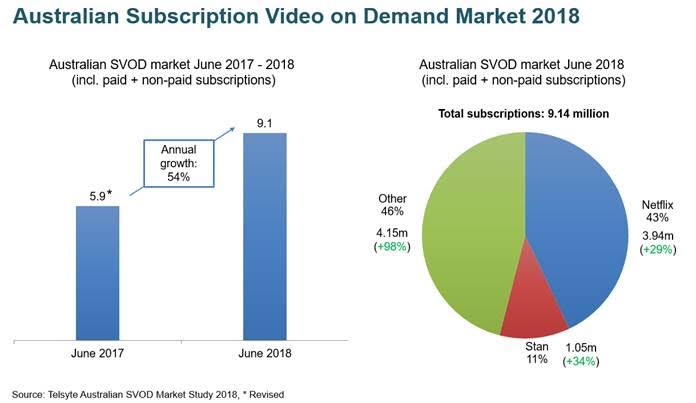

The Australian subscription video on demand (SVOD) services market continues to grow strongly reaching 9.1 million subscriptions at the end of June 2018, a year-on-year increase of 54%, according to new research from emerging technology analyst firm Telsyte.

Over the same period, SVOD revenues in Australia grew substantially (up 90%) reaching over $700m at the end of the 2018 financial year.

Telsyte forecasts Australians will hold more than twice as many SVOD subscriptions (22 million) by the end of June 2022.

In total, Telsyte estimates 43% of Australian households subscribed to SVOD services at the end of June 2018, an increase from around 30% a year ago. This compares to around 70% in the USA and 60% in the UK, showing the growth opportunity within the next few years.

The market leader is Netflix with around 3.9 million subscriptions, with Stan in second place with a little over 1 million. However, new services (e.g. Amazon Prime, Foxtel Now) and a growing list of popular sports and special interests are collectively feeding Australians’ hunger for video content.

New SVOD services, including potentially those from Disney, HBO and various sporting codes, are expected to appeal to even more audiences.

Telsyte research shows Australians are increasingly comfortable with subscription-based entertainment services with millions turning to subscriptions for SVOD, music (e.g. Spotify, Apple Music), and game console subscriptions (e.g. PlayStation Plus, Xbox Live Gold).

The uptake of SVOD services is putting pressure on traditional pay TV, which is found in around one-third of Australian households (end of June 2018), a similar level to 2017. The growth of Fetch TV, that allows access to both SVOD and Pay TV content via its set-top boxes, offset the decline in Foxtel subscriptions.

Telsyte Managing Director, Foad Fadaghi, says the SVOD market is not showing signs of being “winner takes all”.

“Consumers are becoming comfortable with multiple subscriptions and are subscribing to different providers for exclusive content and live sports,” Fadaghi says.

Sports a big winner for SVOD, says Telsyte

Australians’ love for sports has been a big driver for SVOD, with sporting codes like AFL, NRL, and Netball (all exclusive to Telstra) showing strong demand, with usage exceeding the reported 1.5 million subscriptions in February 2018. Other popular niche services include UFC, NBA and MLB.

Despite the technical issues, Telsyte estimates more than 2 million Australians watched the FIFA World Cup in June 2018 via Optus Sport.

Meanwhile, according to Telsyte, growth in uptake of catch-up and live traditional TV streaming services – sometimes called broadcast VOD (i.e. 7plus, 9Now, tenplay, ABC iview, SBS On Demand) – has slowed down, with SVOD penetration on track to overtake it. Telsyte estimates there are currently 4.1 million households with SVOD services versus 5.2 million households with broadcast VOD.

However, BVOD and ad-free services in the case of ABC iview, continue to be an important channel for children’s content with more than 5.5 million children viewing these services, a 6% year-on-year increase.