Seven West Media CEO Tim Worner spoke at the company’s General Annual Meeting this week. Below is a transcript of his speech.

It has been a productive year for your company and we’ve passed some key transformational milestones. At the same time, we continue to lead the free-to-air television industry. We have achieved our 10th consecutive year of market leadership and we are strongly positioned to record our eleventh consecutive year of writing more advertising revenue than any other television network.

ALSO: Commercial TV licence fees are holding back Seven, says Kerry Stokes

In the 2016 financial year, we secured a 37.4% share of 25-54s and a 37.1% share of 18-49s, well ahead of the commercial shares we held in the previous five years. This big change in the composition of our audience underlines our clear leadership. We are also proud to say Seven News has recaptured the number one position in the 6 o’clock timeslot this calendar year to date.

This has all been done at a time when the company is going through significant change. The media landscape is evolving, driven by many more viewing options and the increasing globalisation of content. The advances we have made in content delivery, and our continued progress as Australia’s largest production company, position us strongly to meet these changes.

The brands of Seven West Media are now more widely available. Across a growing range of platforms, we are talking to and engaging with more Australians than ever before – the number one television network and, for the last two months, the number one Australian media company online.

Our coverage of the Olympic Games was unprecedented and set new benchmarks in audience delivery across all screens. Our innovations provide a clear indication of our future – connecting with our audiences on their terms and on any device. And in turn, connecting our advertising partners with those audiences. Our coverage reached 18 million Australians on television and recorded more than 100 million video views across all digital platforms including social.

Last week’s Melbourne Cup was another example of our content everywhere strategy. In addition to the linear broadcast, we delivered over 575,000 live streams across our digital platforms, which is up 18% on last year.

These huge events that attract mass audiences are pivotal in driving the transformation of our business.

We move into 2017 with a new long-term partnership with the Australian Football League and a portfolio of major sports across the next 20 months.

Photo by Michael Dodge / AFL Media

It is a virtual wall of big, live events starting with the AFL Finals Series and the Grand Final, moving to the Spring Racing Carnival and the Melbourne Cup, and rounding out the year with the Rugby League World Cup in Australia and New Zealand. 2018 begins with the Australian Open followed quickly by the time zone friendly Olympic Winter Games in PyeongChang and then the Commonwealth Games on the Gold Coast in April. Eight months of premium, live sport. Seven is also the network of the Olympic Games in Tokyo in 2020. These tentpole events will be the framework of our audience over the coming years.

Our production business is growing in scale and expanding internationally both organically and through new investments. This footprint now covers the UK, US and New Zealand with further expansion planned over the next 12 months.

Over the financial year we grew our program sales and 3rd party commissions revenue by 92% with EBITDA for this business unit also up substantially to approximately $50 million.

We have recently secured a major shareholding in Slim Film + Television – a company with a highly regarded pedigree in successful British drama series.

These companies are securing a wide range of commissions, including the breakthrough productions of My Kitchen Rules in the United Kingdom and the United States.

Here in Australia, MKR was the number one show in the country for the fifth consecutive year.

Seven launched new hit shows First Dates and Seven Year Switch and in another display of the power of television, The Secret Daughter was not just a ratings success but is also now the number one album in the country.

Our publishing assets continue to lead in the markets in which they compete. While we are cognisant of the structural challenges in these businesses, we believe the moves we are making can reposition them for future growth.

Pacific is deepening its engagement with its audiences, building its digital content offering as well as establishing new products that allow us to better monetise these audiences.

I am very pleased to report that since the beginning of this year, Pacific’s digital audience has increased by a factor of 6x, significantly increasing its share relative to its nearest competitor.

The West has undertaken several new initiatives including the launch of a new digital Travel platform, an expansion of its live event capabilities and a greater focus on the delivery of short form video.

This has all been achieved while taking significant costs out.

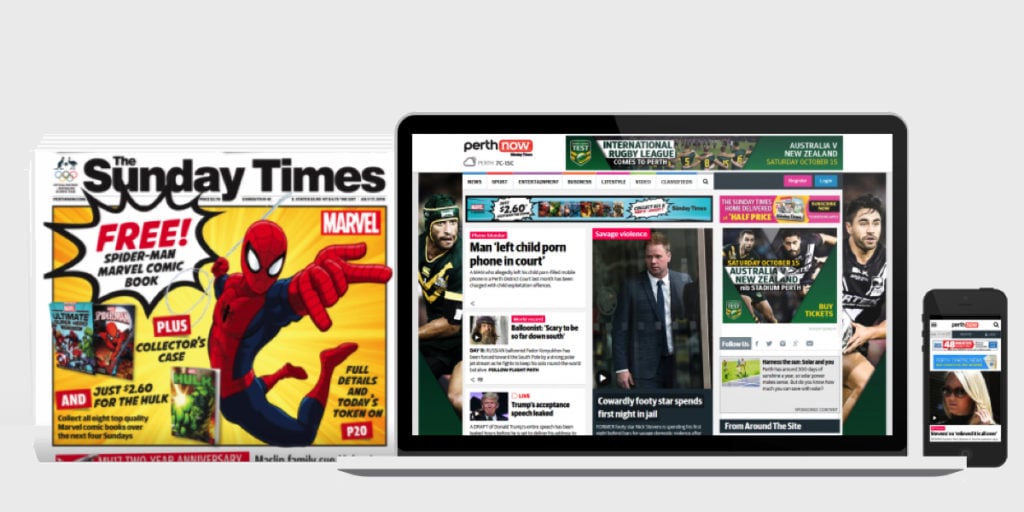

Another fundamental milestone in the transformation of this business has been the acquisition of PerthNow and The Sunday Times. This will be a pivotal transaction in how we re-shape WA Newspapers for the future. We will quickly benefit from printing synergies and the immediately increased audience for our offering in Western Australia.

Perth Now attracts a different demographic to thewest.com.au and we are intent on preserving and enriching the brand of The Sunday Times. It is a great paper with a long history and we respect that. Our first edition of The Sunday Times will publish on 20 November.

Elsewhere, the investments in early stage businesses including Airtasker, Health Engine, Society One, Draftstars and StartsAtSixty are all performing strongly and are growing with the help of the engagement and reach of our audiences. We expect the value of this portfolio to grow materially over the next few years.

While it has been a positive year and we have got runs on the board, there is much more to be done.

Outlook

While the advertising market has remained soft, we have undertaken further cost out initiatives. We previously guided cost growth at CPI but we now expect group costs to be flat year on year including the uplift cost of the AFL rights but excluding Olympics and 3rd party commissions.

As I say, the television advertising market remains exceptionally short and there is limited visibility, but I am confident that we will again deliver a strong market share performance driven by the power of our content.

We issued underlying EBIT guidance at our 2016 financial year results. At this stage we expect to be at the lower end of that range. The first half will be lower than the guided full year underlying EBIT trend given the impact of the Olympics rights falling in the first half.

Since our financial results we have also extended the duration of our debt facilities to 2020 with no change to debt covenants.

Conclusion

We recently presented our plans for 2017 and beyond to our customers. We spoke then about the power of great story-telling and the opportunities that are now available across multiple screens.

Our strategy is clear and we are delivering on our objectives.

We are focused on maintaining leadership across the various media where we compete. We are continuing to transform the operating model within our businesses, working smarter and more cost efficiently. We are expanding our content production capability, both in Australia and internationally. We now deliver our content to our audiences wherever they want it, and we will continue to strive for an even better user experience, and we are using the reach of those audiences to grow new opportunities to build new business initiatives.

All of these moves will define us in a market that is undergoing rapid transformation.