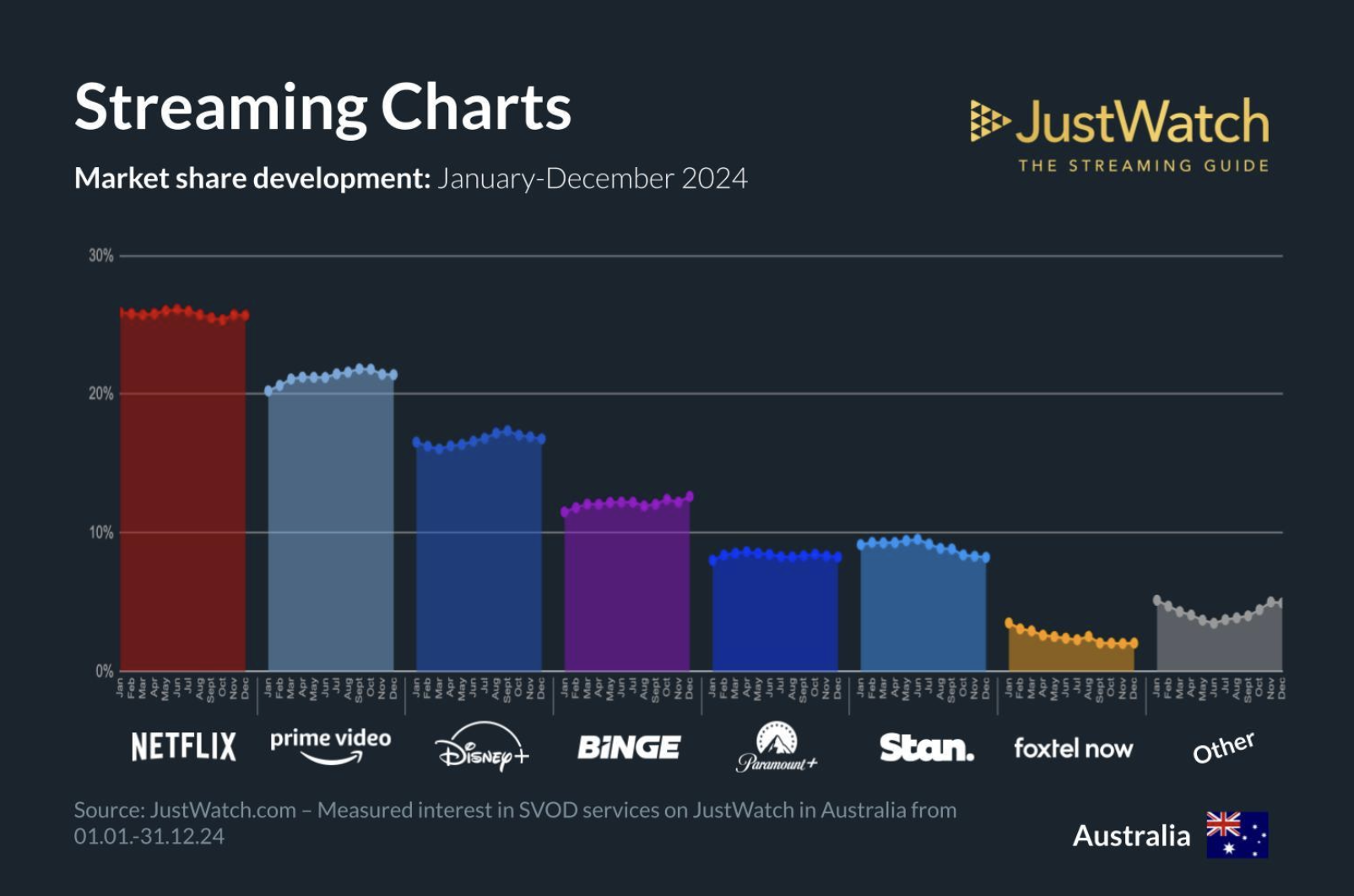

The battle for streaming supremacy in Australia continues to heat up as key players jockey for position in 2024. According to the latest JustWatch insights, Netflix remains the leader in the SVOD (Subscription Video on Demand) market, but with Amazon Prime Video and local platforms like Binge and Stan making serious gains, the competition is fiercer than ever. And the shifting dynamics in media consumption patterns point to an even more fragmented and competitive future.

Netflix continues to reign supreme, holding a solid 25% of the market share in Q4 2024. But this dominance isn’t unchallenged. Amazon Prime Video, now a strong contender, holds a 5% advantage over Disney+. Meanwhile, local streaming services Binge and Stan are gaining ground, collectively claiming a 20% share of the market, just 2% behind Amazon Prime. As Australians continue to choose content that resonates with them, local platforms are showing they can go toe-to-toe with global giants.

Binge, in particular, is showing impressive growth. By the end of 2024, the service had bumped up its market share by 1%, signalling that Australians are increasingly turning to homegrown content. Amazon Prime Video also saw a similar 1% rise, closing the gap on Netflix and continuing to push for a bigger slice of the pie. These figures tell us that Aussies are becoming more discerning, seeking content that speaks to their tastes and preferences, whether it’s international or local.

Streaming Charts. Source: JustWatch.

Shifting habits: More streaming, less social media

In 2024, Australians are spending more time on streaming platforms than ever before. According to Deloitte’s 13th annual Media and Entertainment Consumer Insights report, Australians now spend as much time watching SVOD as they do traditional TV. The average Australian now spends over eight hours a week watching both SVOD and free-to-air TV, peaking multiple times throughout the day instead of the classic “prime time” viewing block.

Yet, while media consumption remains high, there’s a noticeable shift in how and when Aussies are consuming content. Media consumption has become more fragmented, with 75% of Australians engaging with media first thing in the morning, and over 80% doing so on their commute or before bed. This fragmentation highlights the growing flexibility of streaming services in capturing viewers’ attention at any given time.

But it’s not all rosy, Australians, particularly younger generations, are cutting back on screen time. Total entertainment consumption dropped by 10% over the past year, and for Gen Z, social media usage plunged by 20%. Time spent on social platforms like Instagram and TikTok has significantly decreased, with Gen Z spending nearly 20% less time scrolling.

Price hikes aren’t stopping Aussies, but they’re getting smart about it

The cost of living pressures are real, but Australians aren’t willing to cut entertainment from their budgets. Despite price hikes across many streaming services, the average Australian household still maintains 3.3 digital subscriptions, with the average monthly spend increasing by 10% to $63. Gen Z households are actually leading the charge, spending $88 a month on subscriptions, almost double that of Baby Boomers. This shows that while Aussies are tightening their belts, they still find value in their digital entertainment.

Most consumers are avoiding cutting subscriptions altogether, choosing instead to swap between services to take advantage of promotions or opting for a night in. However, as platforms push price increases, many Australians are feeling the strain. A significant portion of consumers (75%) worry about the cumulative cost of multiple subscriptions, yet most intend to stick with the same number of services through 2025.

Social Media: Trust in decline and calls for regulation

A major shift is happening in how Aussies engage with social media. Younger generations, particularly Gen Z, are stepping back due to concerns about the impact on their wellbeing. A growing sense of distrust surrounds social platforms,only 40% of Australians trust the news they consume through social media, compared to 73% who trust major news publishers.

This sentiment is leading to increased support for regulating social media. A staggering 90% of Australians, including 91% of Gen Zs, are in favour of stricter regulations on social media use for people under 16. Some even support an outright ban for under-16s, with 56% of respondents (and surprisingly, about a third of Gen Z) in favour of this move.

Representation is also top of mind for younger viewers. More than 64% of Gen Z actively seek out diverse voices in their media consumption, far above the 49% of consumers overall. This desire for inclusive and representative content is reshaping how Australians, especially younger ones, engage with streaming platforms.