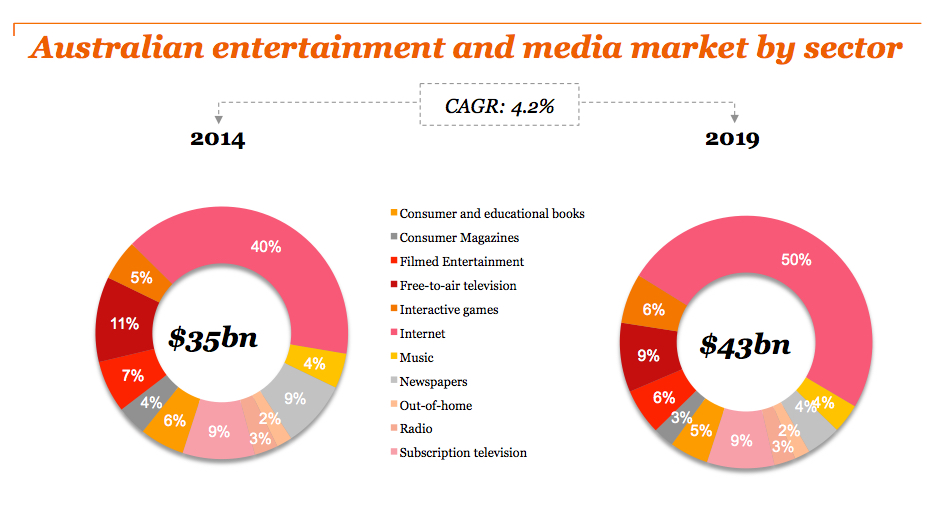

• Australian entertainment and media market is forecast to grow to $43.4 billion by 2019, a compound annual growth rate of 4.2%

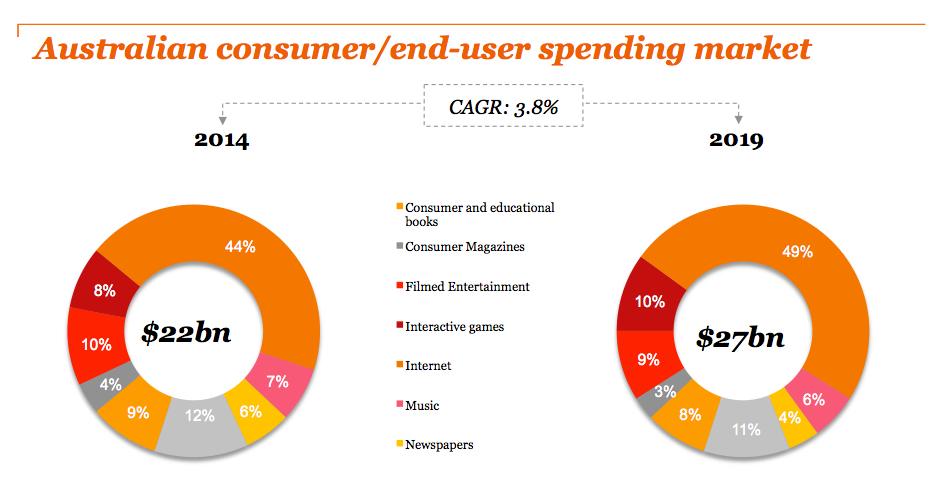

• Consumer spending on entertainment and media products forecast to grow to $27.1 billion by 2019, a compound annual growth rate of 3.8%

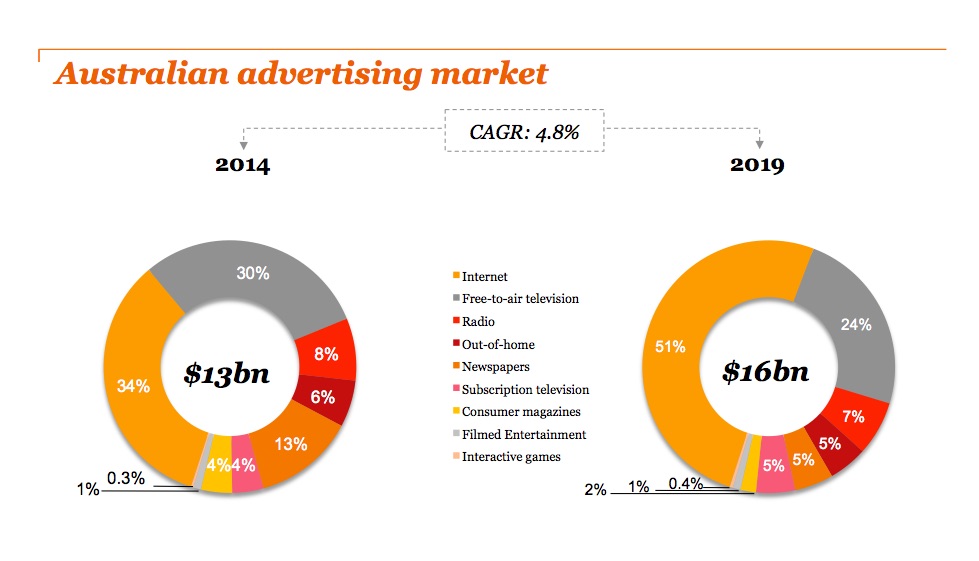

• Advertising spending to reach $16.4 billion by 2019, a compound annual growth rate of 4.8%

• By 2019 internet advertising will account for more than 50% of the total Australian advertising market

The time has come for the Australian media and entertainment industry to innovate and “have a go”, with the headwinds facing traditional media players set to continue through to 2019, according to a PwC report released today.

PwC’s 14th annual Australian Entertainment & Media Outlook shows that growth in total consumer and advertising spending in the sector slowed to 3.3% in 2014, compared to 6.8% in 2013, reflecting a subdued economy and continued industry challenges. Globally, the sector grew 6.2% and 8.8% in Asia-Pacific.

According to Megan Brownlow, editor of PwC’s Australian Entertainment & Media Outlook, the time has come for the Australian industry to “have a go” and innovate, or face terminal pressures on revenues and margins.

“The industry is awake to the need to do things differently, and although it’s important to recognise the impact and role of disruptive technologies, true innovation extends to service, relationships, content, distribution, business models and funding,” she said.

“Look at what the traditional television and radio companies are doing with streaming services, or the agencies with brand-funded content – all of these are digitally supported but they represent much more fundamental shifts in business model.”

Growth in consumer spending nearly halved in 2014 to 3.8%, down from 7.0% in 2013. The Australian advertising market was similarly subdued over the period, achieving growth of 2.4%, compared to 6.4% in 2013.

PwC’s entertainment and media industry leader, David Wiadrowski, said the industry needed to adopt a “start-up mindset” in order to innovate and grow.

“In terms of growth, when you take out spending on wireless, broadband, mobile internet and internet advertising, the rest of the sector will be doing well to keep pace with inflation over the next five years – so now is the time for industry participants, particularly the traditional players, to innovate themselves back into growth,” he said.

“Our own research shows the Australian start-up sector has the potential to contribute $109 billion, or 4% of GDP, to the economy by 2033 – so we know the opportunity is there, the question is how you apply that start-up thinking across the sector.”

• Consumer data critical to the future of the industry

Brownlow believes the plethora of consumer data available through connected devices and wearable technology will be a boon for advertisers.

“Over the last decade we have seen a fascinating shift from PCs, to mobile, to now wearables, the connected car, and in the very near future the ‘connected home’ – all of this has and will continue to generate a rich vein of data for advertisers,” she said.

“The problem up until recently had been converting data into insight and targeted offerings – advertisers were data rich but information poor. However the sophistication of technology such as ‘context engines’ now allows advertisers to target and customise their offerings depending on what consumers are doing, where they’re doing it, even who they’re doing it with.

“For example, advertisers will know via your smartwatch when you’ve finished a workout, and will be able to push you an offer for a discounted sports-drink – provided you purchase it from a specific retailer within a specific time frame.”

According to Wiadrowski, the shift to targeted, measurable advertising will have an enormous impact on every participant in the advertising value chain.

“For the first time we are able create a direct link between a piece of advertising, and individual consumer action,” he said. “The consequence of this is going to be enormous – who is going to pay for untargeted media advertising when you can determine very accurately the impact of targeted campaigns?

“The challenge for the industry will be changing the way content is delivered, in order to sustain what advertisers are demanding; channels that support targeting and accurate reporting.

“On the flipside, this means innovating in terms of product and consumer experience, putting mobile at the centre of your strategy, and developing seamless consumer relationships.

“Measuring engagement – not just time spent – will become not just a ‘nice to have,’ but critical to the sustainability of the media and advertising business models.”

• Internet advertising to dominate by 2019

The rush of advertising dollars from traditional media to online will continue over the next five years, with internet advertising set to account for more than 50% of the total Australian advertising market by 2019.

The internet advertising market will reach $8.2 billion by 2019, compared to $3.8 billion for free-to-air TV, $1.5 billion for newspapers, and $1.3 billion for radio. Internet advertising is also expected to be the fastest-growing sector, increasing at a compound annual rate of 13% out to 2019.

Over the next five years Australia’s total entertainment and media market is forecast to grow at a 4.2% compound annual growth rate (CAGR), from $35.4 billion in 2014 to $43.4 billion in 2019.

Consumer spending continues to dominate the entertainment and media market, and is expected to grow to $27.1 billion by 2019, a CAGR of 3.8%.

Advertising spending is forecast to reach $16.4 billion by 2019, a CAGR of 4.8%.