Since the departure of James Warburton from Seven earlier this year, new chief executive officer Jeff Howard has been familiarising himself with all parts of the business.

Any honeymoon he might have had in the new role ended this month with the Olympics screening on the opposition, and a Four Corners investigation highlighting culture problems at Seven.

Then this week, the full-year results didn’t paint a rosy financial picture.

Since moving into the top job, Howard has visited all metro offices at least once to meet as many people as he can. He also recently held a virtual town hall meeting with over 800 people dialling in. He is writing to all staff once a fortnight with company updates.

Jeff Howard

Before Howard’s Q&A session with Mediaweek, he wanted to provide corrections to a few fake news narratives being spread.

“Some people have been describing our audiences as collapsing,” said Howard. “That’s not the case. In FY24 our broadcast audience was up 0.5% and our BVOD audience was up 39%. YTD calendar year to date, pre-Olympics, we were down less than 1%.”

He was keen to emphasise Seven’s small revenue share lift. “We have delivered a total TV revenue share of 40.2%, which is up 1.7 points YOY. We delivered a 41% share in Q4 FY2024 which was a massive quarter.”

That indicates Seven is doing well, but in a sector that is going backwards. Just how much? Howard explained: “We are seeing the decline moderate. The -8% market drop for the full year impacts us by $100m.”

See also: Total TV ad market records $3.3bn in ad revenue for FY24 – down 8%

Cost-cutting hunting saving over $100m

In light of the poor performance, Seven has been aggressive in finding more cost savings. Howard: “Costs were down 4% in the second half after we announced the first round of costs out at the AGM last November. We have expanded the program into FY25. We said initially we would find $35m of benefits in FY25. We have increased that to $108m.”

A new target cost-saving of $108m in FY 2025 doesn’t mean that costs will decrease by that much YOY. Because of some increased costs already committed to, like the new AFL deal, Seven West Media’s overall net costs will be down by $20m.

Seven content pipleline ‘strong’

“We have some great brands and the content pipeline is pretty strong,” said Howard. When asked about the ability to maintain quality by spending less, he noted, “That’s something we spend a lot of time thinking about. It’s not going to be an easy slam dunk. We make sure wherever costs are being taken out we understand the impact on the quality and also the revenue impact.”

As to any further staff cuts, Howard wasn’t able to discuss the number of staff impacted so far. While some reported the number around 150, it’s thought the job losses were closer to 100. Staff were impacted at all levels and included chief revenue officer Kurt Burnette, chief marketing officer Melissa Hopkins, and head of sport and MD Melbourne Lewis Martin.

Howard was able to say: “We had to look at how this organisation needs to be structured to fit the strategy. The organisation restructure and the move to a profit centre model meant that some of our previous senior leaders didn’t have roles in the new structure.”

Howard said he was pleased with how the new structure was performing initially. “We will constantly review to make sure it’s fit for purpose and delivering what we need to deliver.”

Jeff Howard discussed how Nine’s Tipping Point has impacted early evening viewing

Curtailing growth of 9News

Is the battle between Nine’s Tipping Point and Seven’s The Chase Australia impacting Seven’s primetime performance? Particularly the news hour at 6pm?

“We spend a lot of time looking at the 5pm hour and then later timeslots as they attract premium ad dollars. As we look at The Chase this year, our audiences have held up pretty well. What it seems the Tipping Point did was re-energise people who might have stopped watching the previous show [Millionaire Hot Seat]. What that means for our news is that we need to continue to look at options for driving news audiences as hard as possible. And making some changes to attract new audiences.”

Is FTA giving up on long-form drama?

Apart from Home and Away, Seven doesn’t have much to offer viewers in terms of Australian drama. Howard alluded to the success of Mr Bates vs the Post Office in his presentation, so why doesn’t Seven strive for more Aussie drama hits?

“We launched RFDS and we’ve been very happy with how that has gone. It’s not a long series though. We did a short special series The Claremont Murders which also performed very well. When we plan a content slate we are always considering all the genres that might work and deliver a return on investment.”

RFDS has screened in 2021 and 2023. More might be coming in 2025.

AFL: 7Plus and Saturday games

“AFL and cricket have never been available for free on a digital platform in this country before,” said Howard about a potentially game-changing move. “We expect to see a substantial uplift in audiences once people work out it is available for free. We therefore expect a meaningful improvement in 7Plus revenue as a result of live sport. We feel it will also drive the audience into our other live or VOD content on 7Plus.”

Seven is giving up Saturday night for part of 2025 giving exclusivity of the day to Fox Footy and its homes on Foxtel and Kayo. Given what happened on Nine with the NRL some time ago, isn’t the commercial return from a Thursday match better than Saturday night? “We haven’t talked around the specifics which nights are better. However, when we went into that contract we were very conscious of the structure that we needed to maximise the opportunity for us.”

Progress of Phoenix and its impact

“We’re getting really close,” said Howard to a question about finishing the build of Seven’s total TV trading system Project Phoenix. “We are at the very pointy end of that project. All going well it will be live at the end of calendar 2024 or early in 2025. It will take a little time to get everybody up to speed with the opportunity that Phoenix provides. We are hoping for a [financial] benefit in FY25, but we are expecting the bulk of the benefits to kick in during FY26.”

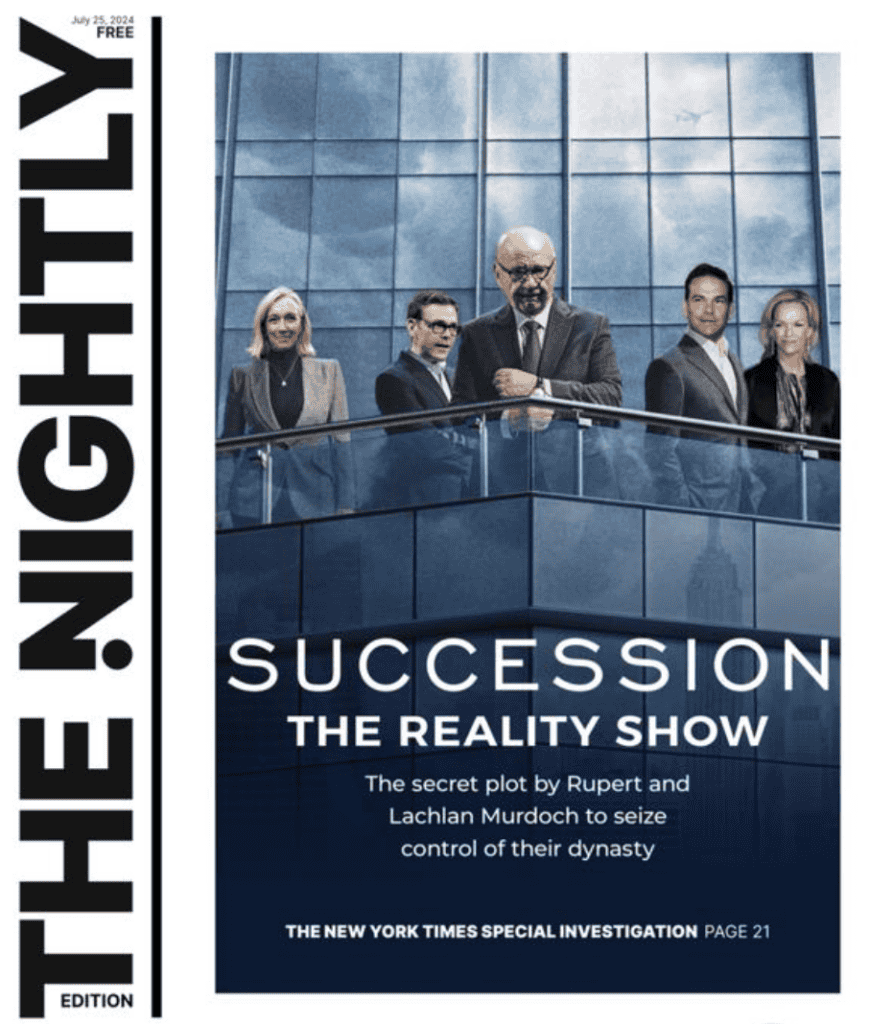

How big can The Nightly be?

Although the financial performance of The Nightly sits inside The West division in the new structure, Howard noted people across the wider Seven West Media group are involved. “People right around the country contribute to content. We think of it as a national business. From a revenue perspective we are talking to national clients in all markets.”

Seven noted The Nightly should become EBITDA positive during FY25. When asked if it could become a significant contributor, Howard said: “We are close in size of audience to The AFR and The Australian. We are pretty happy with that after five months. To have a start-up washing its face in such a short period is a fantastic result.”

Seven’s director of news and current affairs, Anthony De Ceglie, still has a role at the digital publication he founded. “There are a lot of people also involved in how it performs,” explained Howard. “Anthony loves getting involved in storytelling and there are others in the news department who are also active contributors.”

Investigating new revenue streams

Regarding Seven launching its own subscription TV service, Howard admitted it was something the broadcaster is not actively pursuing. “Building a non-ad-based revenue stream though is something that’s high on the list. If we can diversify away from ad models that would be a good thing. The West is doing that already so we will continue to examine that.

“The new management team has been in place for five weeks. It is bedding down the restructure and focussing on making sure we have the plan in place to deliver to FY25 expectations. Once we do that, we can turn our minds to other things.”

Howard said the 7Plus platform doesn’t have the capability to host pay-per-view offerings. “We don’t have the technology at present and we would have to look at the rights we have on content that we are not manufacturing ourselves.”