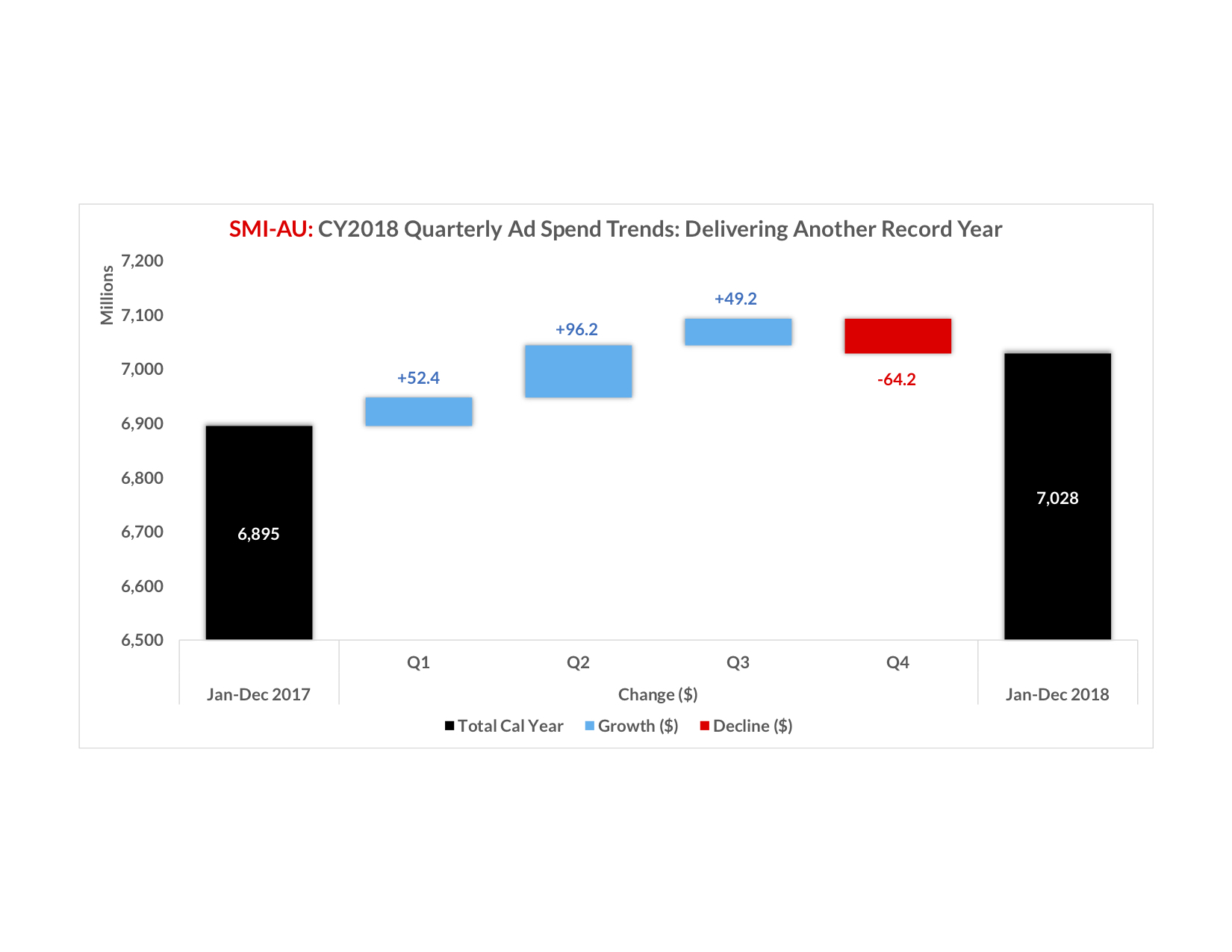

Australia’s media agency market has maintained its unblemished record of market growth, delivering its sixth consecutive year of higher advertising expenditure in CY2018 with the total lifting 1.9% to a new record of $7.02 billion, reports SMI.

Most of the growth was concentrated in the first half of the year (+5.5% to $3.5bn) with bookings for the six months to December more subdued (-0.4%) as the large categories of Domestic Banks, Insurance and Food/Produce/Dairy significantly reduced their media investment.

The CY2018 year featured many notable milestones, including:

• Outdoor overtaking Digital media to emerge as the fastest growing media for the first time, which in turn grew its share of Agency spending to 13.7%

• Digital media breaking through $2bn in agency ad spend for the first time

• Radio media reporting its sixth consecutive year of record ad spend

• Record levels of annual ad spend for the categories of Retail, Automotive Brand, Gambling, Domestic Banks, Other Financial Services, Travel and Pharmaceuticals

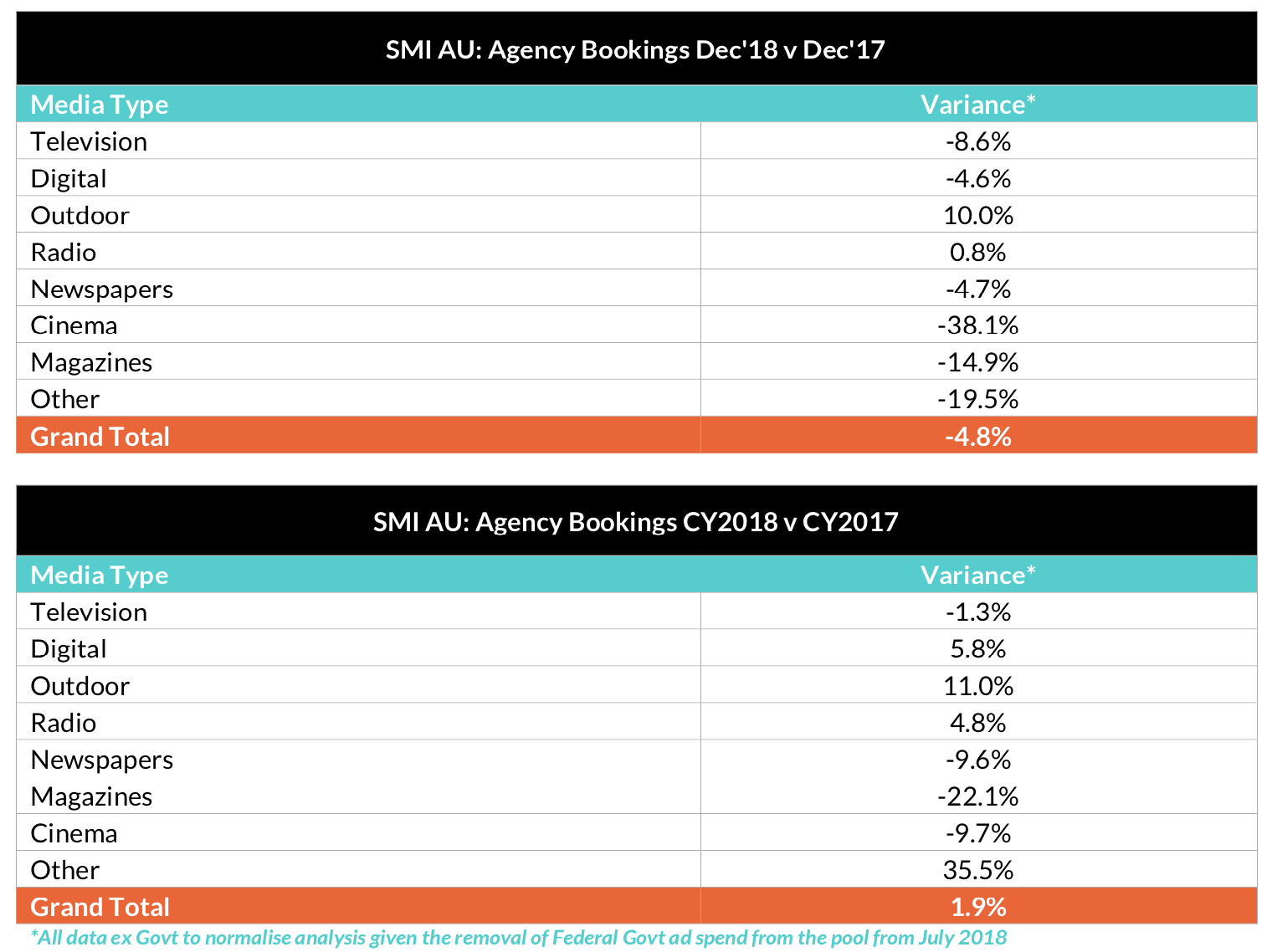

The year ended with a softer month in December (demand -4.8%), although there was continued improvement in Metropolitan Press with total spend back just 1.1%.

While total TV bookings for December were back 8.6%, each of the Seven, Prime and Foxtel businesses reported hugely positive results off the back of the new cricket broadcasts.

Total bookings for the fourth quarter are back 3.3% mostly due to large declines in ad spend from the Domestic Banks (-23.4%), Food/Produce/Dairy (-15.6%) and Restaurants (-13.4%) categories.

SMI AU/NZ managing director Jane Ractliffe said the fact the agency market had hit yet another record level of ad spend again proved the ongoing strength of the industry and its ability to evolve to meet advertiser and market needs.

“We’ve seen agencies spending more on Metropolitan TV for the third year in a row while also branching into new media services such as Podcasting and Digital Outdoor as clients continue to test new services to gain the best value from their advertising investment,” she said.

Ractliffe added the year was also notable for a significant change in growth drivers within the Digital media, with Search and Social Media bookings delivering the highest growth.

“The Search media returned to very strong growth in 2018 after a more subdued 2017 while Social Media maintained strong double-digit growth across both years,” she said.

“But the biggest change was the large slowdown in growth in Programmatic bookings, as in 2017 that market had grown by $174.3 million but in 2018 the increase is a far reduced $19.4 million and as a result Programmatic’s share of total Digital bookings fell across all time periods.”

More detail on the CY2018 and December 2018 ad spend trends across Major Media is shown below: