The ARN board this week pulled the pin on a grenade that threatens to blow up Australian radio. If not diffused by the substantial number of obstacles it faces, the explosion will see the once great Austereo network of 10 metro stations split in two with some of it being used for, in effect, spare parts.

Just six days ago, ARN Media chief executive Ciaran Davis was celebrating the Australian radio industry with 1,000 colleagues at the ACRA Awards at Sydney’s Darling Harbour. There were 80 trophies handed out for achievement to people from all networks in one of the longest award ceremonies on record. Just across the aisle from where Davis was sitting in the Convention Centre was his opposite number at SCA, the recently installed CEO John Kelly.

Ciaran Davis

The two radio executives are colleagues on the board of CRA. Little did Kelly expect that just three days later he and the board would be facing an off-market takeover bid that, if successful, would dismantle the company, with the victor taking the crown jewels and then selling off what wasn’t needed.

It’s understandable the fuse wasn’t lit before the radio awards. It would have been an awkward night for many in the room. It may not be any less awkward next year though.

SCA might reveal its response to the ARN offer when CEO Kelly and chairman Rob Murray front the AGM in seven days.

One of the big questions surrounding the bid is staffing. What is to become of the close to 1,600 SCA staff? Our headline implies there could be employment impact for the metro stars of SCA and ARN, but spare a thought for the troops in the sector who aren’t on million-dollar deals.

Trying to get a grip on how radio could look at the ARN/Anchorage bid for SCA is successful is challenging.

There are so many as yet unanswered questions. Below Mediaweek has tried to construct a map of how radio could look and the many possibilities for ownership that it throws up.

What stays the same

Potentially the KIIS network. But with Kyle and Jackie O at the Sydney flagship KIIS 106.5? Now there’s a question. Just on Tuesday this week Kyle Sandilands noted on air a report claiming they were staying at ARN on a $200m deal. Sandilands commented they were actually going to be getting more than that. (Jackie quickly shut down the discussion.)

If the Kyle and Jackie O deal has been agreed to, it can’t be far from being confirmed as a payment of that much to two people would have a material impact on the company’s results.

Triple M network

ARN’s plans to take the Triple M network is a vote of faith in the brand SCA has resuscitated in recent years. There was a time in the past two decades when some Triple M stations felt like frontier towns that had seen better days. Fast forward to now and it offers ARN a way to reach a hard-to-get-to male demographic with a mix of music and sport. “Triple M is the most clearly defined media brand in the country,” a radio executive once explained to Mediaweek after healthy survey results.

Just who will run the ARN Triple M brand has not yet been explained. If ARN just wants the brand, what about the announcers, the people who run the stations?

Jonesy and Amanda with their 2023 ACRA trophy

The acquisition of Triple M means ARN will have to dispose of the WSFM and Gold 104.3 licences. Could that mean Jonesy and Amanda return to Triple M Sydney? Does it mean The Christian O’Connell Show moves to Triple M Melbourne?

And if the crown jewels are stripped out of WSFM and Gold, does that lessen their value for Anchorage?

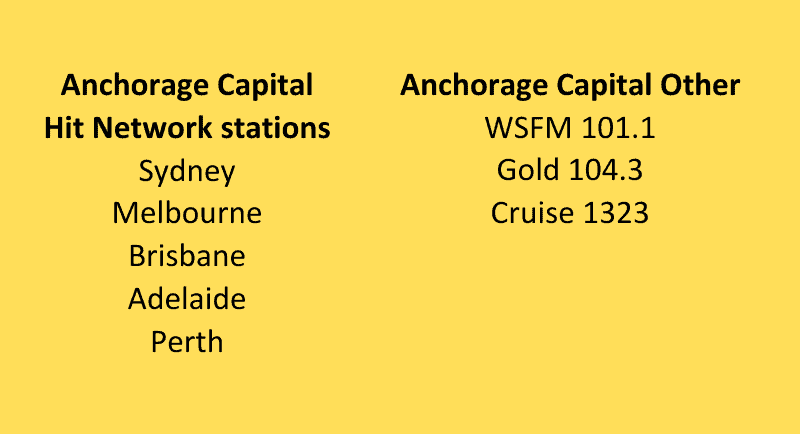

What about Anchorage Capital?

Does private equity investor Anchorage Capital plan to set up a broadcast division, will they take over the SCA offices around Australia? Or will that be home to the new look ARN Media?

If Anchorage Capital is not going to become a broadcaster, as some suspect, will it try and flip the stations for a profit asap?

If they do how will the chips settle after the licence auctions? Is there a buyer for the five-station Hit Network, or does it work better if they are sold individually?

Potential buyers for radio sale of the century

Nova Entertainment: Does the broadcaster have an appetite to expand smoothfm beyond the DAB+ licences it currently broadcasts on in Brisbane, Adelaide and Perth? Would it sell Fiveaa to Nine Radio to help fund the smoothfm licence deal?

Nova Entertainment is a shareholder in Brisbane’s 97.3 along with ARN. The two companies are also partners in Perth’s Nova 93.7. This is getting complicated.

Nine Radio: Would Nine like to add Fiveaa to its talk network? What value is there in a licence for Australia’s smallest metro market?

Any buyers for these?

Cruise 1323: The mighty Adelaide music machine punches well above its weight. But what is the value of an AM music licence in that metro market? As guidance look at what Sports and Entertainment paid for the AM licences 2CH ($11m) and 4KQ ($12m). But Hutchy already has an Adelaide station and he promised to the market the SEN building phase is complete. ACE Radio would be a good home for Cruise.

Gold 104.3 and WSFM 101.7: It’s not a network – but these stations have a great heritage – even if offered without current breakfast hosts. A buyer could get the Gold format thrown in. Even if some dismiss it as just a “playlist”. It’s been a long time since a metro market FM licence was sold. A glut of them might force down the price. Two decades ago Nova Entertainment (trading then as DMG Radio) bought the Nova 96.9 Sydney licence ($150m) at auction and later the Melbourne licence ($70m).

iHeart and LiSTNR and regional stations

What might happen here needs to be examined at another time. There is little mention of how ARN would use the fast-growing and soon-to-be-profitable digital asset LiSTNR. Apart from the comment in the bid document: “Enhanced future growth and an accelerated path to profitability in a more scaled digital audio platform”.

Does that mean wrapping iHeart radio/podcasting into LiSTNR? ARN renewed its iHeart licencing deal in 2019 for 17 years taking it to 2036.

There’s also scant detail about the cherry-picking that could take place in the regional markets. ARN made an undertaking to Grant Broadcasters the network of stations would stay intact for two years after the takeover. That undertaking is thought to expire in December 2023.

See also:

ARN joins private equity bid for SCA and its Hit and Triple M radio networks

Why ARN wants to acquire SCA and its plans for Hit and Triple M networks

Stay tuned to Mediaweek for radio industry analysis and news coverage.