Seven West Media needed some good news this week after a tough start to the month. The company’s FY24 full-year results revealed by new chief executive Jeff Howard didn’t offer any.

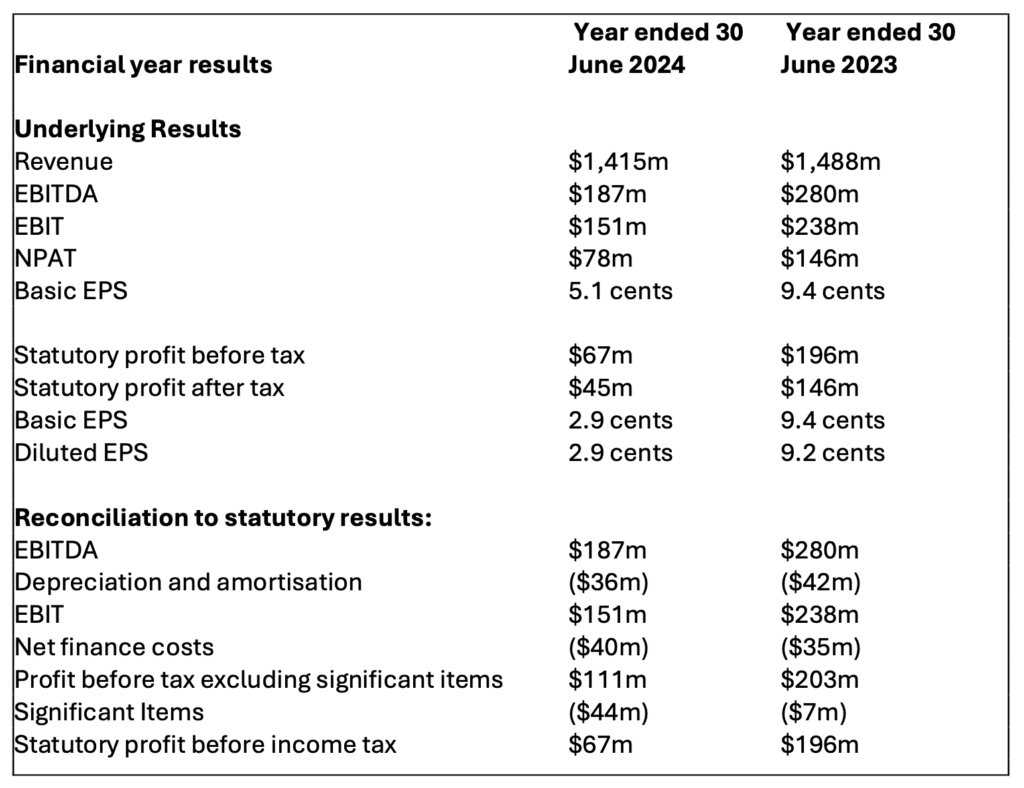

Group revenue of $1,415m was down 5% ($73m) on FY23. Statutory net profit after tax of $45m was down 69% on FY23, while underlying net profit after tax was $78m, down 46%. Group EBITDA before significant items of $187 million was down 33% ($93 million) on FY23.

Without the Olympic Games for the first time since 2012, Seven was beaten up badly in the TV ratings for the first two weeks of this month.

Then on the day of the Paris 2024 closing ceremony, the bad news continued – ABC’s Four Corners dropped its investigation into what was called a “toxic culture” at Seven.

In a statement issued with the earnings results, Howard said: “FY24 is a tough result for SWM in a challenging market. While growth in audience and revenue share partially offset the impact of the weak market, cost growth of 2% contributed to our EBITDA decline of 33%, reflecting the operating leverage in our business.

“Following delivery of $25m of cost-out initiatives in 2H, we have taken decisive action to materially increase the program into FY25 to give SWM a platform to drive improved performance.”

Seven ad share edges higher, cost cutting to continue

Howard continued: “The continued weak economic environment contributed to an 8.2% decline in the total TV advertising market in FY23. SWM was able to partially offset this decline by increasing our revenue share of the total TV market to 40.2%. This share growth was built on the targeted content investments made.

“The group was able to partially offset these investments through the implementation of $25 million of cost reductions in the 2H under the program announced at the FY23 AGM.”

The company noted the cost-out program will see costs decline in FY25 to a range of $1.2 million to $1.21 million. The targeted cost-out program of $108 million includes the already announced $35 million remaining under the previous program.

Seven West Media’s Jeff Howard

“SWM continues to deliver market-leading content across our linear and digital platforms that engaged and grew audiences during FY24,” Howard said.

“We achieved solid growth in our BVOD audience during the year, but we are still to fully capture the revenue opportunity.

“We are committed to driving improved profit and cash flow irrespective of market conditions. Despite the advertising environment, we are focusing on capturing a greater proportion of available dollars in each market including a step change in our digital revenue performance. FY25 revenue will include the benefit of digital rights under the new cricket and AFL sport contracts. We have also implemented an enhanced cost-out program that will deliver a year-on-year decline in costs in FY25.”

Reconfirms new operating model

Seven West Media reconfirmed the June 2024 announcement of a new operating model for FY25.

That new model comprises three divisions: television, digital, and The West. Each division will operate as an accountable and transparent profit centre.

Howard explained: “Our new operating model establishes clear accountability for driving our own financial destiny. We will build a better and more resilient media business that captures the clear opportunity in digital and maximises the financial returns in our traditional businesses. The change in structure and leadership allows us to leverage skills across the business and to embed a performance culture.”

Outlook notes Olympic impact, cricket improvement

A brief trading update noted the TV market grew in July and August off the back of interest in Paris 2024. Seven implied its share suffered though with that new money going elsewhere.

September and October forward bookings are trending down up to 5% YOY.

One bright spot is increased interest in this summer of cricket which features India playing Australia. Cricket bookings are tracking +11% vs the same time in 2023.

See also: Seven West Media: New divisions and leadership roles in wake of redundancies