• National marketer ad spend slumps in February

• Largest percentage decline in ad demand seen since 2009

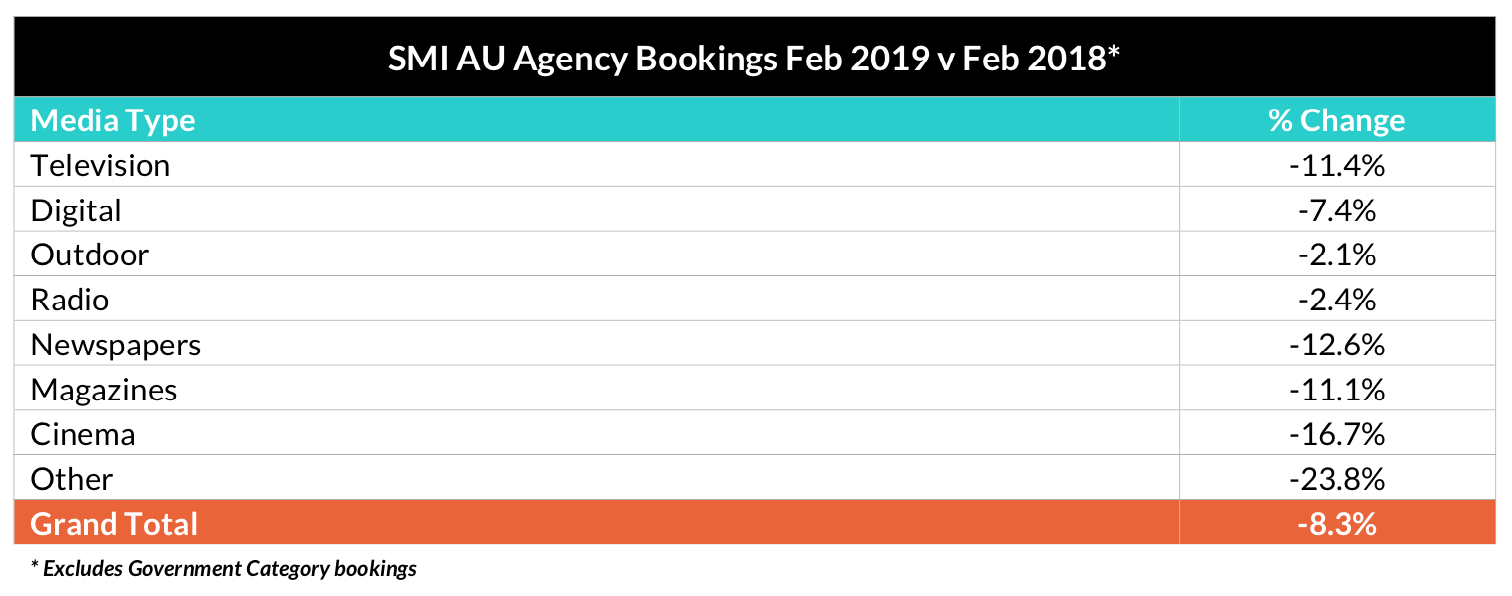

Australia’s media agency market has experienced the softest advertising demand seen in almost 10 years in February, with total bookings back 8.3% to $482.9 million from a record high February result in 2018, reports SMI.

The February decline of 8.3% is the largest seen in the SMI database since April 2009, and the usual strength of the media agency market is underscored by the fact that negative demand has only been recorded five times in SMI’s 12 years of data history.

The lower bookings were partly due to some timing issues as the Winter Olympics were broadcast in February 2018 and that month also featured exceptionally strong increases in domestic bank ad spend (up 56.6% at the time) in the lead up to the Financial Services Royal Commission.

As a result all major media are reporting lower bookings this month, even with Government category advertising excluded to normalise the results.

And although television’s results were impacted by last year’s Olympics, SMI’s new digital client count detail shows there were far fewer corporates advertising in February – at least in the digital media – with the number of large digital advertisers decreasing 17.3% to 1,103.

SMI AU/NZ managing director Jane Ractliffe said while the decline in financial sector ad spend was the primary driver of the market softness other product categories contributing to the malaise included toiletries/cosmetics (ad spend -24.9% YOY) and media companies (ad spend -23.2%).

“There are also some positive signs in the data with SMI, for example, tracking ad spend by political parties and unions and in February – with the NSW and Federal elections approaching – we saw this category’s ad spend grow 52.5% to $4.43 million,” she said.

“The television media scored the largest share of this investment (43%), followed by radio (19.1%) and Outdoor with 14.9% of this category’s media investment.”

And as with any monthly result there are some bright spots, with those for the February 2019 period including:

• The largest category of automotive brand grew its media investment 7.4% in February

• Travel emerged as the 3rd largest category for the first time, driven by ad spend growth from cruise lines (+21.2%) and tovernment tourist bureaux (+30.6%)

• Within Subscription TV, the direct (non-automated) market continues to grow with its bookings up 16.7% YOY

• Regional radio grew the value of its advertising sales 1.1%

• SMI launched NZ’s first digital ad format detail, providing that market the first monthly view of online video, audio, display, native and search ad format ad spend

The February result continues a bleak financial year thus far, with total bookings back 1.2% to $4.56 billion with only the digital (+2.6%), outdoor (+6.7%) and radio (+2.5%) reporting any growth.