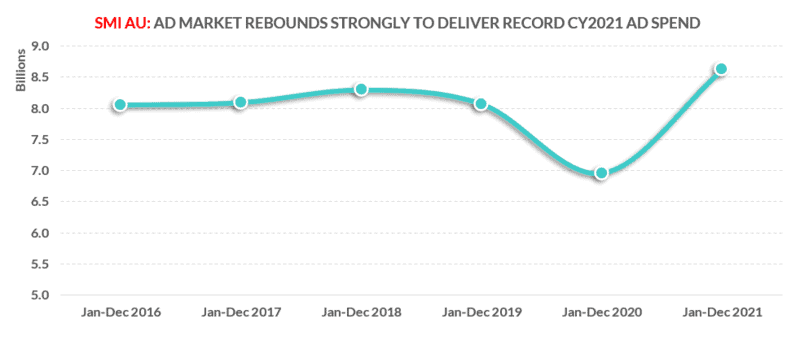

Australia’s media agency market has emerged confidently from the traumatising Covid period in a far stronger position, according to SMI, delivering a record level of advertising expenditure in the 2021 year of $8.6 billion after reporting record levels of ad spend for the December month, quarter and half.

The year was characterised by one of continual ad market improvement with the SMI data showing consecutive year-on-year ad growth for each month in 2021, in turn ensuring the value of advertising bought by SMI’s media agency partners was $323.5 million above the previous record set in CY2018.

SMI AU/NZ managing director Jane Ractliffe said the results again proved the advertising economy is one of the more robust, with SMI showing that numerous product categories are spending far more on advertising now than in the pre-COVID era.

“Given advertising expenditure is so strongly correlated to GDP, this SMI data provides a very strong indication that the broader Australian economy is moving well beyond the original COVID downturn and has instead learned to function extremely effectively in the new COVID era,” she said.

“The SMI data clearly shows the economy is being fuelled by a level of advertising expenditure that’s never before been seen, and among the 20 largest of SMI’s product categories we can see the media investment of 14 categories is well above that reported in pre-COVID CY2019.

“Today’s data shows, for example, the level of ad spend from the Communications category in CY2021 was 47% higher than in CY2019; Alcoholic Beverages ad spend has grown 52% from that time, Food/Produce category ad spend has grown 25% and Technology ad spend has soared 59%. This all underscores the fact that the level of confidence in today’s market is at unprecedented levels,” she said.

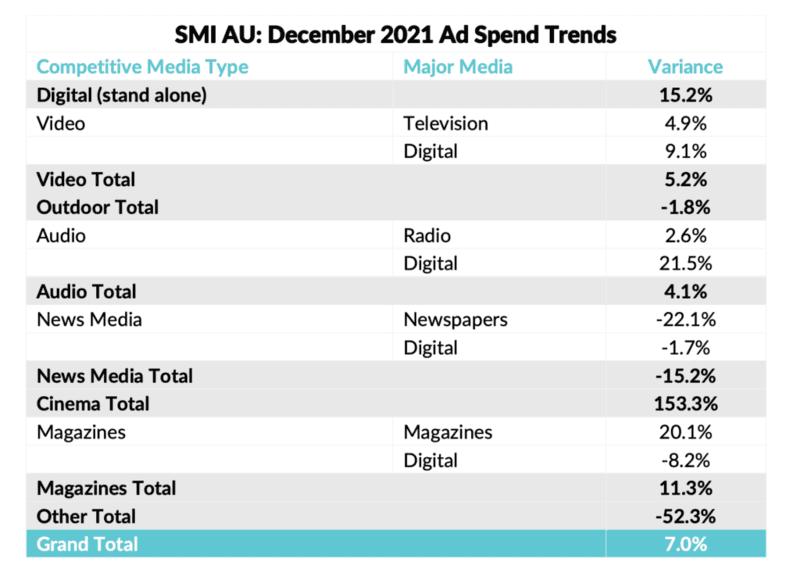

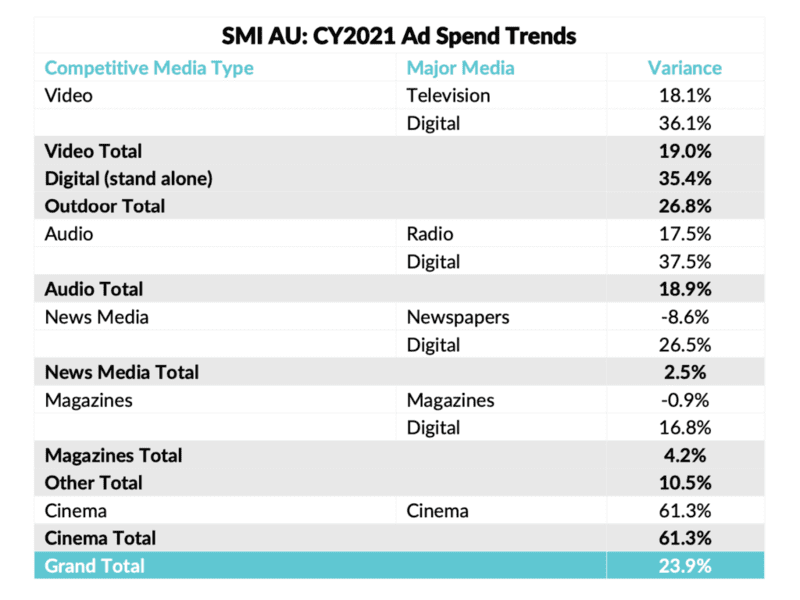

Ractliffe added the Covid experience has also changed the shape of Australian media, and for the first time the Digital media delivered the highest level of annual ad spend in CY2021 after growing 35% from CY2020.

“Digital media now accounts for 38.6% of all Agency ad spend and grew its share by 3.2 percentage points from the 2020 year,” Ractliffe said. “The only other media to grow their share this year were Outdoor (+0.2ppt) and Cinema (+0.1ppt) as they continued to recover from the huge impact on their businesses at the start of Covid.”

But Ractliffe said that when Digital revenues were allocated back to traditional media content, the Video market remains the year’s largest (+19%) with non-traditional Digital revenues at $2.8 billion (+ 35.4%).

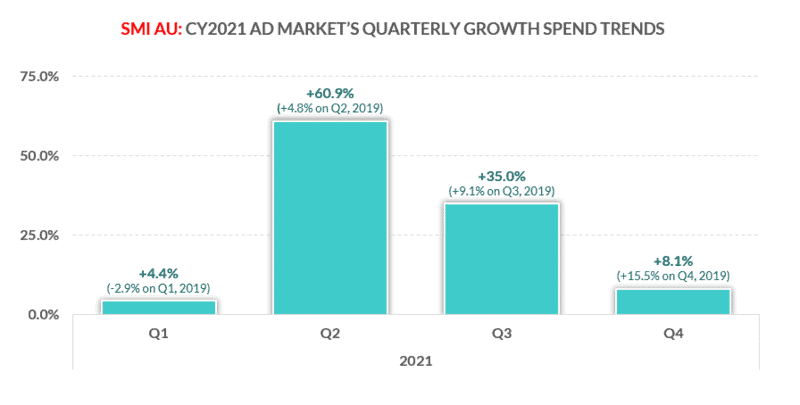

In terms of quarterly ad spend trends, Ractliffe said the CY2021 market was notable for the fact that ad spend continued to grow even as the prior-year periods became more ‘normal’.

“The second quarter of 2020 bore the brunt of the COVID pandemic given the shock of the first wave of COVID, but then the economy began to pick up and these quarterly results highlight the market’s overall strength as the level of ad spend continued to grow well beyond 2019 levels throughout the year,” she said.

SMI: Other key trends from CY2021

• December month ad spend lifts 7% YOY to move beyond $700 million for the first time

• Metropolitan TV delivered a record level of CY2021 linear TV ad spend (+20.1% to $2.52 billion) and Regional TV ad spend just 1.6% back on the high set in CY2018

• Within Digital, Social Media was the fastest growing sector with total ad spend +51% on CY2020

• Regional Radio reported a record level of annual ad spend in CY2021

• National print mastheads grow 19.3% in 2021 to deliver their highest result since CY2016

Ractliffe said the current level of high demand looked set to continue, with the early view of January ad spend already showing growth mostly driven by Television given the move of the Australian Open broadcast into the month of February in 2021.

See also: SMI reports record ad spend in November as media agencies invest $850m+

Top image: Outdoor sector ready to recover post-Covid