Samsung Ads has unravelled how evolving behaviours and a changing TV landscape led to the rise of ad-funded streaming in 2023 in its latest edition of ‘Behind the Screens’ report.

The surge in streaming and tightening of consumer wallets has signalled the end of a decade-long ad-free streaming experience.

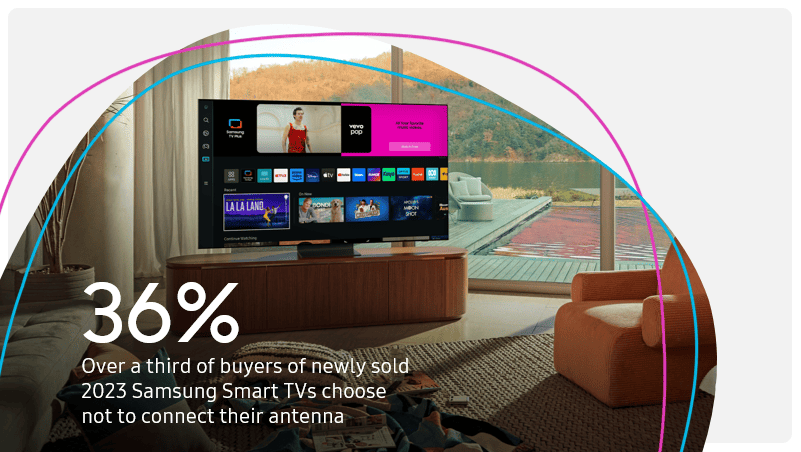

Shift from antenna to app-based TV

The report found that during the first half of this year, there were over one billion app opens on Samsung Smart TVs (+12% YoY). The rise of streaming and penetration of connected TVs is signalling a growing shift towards app-based TV viewing. Over a third (36%) of newly sold Samsung TV buyers are choosing not to connect their antenna at all.

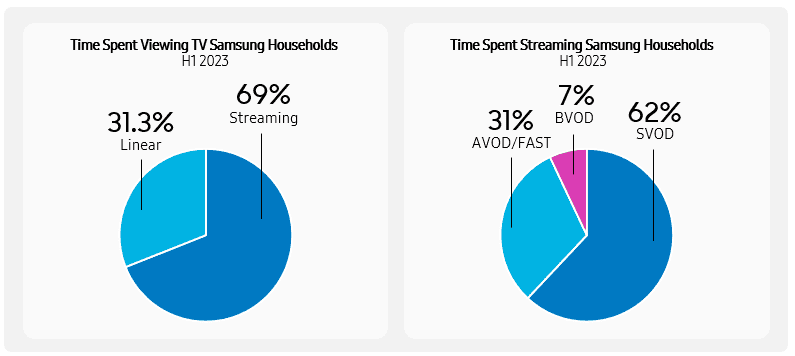

Time spent streaming continues to grow and shows no signs of slowing. On Samsung devices, two-thirds of all streaming time is spent with Subscription video On-Demand (SVOD) services, however, time spent in ad-funded streaming grew the fastest, with double-digit growth across all formats.

At the other end of the scale, traditional linear TV remains an environment of high engagement, although across an increasingly concentrated group of heavy linear viewers who account for 88% of the total time spent within linear on Samsung Smart TVs.

Ad-free or ads with fee

Streaming services pioneered ‘binge watching’ and exploited the key differentiator of being ad-free over the last decade. However, one of the biggest changes in the last 12 months has been the introduction of ads, as services rethink strategies to appeal to a wider set of more cost-conscious viewers.

The report noted that this month Netflix revealed that its ad-supported tier now accounts for 16% of its subscriptions, up almost 70% QoQ globally, while other paid streaming services revealed that ad-supported plans are already proving more lucrative per user than a pure subscription play.

The appeal of ads continues to grow, with three out of five (61%) Aussies saying they don’t mind watching ads in return for free content – and that appetite would be even higher if fees were reduced further. According to Kantar, almost half (48%) of subscribers are now more likely to switch between different services than before to save money.

Increasing production costs, writers strikes and consumer belt-tightening have also taken their toll on the streaming industry, with several big players reportedly looking to cut billions in costs.

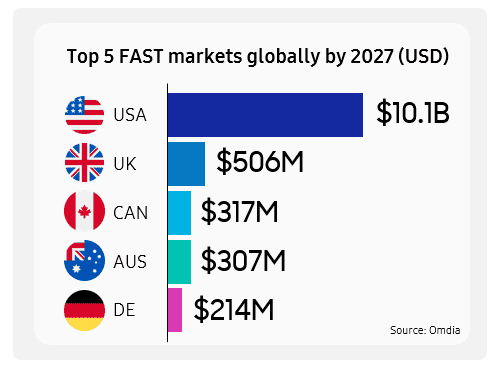

The FAST and the Curious

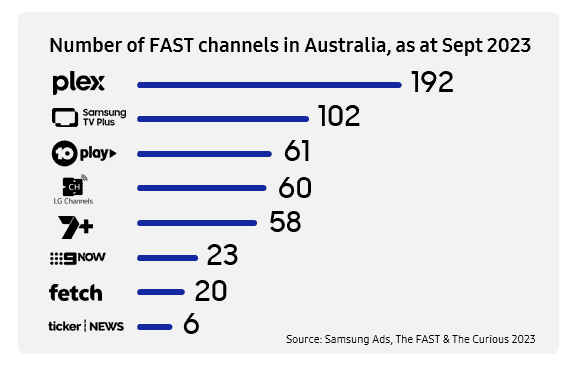

The ‘Behind the Screens’ report noted that free ad-supported streaming TV (FAST) remains one of the newest kids on the ad-funded block. It highlighted that as of September, there were 522 FAST channels in Australia across multiple services.

The adoption of free streaming has leapfrogged some of the FAST innovations in the US. Single show channels now account for one in every five FAST channels in Australia giving Aussies audiences 24/7 access to everything from Married with Children to Mythbusters.

While there is no denying the role of live sports, FAST is a game changer for sporting codes & content partners who want to reach fans every day of the year, according to the report. It also showed that Australia over indexes globally when it comes to FAST sports channels with 15% of all FAST channels dedicated to sport.

Alex Spurzem, managing director, Samsung Ads ANZ & SEA, said: “The adoption of ad-funded streaming suggests the future of TV has more in common with the past than we think. The notion of introducing ads after a decade-long ad-free streaming experience would have seemed impossible just a few years ago.

“Yet platforms are now focused on drawing in the widest audience by catering to all wallet sizes. With the rise of TV app based viewing it is important for advertisers to understand the insights and behaviours of these growing streaming audiences.”

Alex Spurzem