• Seven delivers 21st consecutive half of market leadership in television: in audience delivery, advertising revenue and profitability.

• Seven delivers market-leading advertising revenue share of 40.8% in television across the first half of the financial year and the third-highest Olympic Games revenue share ever and highest since the Beijing and Sydney Olympic Games.

• Seven West Media, including Yahoo7, is the #1 Australian digital content publisher by audience.

• Seven West Media delivers an underlying EBIT of $148 million, down 27.7%, on total revenues of $905 million across first six months of the current financial year. Profit before significant items, net finance costs, tax, depreciation and amortisation (EBITDA) is $170.8 million.

• Seven West Media maintains disciplined cost management – with underlying total costs down 3.8% in the period (excluding Olympics and third party commissions).

• Seven West Media maintains full year guidance for underlying EBIT based on current visibility.

At the start of today’s results conference call, Tim Worner said in regards to Amber Harrison: “I have apologised, do not want to give subject more oxygen…Seven West Media remains focused – we have not been distracted.”

Meanwhile, Seven West Media has reported its interim financial results for the first half of the 2016-2017 financial year.

Commenting, CEO and Managing Director of Seven West Media Tim Worner said: “We are delivering leadership across our media platforms. We are delivering on a successful strategy that provides us with a clear, continuous and sustainable plan for growth to 2020 and beyond. We will continue to build our businesses, manage our costs, grow our content production capacity, and deliver that content wherever the audience wants to consume it and wherever we can monetise it. Much has been done on driving greater efficiencies across all aspects of our business and we will continue to focus on further enhancing our operating margins.”

Advertising Market and Revenue Performance

SMI data reported that the Australian advertising market declined 0.4% in the 6 months to 31 December 2016 compared to the same period in the previous year. Metropolitan television advertising growth declined 4.5% year on year for this period based on KPMG Free TV data. Seven outperformed the market growing its lead across commercial networks with a 40.8% share. Over the same period Seven grew revenue by 4.6% excluding 3rd party productions and program sales. Advertising in the digital market maintained its strong growth, with SMI data indicating an increase of 10.0 percent for the 6 month period to 31 December 2016 against the prior year.

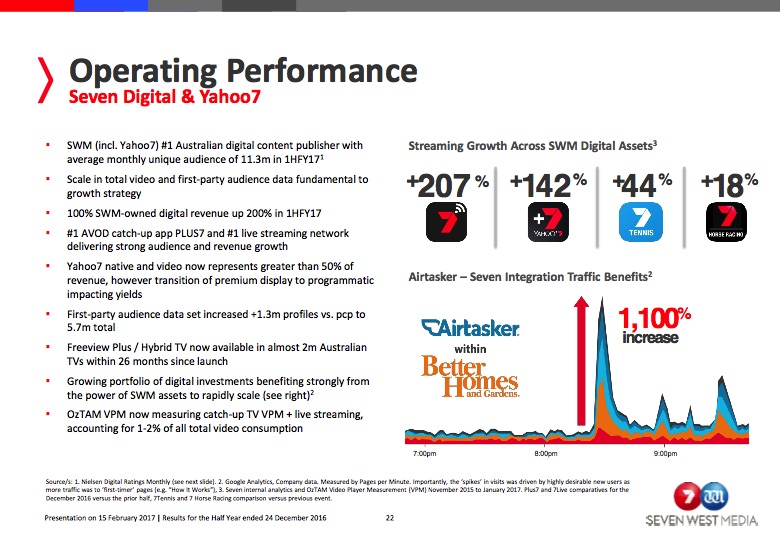

SWM’s digital revenues continue to grow strongly +200% YoY, particularly from live streaming. Yahoo7 has continued to see strong growth in video and native advertising, however softer trends in traditional static display in the move to programmatic has impacted yields. Trends in publishing advertising remained the same, however our assets continue to outperform their peers. This has been achieved while also accelerating the transformation of these businesses. In the face of challenging cyclical conditions in the WA economy, The West Australian Newspapers has delivered a further consecutive period of stronger than market revenue trends with particularly strong growth in digital. Pacific completed a restructuring of its portfolio including the sale of several titles in the half which impacted revenue. Yet despite this Pacific continues to gain traction on its closest peer.

Group revenue of $905.1 million (including share of net loss of equity accounted investees) was 1.4% higher than the prior half year with advertising revenue of $674.4 million. Television revenue represents 77 per cent of group revenue.

Seven

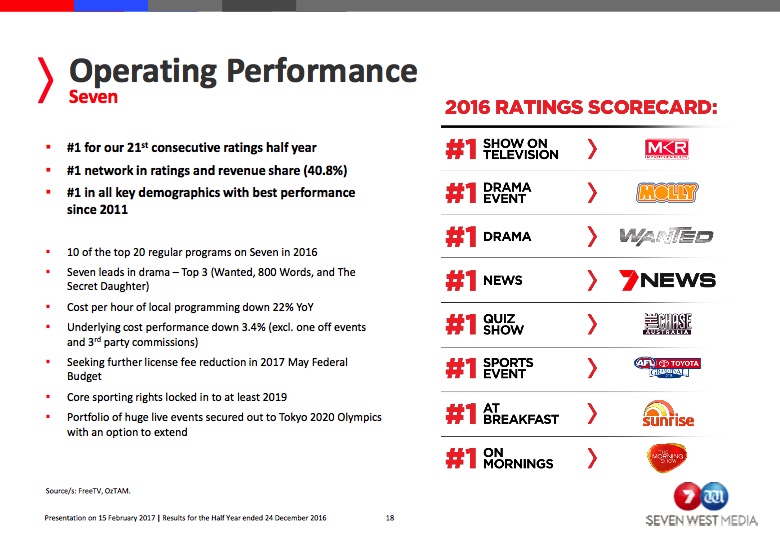

Seven continues to lead the market in television advertising revenue share based on KPMG Free TV data, delivering a 40.8% share for the 6 months to 31 December 2016 (Dec 15: 38.5%) in what continues to be a tough and competitive advertising market.

In 2016, Seven completed its 21st consecutive half of ratings and revenue leadership with a 38.9% total individual rating share excluding Olympics for primetime 18:00-22:30. Seven’s broadcast audience for the 2016 ratings year grew by 1% year on year. With its strongest performance in 5 years, Seven delivered the number one position in all key demographics, all people, 16-39, 16-54, and 25-54. Key to this demographic performance was the success of Seven’s new produced programming, Seven Year Switch, Wanted, 800 Words, First Dates and The Secret Daughter.

Seven is Australia’s most-watched broadcast television platform. Through its broadcast channels including 7, 7TWO, 7mate and 7Flix (which launched in late February 2016) – Seven continues to lead in primetime and dominate across breakfast and morning television. In 2016, Seven’s news and public affairs performance strengthened and sees the network delivering positive audience growth at 6:00pm and leadership across breakfast and morning television.

Seven delivered the most watched program (AFL Grand Final), top entertainment program (My Kitchen Rules), top event drama (Molly) and top regular drama (800 Words). Seven’s broadcast of the 2016 Olympic Games reached over 18 million Australians. As a result of Seven’s ratings dominance in the Olympic broadcast period, Seven’s leadership in news and current affairs, including breakfast and morning television, was strengthened in the second half of the year.

Seven continues to innovate in the delivery of its content, ensuring it is available to consumers anywhere, anytime and on any device. The delivery of the Olympics established a new precedent in the way Seven delivers content. Over 20.7bn minutes of content was consumed across Seven’s platforms, reaching 18.6 million viewers. Olympics on 7 app was achieved over 1.5 million downloads and reached a Unique Audience of over 2.9m Australians according to Nielsen. Over 37 million streams of live streaming and video on demand were consumed. Over 250,000 people registered for the premium Olympics offer. This form of delivery will be enhanced further with our upcoming sports line- up over the next 18 months.

Seven continues to deliver strong growth across its digital platforms with total streams across the network, including Plus7 increasing 119% on the prior half based on VPM data with 140 million streams. Plus7 average monthly audience increased 17% year on year.

Program sales and third party productions grew revenue 16.7% in the period driven by sustained international demand for Seven’s productions and new third party commissions. Seven established a wholly owned production company in New Zealand in the period and also took a controlling stake in UK scripted drama production company Slim Film and Television.

Program sales of Seven content and third party production activities continue to be strong. Highlights for the period include the commission of a second series of MKR UK by Channel 4, commissions in Germany and the success of Beat Bugs for Netflix and the release of the second and third special episodes of Home & Away on Foxtel Play and Presto. 7Productions also delivered series 4 of A Place to Call Home for Foxtel in the half, securing a commission for series 5 of this internationally acclaimed drama.

The West

The last six months has seen some of the most positive initiatives in WA Newspapers’ history, with the acquisition of The Sunday Times and Perth Now in November, followed by the relaunch of The West Australian website in December.

WAN relaunched The West Australian website on December 12, 2016 in a critical milestone of the company’s digital strategy. This, combined with the acquisition of Perth Now, has resulted in 163% YoY increase in digital audience to 1.1m people per month (Nielsen DRM, December 2016). WAN digital revenue also increased by 107% YoY and continues to scale rapidly. A number of new digital initiatives are underway, including the launch the of iOS and Android mobile application for The West Australian in Q3 FY17.

In print, The West Australian was the best performing weekday newspaper in 2016, with 3.7% net readership growth for Monday to Friday taking it to 894K, while The Sunday Times was the best performing Sunday newspaper in 2016, with readership of 471K (EMMA, 12 months to December 31, 2016). The West Australian continues to publish Australia’s best performing newspaper-inserted magazines. Readership for Seven Days and West Weekend magazines deliver greater reach in their state market than any other newspaper inserted magazine in a major metro newspaper. Seven Days is the best-read magazine in Western Australia (followed by West Weekend magazine).

The West Australian’s total masthead sales declined by 4% YoY to 167K per day, while The Sunday Times declined by 4.9% YoY to 179K per week. Total market sales declined by 16.5% for the major metro newspaper mastheads, making WAN one of the best performing publishers in the country (Audit Bureau Circulation September 2016).

Financially, WAN has been impacted by challenging economic conditions in the state. The company continues to execute its integration with television with the appointment of a local Chief Revenue Officer to drive additional sales synergies across all media, including TV, print, digital and radio.

Pacific

In the period Pacific has undertaken Phase One of a determined transformation plan to drive organisational change and future growth, and which has delivered immediate business performance in key metrics.

Central to the transformation plan were three initiatives: the refinement of the portfolio to focus on the key consumer and commercial categories of Homes, Health, Food, Fashion & Beauty and Entertainment; the optimisation of its core print business, leading to significant cost-out reductions; and investment in digital growth and new revenue opportunities.

Pacific initiated the transformation plan in September, with the decision to close, transition certain titles to digital only and sell non-core and non-strategic titles. As a result of the restructuring of Pacific’s portfolio in the period, revenue and profit have been impacted due to the lost revenue from closed or sold titles and the cost of implementing this transformation.

The cost-out focus of the transformation plan drove a 20% reduction in headcount, delivered through structural and systems-based changes which have revolutionised the content production process and fuelled content efficiency, output and quality. This has been shown in the period, where Pacific has also extended its position as Australia’s best-performing magazine publisher, securing 27% of all readership (consumer paid) with only 12% of total titles published (emmaTM by Ipsos MediaCT, 12 months to Nov 2016, people 14+, based on average gross readership).

The cost-out program has also helped protect the business against continuing advertising trends in magazines, with the market down 18% in the period. Due to the timing of the program, the business captured $0.5m of benefit this half, but will realise approximately $5m in savings in the second half.

The falls in advertising revenue have also been partially offset by strong growth in digital advertising, social media revenue and other projects, including e-commerce. In July 2016 Pacific also took in house the development, management and monetisation of all its digital properties, and over the last 6 months digital audiences grew 177% with 80% of the audience via mobile, making Pacific the leading mobile publisher in the country. Pacific grew digital revenue 102% in the period.

The transformation at Pacific is gaining traction while at the same time delivering on its strategy to create new revenue opportunities through its brands across online transactions, services, brand extensions, events, and strategic partnerships. These dual priorities – optimising and protecting traditional, while fuelling and accelerating new growth – will remain at the heart of Pacific’s strategy moving forward, partnered with an unrelenting focus on cost management and improving the company’s profitability.

In the second half of this financial year, Pacific will focus on leveraging the scale it has built in digital to drive greater monetisation across its assets as well as to continue to drive growth in its new digital ventures. The business expects to deliver material earnings growth in the 2H post this transformation.

Other Business and New Ventures

Other Business and New Ventures assets include Yahoo7, Community Newspapers, Western Australia Radio, Red Live as well as our investments in early stage businesses including: Airtasker, Society One, Health Engine, StartsAtSixty and Nabo. Investments in the period included Draftstars, the leading daily fantasy sports operator. Seven’s holding in Australian News Channel (Sky News) was sold to News Corp in November 2016. Seven also sold its stake in Presto to Foxtel during the period.

The reach and effectiveness of Seven’s media assets has driven significant growth for our portfolio of early stage businesses. This portfolio now includes Australia’s #1 Peer to Peer Lender, SocietyOne; #1 GP booking platform; HealthEngine; #1 Peer to Peer Job Marketplace, Airtasker and #1 Daily Fantasy Sports operator, Draftstars, as well as the fastest growing publisher for digital audience over 50 with StartsAtSixty.

SWM (which includes Yahoo7) has secured the position as the leading local digital publisher by audience. This position has been supported by the strong audience growth in Pacific and The West as well as the success of Seven’s Olympic coverage through its digital offering. Video and Native now represent greater than 50% of revenue with total video streams up 49% in the period. However, traditional static display advertising has remained under pressure from the transition to programmatic which is impacting yields. The decline in higher margin display advertising and the cost of transformation in the period resulted in Yahoo7’s profit declining 40%. Initiatives have been undertaken throughout the period to reduce the cost base of the business to reflect the revenue environment. Yahoo Inc. has announced that the proposed Verizon transaction has now been delayed until 2Q of CY17.

Other Business and New Ventures contributed negative EBIT of $2.9 million, an improvement of 14.3% compared to the prior year. The group’s investment in various early stage investments have a negative impact on the current half year results; however, are reflective of an investment in future growth for the Group.