Content options have never been so many, and yet the fragmented TV landscape is draining our wallets and minds. So what role does free ad-supported streaming TV (FAST) fill with decision fatigue at record levels?

Daniel Palmisano from Samsung TV Plus writes about the resurgence of linear TV.

The world of TV was disrupted by the overwhelming popularity of subscription video-on-demand services, which tapped into our desire to access quality content without the wait.

But fast forward to today, and despite the seemingly never-ending stream of new players in the market, linear is set for a renaissance. Just not the way you might think.

As the TV market continues to diversify, consumers are looking beyond the traditional subscription-based platforms and we’re seeing ad-funded services rising into prominence.

If reports from MIPCOM at the end of last month are anything to go by, Free Ad-supported Streaming TV (FAST) services were the talk of the market. FAST can create a simpler journey of content discovery for viewers that mimic the linear experience whilst providing new distribution and revenue opportunities for content owners.

Closer to home, the latest upfronts season had Paramount among others spruiking FAST benefits for advertisers with its Pluto offering, as Beverley McGarvey, EVP and Chief Content Officer for Paramount ANZ, explained: “There can be multiple genres on there, or a single genre channel – perhaps a cooking channel or a MasterChef channel for superfans of that show.”

FAST: Looking back for our future

While the past two years have acted as a catalyst for increased levels of streaming, we’re seeing increased fragmentation of that growth. An interesting new trend is emerging, with consumers reconsidering the number of subscription services they are signed up to.

“Subscription fatigue”, is a rejection of the abundant choice on offer and a response to tightening budgets with rate rises and higher costs of living. FAST, being free in nature has become a significant mover in the US streaming game.

Kantar’s Entertainment on Demand Q3 2022 paper confirmed this trend with over 1 million video-on-demand (VoD) services cancelled between July-September, and the warning that almost one quarter (24%) of all SVOD households plan to cancel a service in the next three months.

Coinciding with this trend are moves from the linear playbook by some of the larger SVOD players. Disney+ has found huge success with its weekly-episode approach for its new Star Wars and Marvel series, so too Binge and Amazon Prime with their epic series House of the Dragon and The Rings of Power. Even Netflix has spent the past 18 months trialling a linear-style channel in France. Some commentators claim that to beat linear TV, Netflix must first become it.

Satisfying a craving for comfort

Why the change? Well for some, the desire to lean back never went away. Why spend 100 days of your life deciding what to watch, when there’s the option to let a channel curate an experience for you?

Clicking in and out of different apps to find something to watch is rarely appealing with 49% of people admitting that they’ve spent so long trying to find something to watch, that they ended up watching nothing.

The “lean back” experience is comforting and taps into the nostalgia of turning up for and tuning into a favourite TV show at the same time every day. For broadcasters, each program on a genre-focused channel rolls into the next one and can ultimately result in more time spent enjoying the content.

Offering specialist content “binge channels” can be a real winner for broadcasters and viewers alike, for example in the US, Peacock offers a channel dedicated to Law & Order and in the UK Fremantle is moving to free ad-supported for a Jamie Oliver Channel on Samsung TV Plus.

Different strokes

According to comScore, there’s a lighter use of SVOD services like Netflix during the workweek, so the linear format may have more pulling power when we are tired and don’t feel like rummaging through a huge on-demand catalogue.

Wallets can’t stretch any further and cord-cutters from subscription TV have started to feel like they are overpaying without getting as much value.

Meanwhile, FAST services have seen a 15% uptick in the last two years in the United States, with 53% of viewers regularly tuning into FAST channels. Here in Australia a recent Behind the Screens report revealed that time spent in ad-supported video on demand (AVOD) is experiencing the fastest growth, with viewing time now up to 51 minutes per day from June 2021 to June 2022.

FAST is becoming a popular route to viewers and provides new revenue streams for major media companies, content distributors and rights holders.

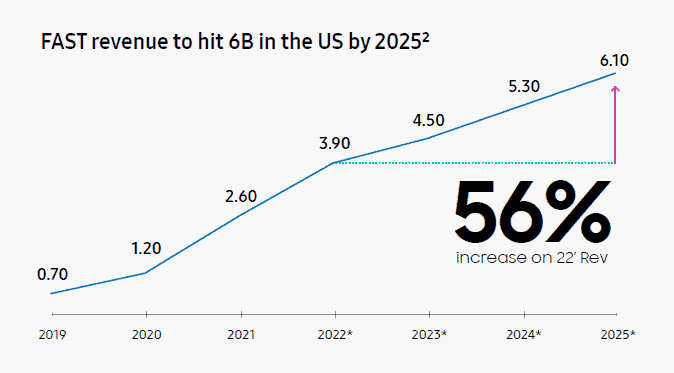

VIP+ estimates US ad revenue from FAST will be worth over $6 billion by 2025. There are now over 1,000 FAST TV channels airing on around 23 platforms in the US. Locally, Fetch launch of eight FAST channels, and Samsung’s free ad-supported streaming TV service Samsung TV Plus, has over 85+ channels across genres such as movies, news, sports, entertainment, music and more.

New meets old and rekindles the romance

FAST platforms are sparking a renaissance by combining elements of innovation and tradition into the ideal linear viewing experience for consumers. They have a place and fulfil a need that continues to grow. There is even space for hybrid experiences, in which audiences can discover content via FAST linear streaming and then tap to watch more of it on demand. The best of many worlds are coming together and the industry will be stronger for it.

Daniel Palmisano (above) is head of business development at Samsung TV Plus

Daniel Palmisano (above) is head of business development at Samsung TV Plus