Magnite has released a new study, Live and Kicking: An In-Depth Look At Live Streaming in Australia, which has claimed that sports streamers are more responsive to advertising than traditional TV watchers.

Mediaweek caught up with Magnite’s James Young, managing director, Australia, about what these findings mean for the industry.

82% of all Australian OTT users can be classified as live streamers according to the study, and many stated that they often remember the ads seen (39%) and discuss the ads with someone (32%) after the fact.

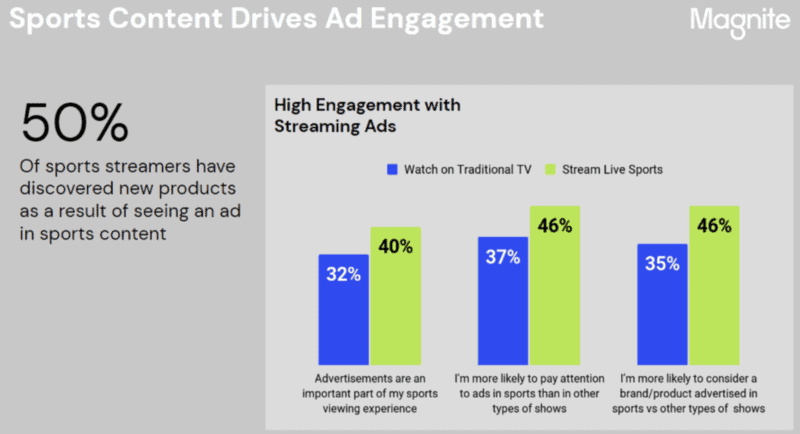

The study also found that half of sports streamers have discovered new products as a result of ads placed around sports content, while 31% have bought the product or service advertised. These results signify the effectiveness of live sports content in driving action and engagement.

“It’s important because it shines a light on an area of streaming which is largely thought about as just sport,” said Young. “While sport makes up a huge proponent of it, it also includes a wide range of different mediums. Live streaming is becoming a far more normal way of consuming media. It’s interesting to know that this is the way that the industry is shifting. Consumers are wanting to consume media, it’s just easier to get it over the internet.”

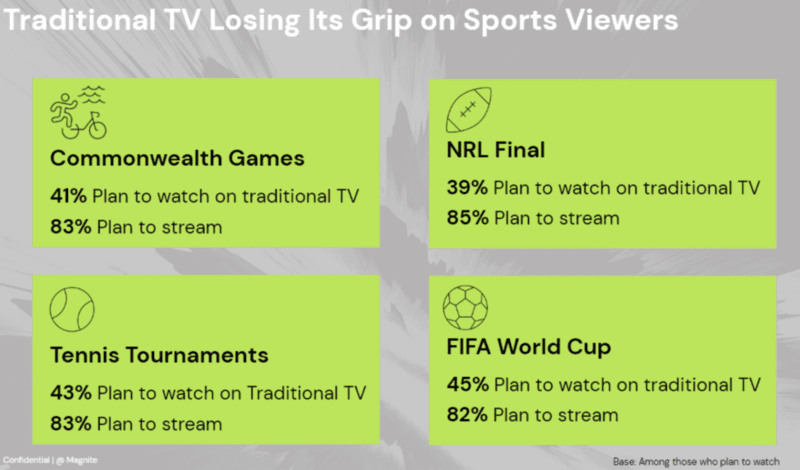

The study also found that more sports viewers intend to stream live sports events including the Commonwealth Games, NRL Grand Final, FIFA World Cup and tennis tournaments, than watch on traditional TV.

“If you take something the Australian Open, for example, the 16 courts available are all running at one time, so you want to watch some smaller player that you’ve been following their career with interest, you now can. Previously, you were held to whatever the broadcaster wanted to put on the linear channels.”

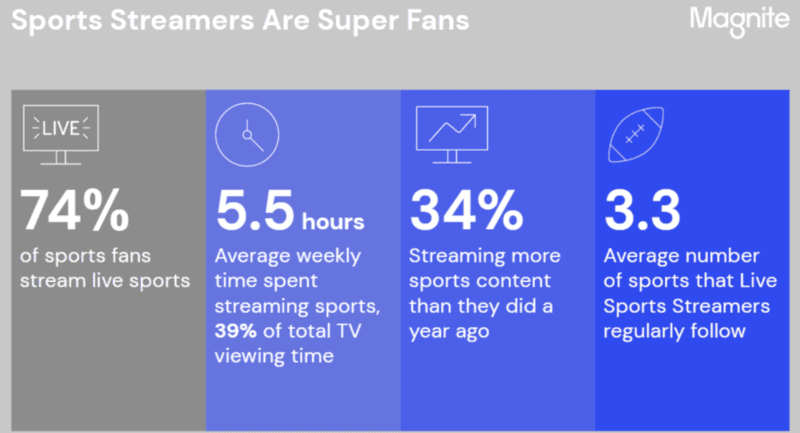

The study showed that with sports streamers, sports content made up nearly 40% of their weekly total viewing time. 40% of sports streamers also agreed that TV ads are an important part of the viewing experience, and 46% said that they are more attentive to ads in sports than those in other genres. Young said that Magnite had been working in the sports streaming space for a number of years and has spent the last 18 months building technology for the medium, with their Live Stream Acceleration technology allowing the company to spread the ad calls out to buyers.

“The one factor of live streaming that’s different to all other digital mediums is that everyone hits the ad break at the same time. In a digital world, you’ve got to scale really fast to be able to get ads back in, especially in the programmatic sense. We have to go and call 100 plus different buyers and ask if they want to advertise to this particular consumer, and then multiply that by how many consumers are watching that game at once and then multiply that by the number of ads per consumer that are made available. Suddenly, you’re into the hundreds of thousands of ad calls all going out in a split second. We then quickly run into scale issues with the buying platforms where they have limits per second that they can stick to. Our technology spreads those out a little bit more to allow for limits that the buying technologies have to adhere to. Instead of sending it all in one second, we’ll send that over a period of multiple seconds.

“Secondarily, we will cache creative. If we get a bid in from a buyer, we will hold on to their creative. If their ad doesn’t cache in time and make it to the ad break they want, if they bid again in future we’ll already have their ad ready to go rather than having to pull it down, download it, transcode it, and do all the other bits and pieces that need to happen.”

When asked about the future of sports streaming and advertising, Young said that he doesn’t think advertising would ever get taken out of sports.

“If you look at the Kayo model, you are paying a subscription fee, but you do have advertising as well. The future is incredibly bright for live sports and advertising. Optus is another perfect example of that subscription service, but they run advertising, ESPN as well. As the ecosystem grows and adapts and changes, we’re going to see sporting rights move around quite significantly. Big global players coming in and bidding on rights, driving prices up. Live sports staying free and having the ability to get access to them through a broadcaster is going to be paramount. There’s going to be a healthy mix between the two.”