Seven West Media chief executive James Warburton delivered the full-year results this morning, revealing a significant jump in profit for the year ended June 26.

In addition to a profit of $229m, group net debt dropped 40% to $240m.

Metro FTA ad dollars lifted 25.8% in the second half of the year, up 11.5% across the whole year.

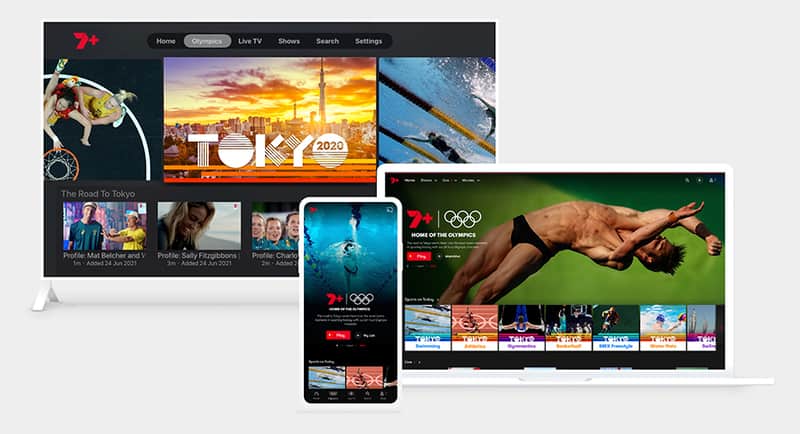

Like Seven’s counterparts, digital ad revenue was the star performer, 7plus revenue was up 78% YOY, with market share improving too.

James Warburton commented: “Our result today reflects the material progress of the changes made over the past two years.

“Since 2019, we have increased EBIT and grown our digital business to over 25% of earnings. We have a new entertainment schedule that is increasing ratings across all key demographics. We were the only network to grow commercial audience share across the key demographics in the financial year, which has set us up strongly to monetise this in FY22. At the same time, we have slashed our net debt position by 57% since FY19, giving us a balance sheet to pursue future growth opportunities.

“The evolution of the digital and data side of our business has been a core element of our transformation strategy and the results are clear. 7plus revenue grew 78% in the financial year, outstripping the BVOD advertising market growth of 55%, and 7plus now has 9.2 million registered users. Seven’s digital earnings in FY21 were $60 million, up 131% on the previous year.

“A landmark milestone achieved this year was our commercial agreement secured with Google and Facebook, which was first in market and reflects the quality and value of our news content.

“WAN has grown its audience across print readership and digital, increasing circulation and subscription revenue while also transforming the cost base,” he said.

“We have reignited the Seven West Ventures strategy, with several new investments underway, and the portfolio increasing in value by 11% to $56 million.”

Seven West Media outlook

Commenting on the outlook, the company told the ASX its market momentum had continued into the new financial year.

Seven is targeting a 40% broadcast share in the first half of 21/22. First-quarter bookings are up 60% YOY.

Digital earnings are forecast to double to more than $120m in FY22.

West Australian Newspapers is tracking 7% ahead on July 2020.

Warburton continued: “Our company has seen many changes over the past 12 months and the results have been very encouraging. The improved performance has been driven by the relentless pursuit of the three strategic priorities we introduced in the second half of calendar 2019.

“The priorities – content-led growth, transformation, and capital structure and M&A – sit at the core of our three-year plan and they remain our focus.

“Seven West Media is unashamedly a content company. Our content-led growth strategic pillar underpins our plan to return to market leadership across linear and digital television, with a focus on younger demographics,” he said.

“The content changes are delivering audience share gains, with growth in revenue share to follow. Returning to our historic average share is a $90 million incremental revenue opportunity.

“7plus is also a key focus. We will continue to expand our BVOD offering and examine SVOD options that are viable and make financial sense.

“Cost discipline and addressing onerous content contracts are an ongoing focus for us. This year we will also renegotiate our debt facilities to secure an improved financial position.

“All of this, particularly the improvement in our balance sheet, puts us in an excellent position to work with new partners and/or towards consolidating the media sector. We are pursuing several options in these areas.”

See also: James Warburton digs deep into Seven West Media first half results