Guideline SMI has reported results for February 2024 continue to indicate a soft start to the calendar year with total ad spend.

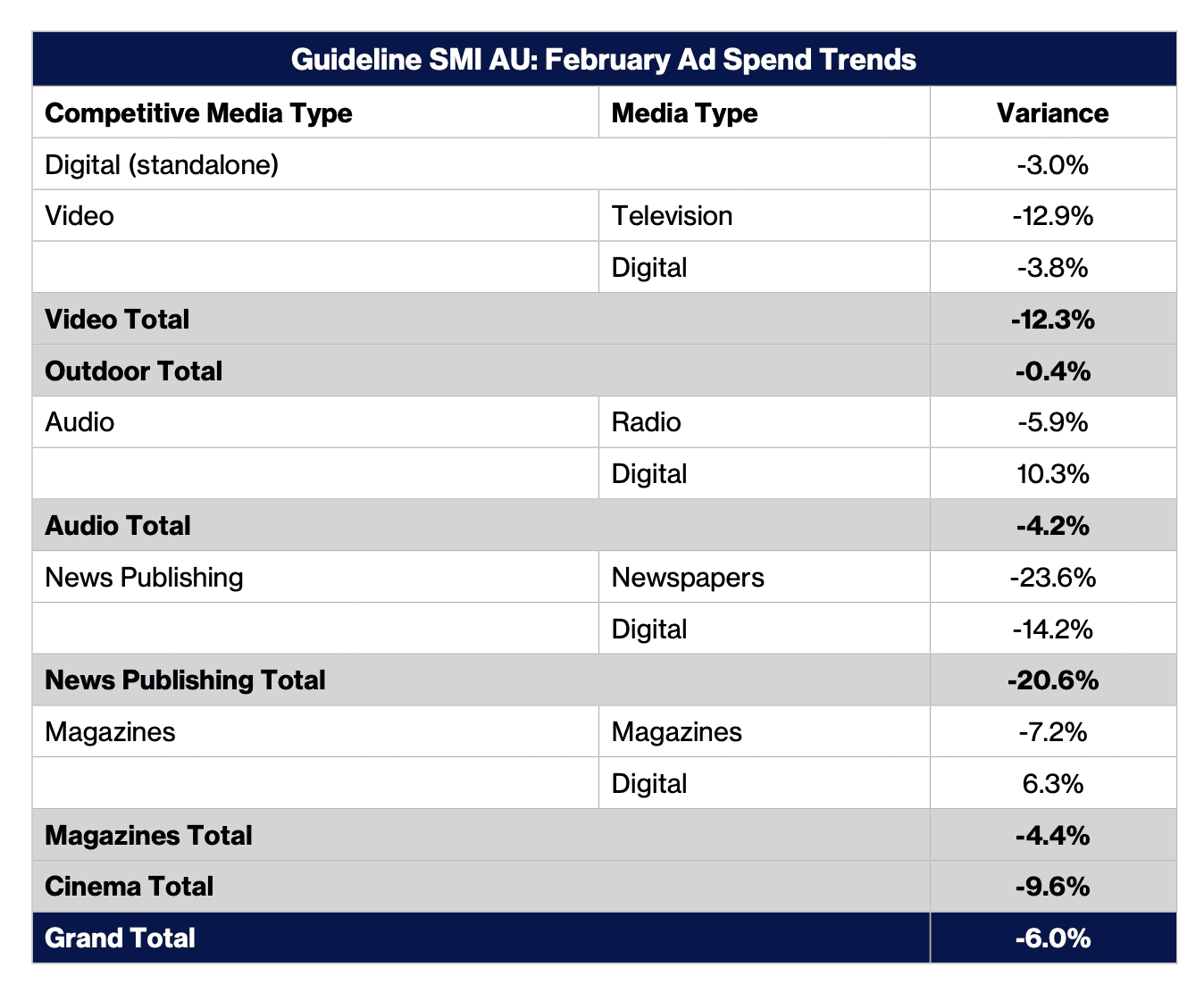

An analysis of media agency February data indicates the market is back 6% year-on-year. The lower Australian ad demand contrasts to record and near-record results in other ad markets.

Outdoor sizzles on lukewarm BBQ

In Australia in February, Guideline’s data indicated outdoor again emerged as the best-performing media. Outdoor recorded a small year-on-year decline in demand of just 0.4%. Within the outdoor sector, retail outdoor, programmatic outdoor, and transit all reported double-digit growth.

Digital ad spend was back 3.1%, but within that, social media bookings were up 5.9% and programmatic bookings returned to growth, up 4.7%.

Guideline SMI APAC managing director Jane Ractliffe said the February result for the Australian market varied significantly from those seen in other sophisticated media markets. Guideline’s US team reported record US ad spend in February.

“We’ve also seen a 7% increase in Canadian ad spend in February to a level only exceeded in 2018 when there was the Beijing Olympics. In China, ad demand grew 12.5% in February and is now up 6.7% this calendar year after a tougher 2023,’’ Ractliffe explained.

“We have always expected a softer period in Australia up until at least Easter. Ad demand will likely to pick up in the second half when tax cuts and key sporting events – such as the Paris Olympics – combine to lift demand.’’

Australian ad demand was mostly impacted in February by large declines in ad spend from banks and the communications categories.

The automotive brand category dropped by 10% despite a 50% increase in bookings to the electric vehicles subcategory.

Media owners were missing in action too with category ad spend almost halved with a steep decline in ad spend from TV and radio stations.

The good news from SMI Guideline

There was strong double-digit growth from food/produce/dairy advertisers. Ad spend from the toiletries/cosmetics category soared 42.9% YOY.

Ractliffe noted the local FYTD results were more positive, with a decline of 2.1%. This represents a small fall against last year’s record period. In that time, outdoor ad spend has achieved the strongest gains (+12.1%) while total digital bookings are up 3.6%.

See also: “Very hard not to grow” – Guideline SMI predicts growth for Australian ad market in 2024