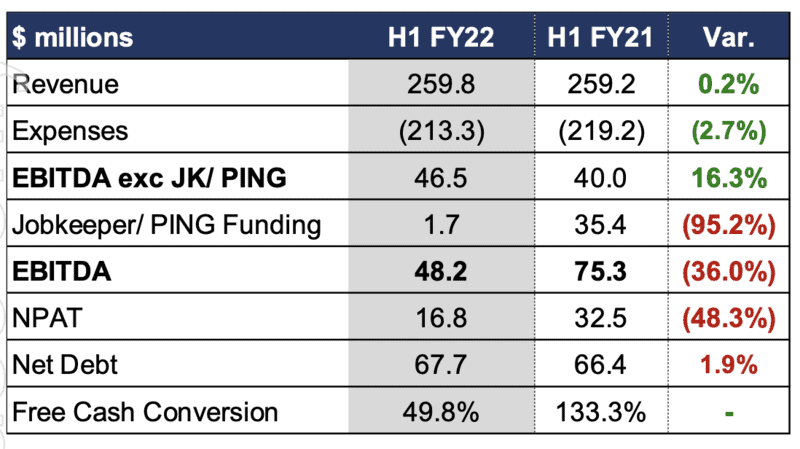

TV and audio group Southern Cross Austereo (SCA) has reported a flat revenue result for the half-year, but an improved profit. Revenue for the six months ending December 2021 was up 0.2% to $259.8m.

EBITDA for the period (ex-JobKeeper) was up 16% to $46. Expenses grew 2.7% to $213.3m.

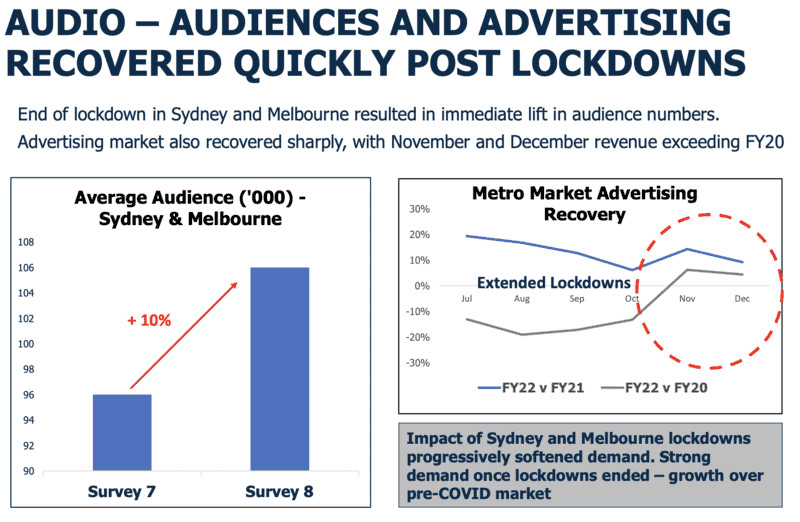

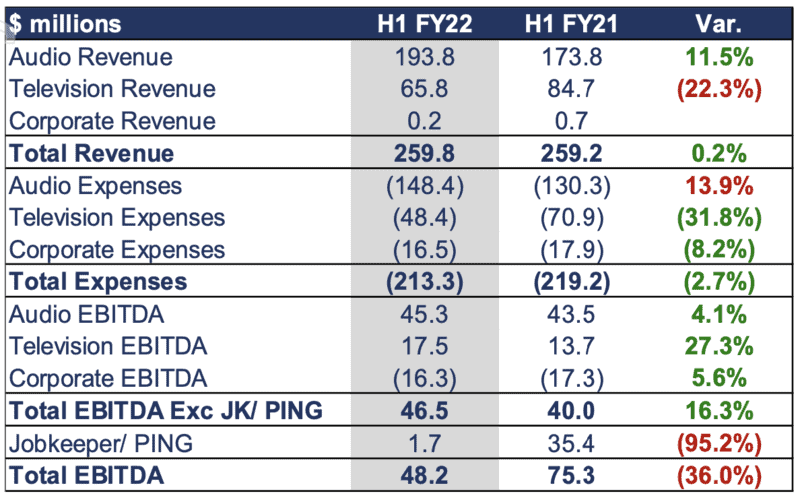

Total audio revenue grew 11.5% to $193.8m. Broadcast audio revenue was up 10.3% to $183.3m. Digital audio revenue for LiSTNR was up 37% to $10.5m. LiSTNR now has 500,000+ registered users in the 12 months since launch.

In television, SCA reported is transitioned seamlessly is affiliation from Nine to Network 10 from July 1, 2021. While television revenue was down 22.3% from $85m to $66m in the half-year, EBITDA improved, up 27% to $17.5m.

SCA CEO, Grant Blackley, said in a statement:

“SCA delivered underlying EBITDA of $46.5m, which was 16.3% ahead of the corresponding half in FY21.

“Audio revenue rose 11.5% to $193.8m. Pleasingly, this result was delivered on the back of stronger metro, regional and digital audio markets. SCA’s metro audio revenue increased by 13.8%, regional audio revenue grew by 4.9%, and digital audio revenues improved by 36.8%.

“LiSTNR is at the core of SCA’s business and has rapidly gained over 500,000 signed-up users in the last 12 months. The strong brand recognition and expanding premium library of content are generating a higher number and increasing weight of advertising briefs from marketers looking to connect with addressable audiences at scale.

“SCA’s television assets performed strongly. With television advertising markets recovering more quickly than audio markets, our open and effective operating relationship with Network 10 delivered above-market returns for both parties. From 1 April, SCA will take over national sales representation for Network 10 programming in northern NSW and Tasmania which will simplify buying of Network 10 for national advertisers in regional Australia.

“The recovery in advertising markets continues to strengthen but is uneven, with Omicron related disruptions tempering the strong momentum from November and December. January Audio revenue rose 3%. SCA’s Q3 Audio revenues are expected to finish with mid-single-digit growth on the prior year, while television revenues are expected to deliver a result consistent with H1.

“Advertising markets in Q4 are expected to benefit from a normalising market, improving consumer and business demand and the upcoming Federal Election.

“SCA has a strong balance sheet with net debt of $68m and leverage of 0.7X EBITDA. Our quality of earnings continues to drive strong cash flows to support investment in new and emerging products and income streams and increasing shareholder returns.”