As Australia’s biggest commercial radio group, SCA financial results are always important.

But there is one question overriding recent performance – will the company be broken up by ARN and Anchorage Capital? Quite probably is the conclusion after reading today’s carefully worded release to the ASX.

Can you believe that four months after this deal was first revealed, the SCA board still doesn’t have enough detail to “form a view”?

Here is the opening par from the board today:

Mutual due diligence and active discussions continue with ARN Media and Anchorage Capital Partners (Consortium) to determine whether the Consortium’s non-binding indicative proposal is in the interests of shareholders. SCA and the Consortium have not reached any binding agreement and there is no certainty these discussions will result in a transaction. In conjunction with its advisers, SCA’s Board has requested sufficient information to accurately form a view on the value and executability of the proposal.

SCA in last six months

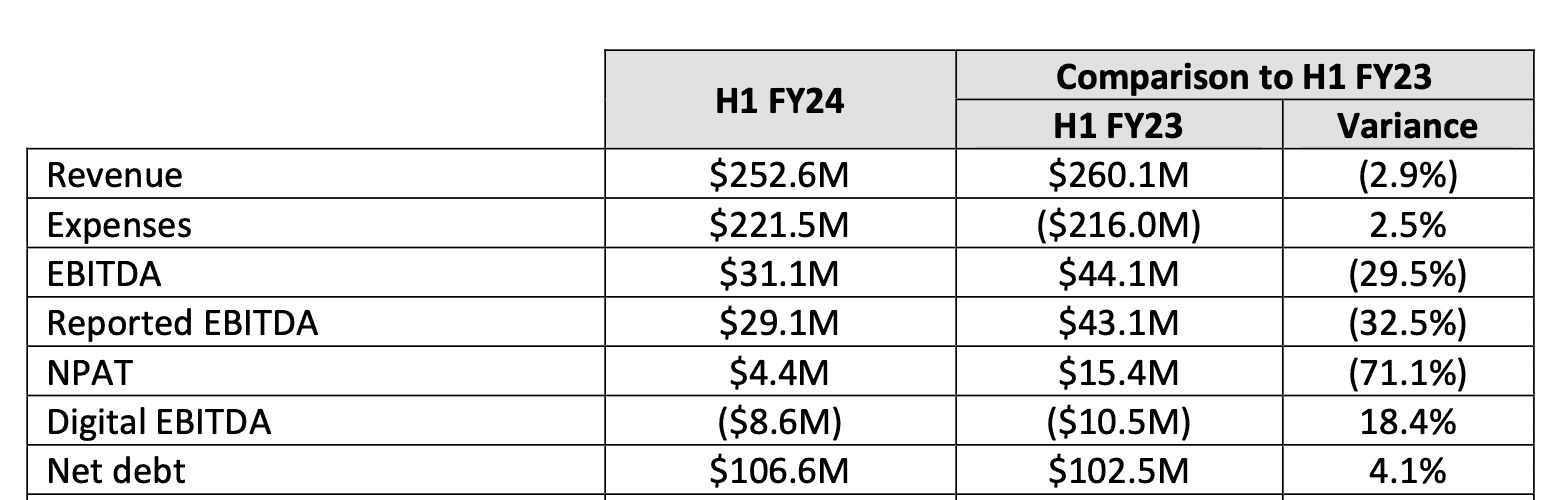

With regard to the performance of SCA in the six months to December 31, 2023, these are the headlines:

• Revenue dips, expenses climb, earnings and profit slides

• Cost management has delivered $30 million in annualised savings, well above previous guidance of $15 million

• LiSTNR remains on target to reach a breakeven in Q4 FY24. Also forecast to become cashflow positive in early 2025 (if it still exists and not part of an iHeart/LiSTNR JV)

Platform for growth

CEO John Kelly commented on the release of the results:

“SCA maintained and expanded monetisable audiences to record levels in our core radio and digital audio markets during the period. Importantly, our national leadership in the core buying demographics of men and women aged 25 to 54 provides our sales teams with a platform for growth in the second half and beyond.

“The impact of lower industry-wide national advertising expenditure was mitigated by the geographic diversity of SCA’s radio portfolio comprising 10 stations in metro markets and 78 in regional markets. Fuelled by robust performance from local advertisers, regional radio revenues grew by 2.0%.

SCA’s John Kelly

“We were pleased that the number of users signed up to LiSTNR rose 60% year-on-year to 1.8 million. We have recently rolled out major enhancements to improve the user experience on LiSTNR and expect ongoing growth in the number of signed-up users and in the time they spend on LiSTNR.

“Our strategic cost management review has delivered significant cash savings, setting us up for improved results in the second half of this year and future years. And completion of our major digitisation investment cycle is enabling teams across all parts of our network to generate further savings and open revenue opportunities by optimising business operations and workflows.

“Regional television revenues continued to contract. We were pleased, however, to extend our affiliation with our principal programming partner, Network 10. The growing collaboration between our national sales teams in recent months has seen our power ratio – measuring conversion of ratings to revenue – return to above 100% in the four east coast aggregated markets.”

What’s the future for Triple M broadcasters including Sydney’s Mick & MG

Going, going, gone? Triple M and Hit Network

There was no comment from the chief executive about the ARN/Anchorage Capital plan to break up the company.

However, the language used in the presentation slides during the analysts call is instructional:

“Based on the proposed scrip consideration, SCA shareholders will own approximately 33% of ARN New Co (new look ARN post deal) following proposed transaction.

“ACP (Anchorage Capital radio company) is expected to acquire all existing radio stations not being acquired by ARN New Co, plus 3 metro and 10 regional stations from ARN.

“ACP will also acquire SCA’s existing television business.

“The consortium will form a digital joint venture, in which ARN New Co and ACP will each hold a 50% stake.”

See also: ARN and Anchorage’s ambitious dream to carve up SCA broadcast assets closer to realisation