• Nearly half of SVOD subscribers claim to rarely watch FTA TV

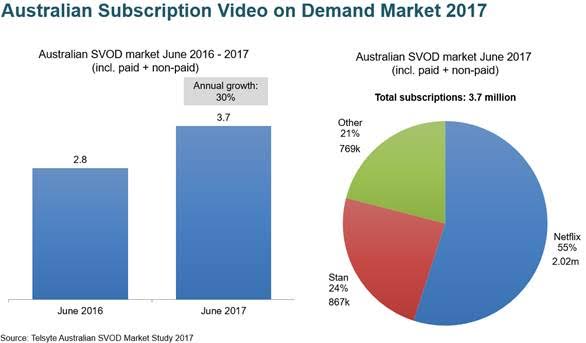

Subscription video on demand (SVOD) services delivered over the internet continue to feed Australians’ appetite for entertainment with subscriptions reaching 3.7 million at the end of June 2017, a year-on-year increase of 30%, according to a new study from technology analyst firm Telsyte.

Highlights from the report released this week reveal:

Almost half (49%) of Australian households currently subscribe to either Pay TV or SVOD services, with 11% subscribing to both, an increase from 38% in 2015.

Telsyte predicts paid SVOD subscriptions are on track to overtake traditional Pay TV subscribers by June 2018, as consumers increasingly consume content on-demand, and across multiple devices.

Popularity of exclusive and original content, as well as live streaming, is expected to continue to the drive the market to 2021 when subscriptions are expected to exceed 6 million.

Telsyte believes consumers will consider multiple providers, leaving room for services from Stan, Amazon, YouTube Red, Foxtel, Optus Sport and a long list of others to encroach on Netflix’s market leadership.

Telsyte estimates that Netflix exceeded 2 million subscriptions at the end of June 2017, with Stan in second place with 867,000, and others making up 769,000.

Telsyte research indicates around a third of pay TV subscribers also have at least one SVOD subscription, with 46% of SVOD subscribers claiming to “rarely” watch FTA TV. Telsyte research shows that the average SVOD subscriber watches nearly 26 hours of video content a week across FTA TV, pay TV, SVOD, online TV on demand (catch-up TV & live streaming TV), and other video content sources (incl. non-streaming videos), compared to around 21 hours for the average Australian.

“SVOD adoption in Australia has started to reach a scale which has strategic significance to media and telecoms companies alike,” Telsyte managing director Foad Fadaghi said.