Seven West Media Limited (ASX: SWM) managing director and chief executive officer, James Warburton, is set to make the annual investor presentation and trading update presentation at the Macquarie Australia Conference on May 4th.

The presentation includes a trading update that upgrades SWM’s expectations for earnings before interest, tax, depreciation and amortisation (EBITDA) for the 2021-22 financial year from the previous guidance of between $315 million and $325 million to between $335 million and $340 million.

Warburton said: “The earnings upgrade reflects the strength of advertising markets and the ongoing success of Seven’s broadcast and digital businesses.

“The recent acquisition of Prime Media Group, coupled with the winning performance of the Seven broadcast television business and the strong growth of 7plus, make SWM the undisputed leader in the national total television market – a position that we plan to build on in the future.”

For FY21-22, Seven’s Group Revenue has come in at $1.27bn, with 80% of that total driven by TV broadcast. Group EBITDA total was $254m, 67% of which came from TV broadcast.

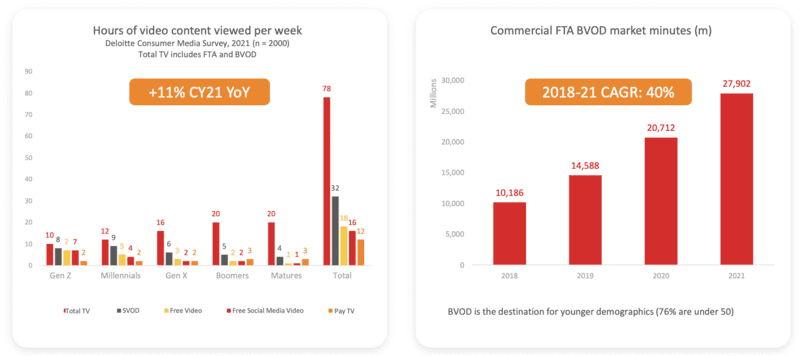

Broadcast and BVOD were the dominant forms of consumption across all demographics, with commercial FTA BVOD market minutes rising by 7.19bn between 2020 and 2021.

Across broadcast and BVOD, total TV reaches 22m deduplicated Australians every month, with VOZ measurement confirming 57% greater reach after 28 days compared to overnight only.

A prime example is that of The Voice, which saw 1.31m tune in across national TV and BVOD for its launch episode, a number which rose to 1.53m after seven days.

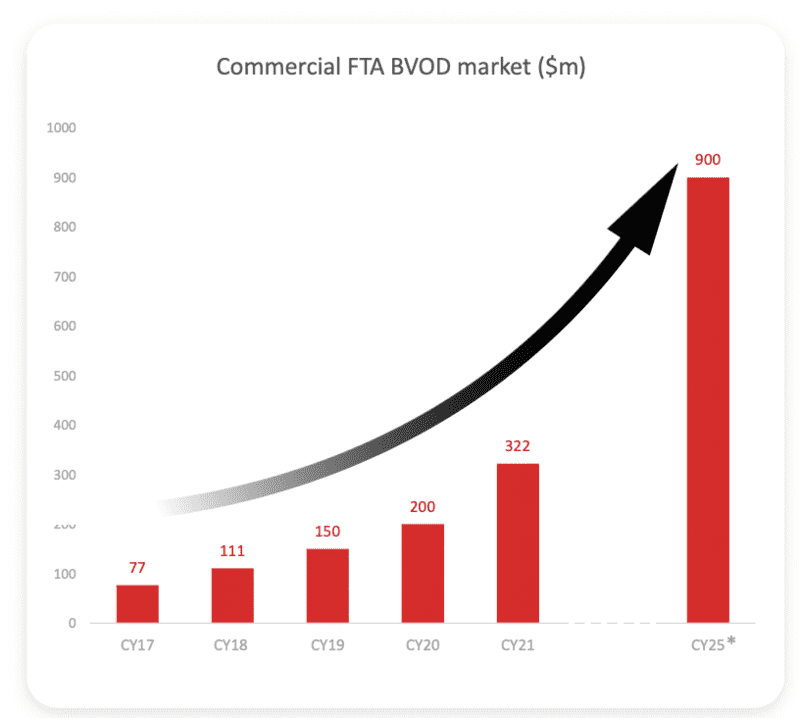

This growth is not expected to be slowing down any time soon either, with the commercial FTA BVOD market expected to make $900m by CY25, exponentially growing when compared to CY21’s $322m.

Looking ahead for 7Plus, Seven is aiming to invest in BVOD content to drive incremental returns, and ultimately evolve 7plus beyond BVOD into subscription and transactional businesses.

Finally, in a trading update, Seven has reported that the TV market remains buoyant, with the FTA market estimated to grow 4-5% in Q4 YoY after growing +6.7% in Q3 (metro & regional FTA TV). Strong trading conditions underpin an upgrade to EBITDA range from $335m to $340m (including $10m from Prime). In BVOD, market growth continues to be strong, with results up 41% in Q3.