Paramount surprised agencies and brands this upfront season by hosting a series of presentations in Sydney on Tuesday and Wednesday.

While more are planned for the other state capitals this week, Sydney attendees were treated to an intimate showcase of the network’s new innovations and measurement capabilities, as well as new and returning content to expect in the year ahead.

Following the presentations, Mediaweek caught up with media buyers from holding companies and independent agencies for their thoughts on Paramount’s offering, what piqued their interest and if that will move the needle on the amount they spend with the network.

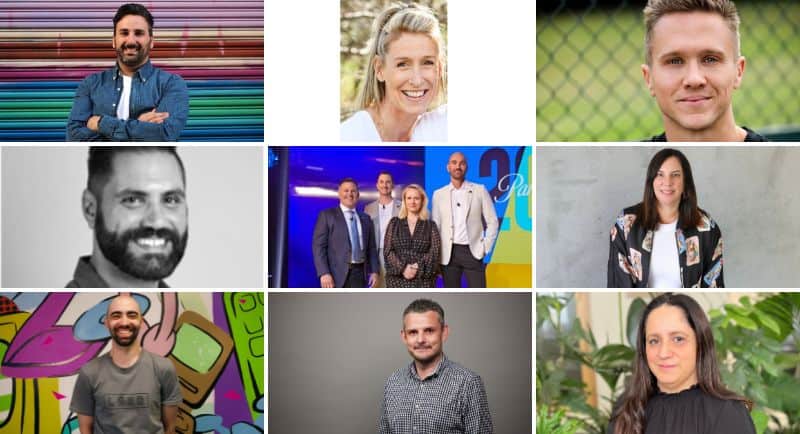

Jarrod Villani, Daniel Monaghan, Beverley McGarvey and Rod Prosser

See more: Paramount Upfront 2024: Every Announcement

Daniel Cutrone, managing partner, Avenue C

Paramount10 are rolling out some big, bold and risk-taking moves, which we hope will deliver more hits than misses in 2024.

Coming out of the gates, the return of the 90s smash, Gladiators will see a family fun alternative to the Tennis and Cricket premiums in January. We’ve seen the success in the past with I’m A Celebrity, so this strategic move has the potential to gain audiences.

In a refreshing contrast to the other networks, Paramount10 are re-energising majority of their programming slate with fresh formats and hosts. Whilst this will generate early interest in the properties, the true test will be in how they maintain audiences throughout the series.

We are beginning to see the benefits of the multinational Paramount/CBS with its new host, award-winning UK funny-man Graham Norton, hosting Wheel of Fortune Australia, but there is significantly more talent potential here with its global base.

Grant Denyer, Sandra Sully, Rod Prosser, Beverley McGarvey, Jarrod Villani, Robert Irwin, Beau Ryan, Tara Rushton, Blair Joscelyne, Julia Morris, and Daniel Monaghan

Whilst Paramount10 clearly attempts to cover all possible entertainment options, it lacks the dominant sporting accolades of its competitors, however, Ten will be the home of Formula One and digital network Bold will telecast the A-League & NBL matches through the 2024 seasons.

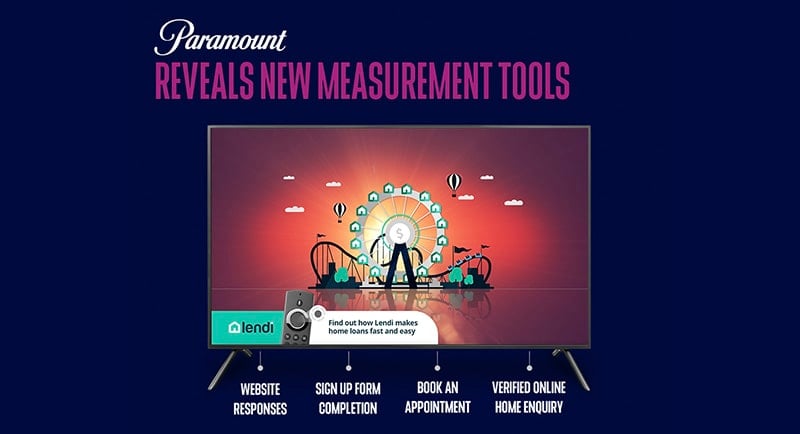

Paramount10’s partnership with KERV is pioneering the CTV experience in our market, bringing innovative ad formats (i.e. Shoppable TV, Ad Selector, Smart Snap) to its repertoire, backed by the Innovid partnership demonstrating tangible business outcomes through attribution.

2024 has also been marked as the year of the SVOD ad-tier model, with Paramount+ announcing that it too are opening its doors to advertising. Paramount+ will launch the exclusive NCIS: Sydney and Top Gear Australia with Beau Ryan, Jonathan LaPaglia and Blair “Moog” Joscelyne; among other premium originals including: Special Ops: Lioness, Tulsa King.

Paramount feel like they have all the puzzle pieces now in place to hold audiences across linear, BVOD, AVOD and now SVOD and are probably best prepared to mop up viewing fragmentation than any other network.

Suzanne Mellon, head of investment IAG, Initiative

Taking a sensible approach to their upfront, the more exclusive, understated, and tailor-made Holdco based sessions were a hit, where extensive Q&A allowed the audience to play a bigger role in the event. What was clear from the upfront was firstly, the impact of their global presence, allowing for the execution of global strategic intelligence in conjunction with localized market expertise.

Secondly, was the emphasis placed on their unified approach with the phrase “We are One,” with a multi-platform offering across 10, 10 Play, Nick, Paramount+, and MTV. This comprehensive content presence translates into disruption across BVOD, AVOD, and FAST platforms.

The presentation centered on content, showcasing highlights from their extensive multiplatform ecosystem while celebrating their substantial audience base of 16.2 million. They took pride in being the fastest growing on several platforms, notably Paramount+.

We commend the network for confronting the evident challenge they’ll encounter in 2024, competing against the formidable force that is the Olympics. Offering a distinctive, family-friendly, brand-safe alternative with the aim of not only securing most of the viewership outside of the games but also diverting those Olympic saturated audiences.

Paramount will be hoping the reality show serves as a platform to retain these newfound audiences on the network in the long term. For advertisers, this is a strong alternative to the behemoth and for brands who cannot compete with category competitor sponsors, rather than playing second fiddle with share of voice, can look to engage with this nostalgic format and deliver clear space.

Recognising the fact that there is a “void left by a man that cannot be named” (aka Dr Chris Brown), the introduction of Robert Irwin alongside Julia as the dynamic duo in the jungle was presented through an animatic jingle that is sure to excite and delight audiences.

Although filling the shoes of Chris Brown is no small feat, Ten’s decision to bring on a quintessential Australian figure who closely aligns with Ten’s persona is a strategically sound move. My intuition suggests that he will captivate audiences and become a guilty pleasure to many. Capitalizing on his father’s status as a national treasure, this change is poised to broaden the show’s viewership demographics, with a notable increase in older viewers.

Robert Irwin and Julia Morris

Paramount openly acknowledged their responsibilities for 2024, aiming to inspire advertisers by emphasizing their commitment to “taking a big bold swing and knocking it out of the park from the get-go”.

Nevertheless, it would have been beneficial for more comprehensive insights into their strategies for reclaiming audience share, particularly given the evident challenges they face. These challenges include the absence of a national (regional) footprint and a presence beyond the realm of total TV, distinguishing them from their fellow Free-to-Air counterparts.

The key announcements outside of content could have benefited from more extensive elaboration, offering a clearer visualization of how these initiatives would be executed and their practical applications to specific advertising categories. In particular, the Brand Boost offering aligns with prevalent market trends emphasizing personalization and relevance. However, presenting a real-life example to illustrate its implementation would have resonated more strongly with the audience, enabling more informed discussions with clients.

Chris Parker, founder and CEO of Awaken

In the recent whirlwind of network unveilings, Paramount+ has carved its niche. While Seven and Nine have delved deep into Sport and the Olympics, Paramount+ is utilising its global network to build its audience.

Paramount+ has again presented a solid line-up of returning crowd-pleasers. Shows like The Bachelors Australia and The Masked Singer Australia have consistently drawn in viewers. Their unfaltering appeal serves as a magnet for both audiences and advertisers.

Yet, it’s not solely about the stalwarts. Paramount+ demonstrates its dedication to varied programming with the resurgence of classics such as Gladiators. This is complemented by the fresh addition to the revamped I’m A Celebrity… Get Me Out Of Here! featuring the beloved Robert Irwin, this crowd pleaser will grace our screens again.

Channel 10’s new content, with shows like Australian Survivor: Titans v Rebels and the renowned game show Deal or No Deal, layers on more advertising possibilities. With their widespread allure, these programmes secure prime-time spots.

Top Gear Australia returns with a local flavour, reviving nostalgia aimed squarely at the automotive market’s advertising spend. Add to this a touch of sentimentality with iconic programmes like Teenage Mutant Ninja Turtles and SpongeBob SquarePants marking their anniversaries, and Paramount+ is poised to cater to both young and seasoned viewers, paving the way for diverse campaigns.

However, Paramount+ is not resting on its content. Joining ranks with other platforms, it introduces Premium and Advertising subscription tiers, underpinning a commitment to superior viewer engagement, I just hope it does better than Netflix’s launch of an ads tier….

Pioneering endeavours such as Shoppable TV and the Innovid partnership chart exciting waters. With these more interactive, direct-to-consumer advertising strategies, the evolution of sponsorships promises real-time sales boosts, especially in the fashion sector.

Coupled with the integration of VOZ streaming, advertisers are assured a fluid experience across multiple BVOD platforms. Together with Seven and Nine, Paramount+ is set to accentuate performance and reach, making them central themes of 2024.

The forthcoming year promises much for Paramount+. It will be especially interesting to see which brands will partner for in-show shopping. Will it be The Bachelorette featuring real-time ‘The Iconic’ adverts or perhaps MasterChef paired with ‘Uber Eats’. We will wait and see.

Frank Carlino, group investment director, Carat

Today Paramount revealed its content business plan for 2024 at an intimate gathering on Saunders St.

Paramount is the only Australian media company that has a guaranteed pipeline of global and local content, with distribution across all mediums – free-to-air, BVOD, SVOD and AVOD with FAST.

Last year, Paramount promised continued focus on scaling their streaming platforms – 10 Play with the introduction of Live TV with Pluto TV and Paramount+, while maximising their traditional business.

In 2024, Paramount made it clear from the outset its focus was on “fresh content, measurement and attribution, and less on areas of converged audiences and sport”. Will that come back to bite them is anyone’s guess….

What is safe to say though, is the re-energized focused early evening schedule looks like a proven alternative to the Olympics which can only be a good thing for the network. Spearheaded by a content slate which “bursts out of the blocks” starting with IAC in January and a new host in Rob Irwin.

Lovers of nostalgia will embrace Gladiators, Wheel of Fortune & Deal or No Deal. Proven ratings success stories in Gogglebox, Masterchef & Survivor which will further deliver consistent audiences for a programming format that has lacked “survey year” consistency in the past.

Outside of content, Paramount have enhanced their world class ad tech and trading capability, as well as deepen their growth opportunities through integration and partnership. However, the “game changer” in my eyes is the much-awaited launch of Paramount+ Premium Viewer & Ad Tiers to roll out mid-November into 2024.

Paramount + will meet viewers where they want and be there for what they want to watch, with a slate of desirable local content in NCIS Sydney, Paper Dolls, Top Gear Australia, Last King of the Cross and MTV Aussie Shire enough for anyone to pay the $13 a month for.

Not a TEN, but a Paramount performance that’s deserving of the accolades. Pun intended.

Maisy Richardson, national commercial director and Brisbane head of investment at Zenith

In contrast to the glitz and glamour of recent upfronts, Paramount’s 2024 event was a more intimate affair. Their focus was on quality entertainment programming, with a pipeline of global and local content across a broad ecosystem – FTA, SVOD and streaming – catering to varied viewer ages and interests.

Their programming strategy largely mirrored 2023 with all the fan favourites back next year, showing confidence that their current slate is drawing a different audience to competitor networks.

This was the most content focused of the upfront presentations, with a smattering of new talent and announcements aimed at drawing in audiences though nostalgic revivals, such as the re-launch of Gladiator and Deal or No Deal as well as the return of Ready, Steady, Cook and Wheel of Fortune with Graham Norton to our screens during prime time.

SVOD offerings on Paramount+ were front and centre, with the launch of their premium streaming service on 16 November as well as advertising tiers in 2024. While they left us hanging on a more specific date, it seems Paramount+ will give advertisers the ability to maximise reach across their platform and drive higher engagement with audiences in environments curated by the viewer.

On the innovation front, Paramount announced a compelling suite of measurement solutions. The most interesting being LiveRamp, which will utilise advertisers’ first party data to link media activity with business outcomes.

Notably, Paramount also announced the pilot of Shoppable TV in Australian Survivor, which will integrate into KERV technology to engage and provided viewers a shopping experience through the larger screen. Such a move will give brands more opportunity to connect beside the traditional 30-second TV spot. If effective, we should see this format rolled out to other tent-poles on the network.

As we move into an Olympic year, sport will continue to be a juggernaut on Free-to-Air TV. Changes to AFL and Cricket streaming rights will ensure both major summer and winter codes are more accessible to viewing audiences than ever before. Other networks can leverage their sporting platforms to promote upcoming content, attracting a breadth of viewing audiences.

However, with soccer (football) the only major sports code in their arsenal, Paramount needs to capitalise on the significant interest generated by the Matildas and the recent FIFA World Cup. It will be intriguing to see if they can parlay this interest into long-term engagement for fans and advertisers alike.

Matt Papasavva, managing director at This is Flow

The event was absolutely a refreshing change to what I’ve come to expect from a traditional market upfront. The strategic shift to smaller, more intimate group as opposed to one mass audience was definitely the right one, and ultimately allowed the Paramount team to capture attention – in my opinion, at a much higher level than the same content would have received in a mass group.

The offering at its core is simple and underpinned by the idea of best local content / talent, any time, any place. Leaning into their access to SVOD is a differentiator and will be one to closely monitor, particularly once ad-supported and premium tiers are rolled out to Australian market.

The most interesting selling points was absolutely the focus on attribution and measurement. The launch of their shoppable TV pilot has the potential to be a game-changer, although there are questions whether users will choose to engage with the format during their lean-back viewing time.

BrandBOOST and independent brand lift studies will excitingly offer clients an opportunity to have a more personalised message and then understand the real impact of that investment, which for us at This is Flow absolutely resonates.

There was an opportunity for more time to be spent discussing their focus on measurement, however in a relatively shorter Upfronts session, it’s also clear why more time would be spent highlighting their more flashy announcements of new shows, returning shows and the talent slate for 2024.

For me, it’s going to be interesting to see the real impact of their new innovations, coupled with their programming slate for 2024…particularly in what will be a challenging year, made even more competitive in having to compete with the Olympic Games.

Andrew Murray, head of trading, UM Australia

Paramount’s more intimate approach in delivering their Upfronts for 2024 was a refreshing way to hear from the business on their plans for the year ahead as it allowed for a two-way engagement with some robust questions raised from the floor.

From a programming perspective, Paramount have a well-defined strategy as they move into 2024 with a focus on a core People 25-54 audience. Their existing programming such as: Have You Been Paying Attention, Survivor Australia, Masterchef, Googlebox Australia, Cheap Seats and The Amazing Race deliver pockets of consistent audience for our UM clients.

New programming joining in 2024, such as: Gladiators, Deal or No Deal, Wheel of Fortune with Graham Norton should help build out further consistency and stability in their audience delivery.

For UM’s clients, investment levels with media partners are always driven by their ability to deliver audiences that we have defined as critical for business outcomes. In 2024, increased investment with Paramount will be based on audience improvements from their 2023 levels. Their approach to Q1, 2024 looks strong, with Gladiators leading into Survivor Australia and then I’m A Celebrity and they will need to see this fire to give us, and our clients confidence on their continued delivery throughout the rest of the year.

Finally on programming, their limited sport offering vs. their competitors is a watch-out. Although Sport is not the be all for all clients, it does offer competitive networks to deliver promotion for the rest of their schedule.

We will be watching Paramount’s evolution into Total TV converged trading on a national scale and it will be critical to have them work closely with SCA Regional to ensure they offer a competitive national product similar to what Seven and Nine are able to.

From a streaming perspective, the new announcement regarding the ad-tier coming in 2024 is well received as it delivers us the ability to target audiences which have moved away from more traditional screens such as Linear TV and BVOD. It will be critical for Paramount to get the model right for Paramount+ when it launches as to ensure that there is scale from the beginning.

The continued innovation in the digital space, such as the global pilot for shoppable TV in Survivor Australia offers clients new opportunities to use an engaged audience to deliver on business outcomes.

Marianne Lane, head of investment, Kaimera

I thoroughly enjoyed Paramount’s more intimate upfront session this year. The close-knit setting added a personal touch that made the entire event more engaging.

Paramount has some great core programs, such as Thank God You’re Here, Survivor, Gogglebox, The Hunted and Masterchef, and the session served as a reminder of the quality of these programs. One highlight that particularly caught my attention was the announcement of the return of Gladiators. I firmly believe it will contribute significantly to Paramount’s strong start to the year. The nostalgia associated with Gladiators, coupled with the network’s commitment to maintaining its excellence, promises an exciting viewing experience.

Additionally, the announcement that Robert Irwin is taking over as the new co-host for I’m a Celebrity injected a fresh burst of energy. Irwin’s charismatic presence and genuine enthusiasm are bound to breathe new life into the program. It’s a strategic move which introduces a captivating personality that aligns seamlessly with the show’s adventurous spirit.

I am optimistic about Paramount’s trajectory in the upcoming year. The blend of established favourites and innovative additions positions Paramount as a network committed to delivering compelling and dynamic content.

Michael Betts, head of media solutions and investment, Sydney, EssenceMediacom

Paramount Plus

The most exciting news by far was the announcement of an ad-supported tier to Paramount Plus. As audiences across the screens landscape continue to become fragmented, particularly with younger audiences, any opportunity to extend reach with these audiences is good news for advertisers.

There are an increasing number of reasons for Aussies to add Paramount Plus to their subscription mix with a second series of the successful Last King of The Cross, Matildas and Socceroos fixtures, and the launch of Top Gear Australia. The cheaper Ad-supported tier will make it far easier to grow the subscriber-base with consumers struggling to justify subscribing to a 4th or 5th platform.

However, by introducing an ad-supported tier (as Netflix did) rather than introducing ads to the existing standard tier (as Binge and Prime did) could mean that audiences start at a low level making it hard to scale activity from launch.

Top Gear Australia

Content Slate

The content slate was full of tried and tested formats that are proven winners with audiences. While not revolutionary and unlikely to win over younger audiences at scale, they provide familiarity with existing audiences and an element of predictability and security for advertisers. Paramount seem conscious of this, keen to point out the variety of audiences they can reach across SVOD, BVOD, FAST and Linear formats.

Measurement

The Paramount Data collaboration tool, allowing advertisers integrate their own first party data to measure the impact of Paramount in their own attribution studies, is going to be extremely valuable to progressive advertisers with large and meaningful 1PD sets.

Product

The pilot of shoppable ads in Australian Survivor will be one to watch for certain brands, particularly for fashion and CPG clients. It’s a delicate balance between adding value to the consumer experience and providing a disruption, but done well it opens up a world of opportunities for direct response activity.

Melanie Kay, group investment director, OMD Sydney

It is exciting to see Paramount looking to 2024 and beyond, staying true to their roots as Australia’s Under 50 entertainment platform. Revamped classics, strong comedy and premium drama should position Paramount to grow audience throughout 2024, bringing back lapsed and light viewers.

From the word ‘go’, Paramount exuded energy, gearing up to make 2024 a year to remember. With an extensive mix of international and homegrown content, it’s evident Paramount has a spotlight on Australia, showcasing their skill in balancing global scale with local expertise.

The introduction of the Paramount+ Premium Tier is set to roll out on 16th November with a promise to provide consumers with choices on how they access a ‘Mountain of Entertainment’. The advertising tier will roll out in select markets including Australia during 2024, giving us a highly anticipated opportunity to engage with consumers.

The spotlight is undeniably on Paramount+, the fastest-growing streaming giant. It’s the platform where all Premium Drama will exclusivity launch with the 10 and 10PLAY platform catching the second runs. November 10th will see the long-awaited launch of NCIS Sydney, starring an ensemble of international and Australian talent.

BTS of Olivia Swann as NCIS Special Agent Captain Michelle Mackey and Todd Lasance as AFP Liaison Officer Sergeant Jim ‘JD’ Dempsey, on the set of NCIS: Sydney season 1. PHOTO CREDIT: Daniel Asher Smith/Paramount+

This will be followed by Fake starring Asher Keddie and David Wenham, Paper Dolls, Last King of the Cross S2, The Inspired Unemployed, and Aussie Shores. We’re on the brink of some strong content, the critical ingredient to entice viewers back to the screens.

The home of Australian comedy continues across 10 and 10PLAY! From ‘Have You Been Paying Attention? to Cheap Seats and Gogglebox. Paramount presented brand tracking that showed brands could achieve +17% in consideration and +26% in brand positivity when positioned in the comedy genre, highlighting the impact of attention viewing.

To revamp the critical 6pm slot, 10 has brought in Grant Denyer to resurrect Deal or No Deal. With the current global climate, this is a good option for viewers wanting an alternative to news. This is a strong strategy that will see viewers shift from news to this family friendly entertainment option and draw a larger audience into The Project.

Amid speculations, we now know Rob Irwin will accompany Julia Morris, replacing Chris Brown on I’m a Celebrity Get Me Out of Here. Their on-screen chemistry hints at an inventive idea by Paramount to lure younger viewers to 10.

Expect more content from 10, kicking off with a revamped Gladiators, reminiscent of a Marvel blockbuster! The cinematically produced promo and the promise of a theatrical sport style show, offers a strong family viewing option.

The first quarter boasts a line-up featuring Australian Survivor, I’m a Celebrity, and the Australian F1. Masterchef will return with new judges joining Andy Allen and will see Melissa Leong move to head up Dessert Masters. This promises advertisers more weeks of awesome food content with ample integration opportunities.

Paramount’s partnership with Live Ramp promises cutting-edge ad strategies, real-time performance metrics and tailored ad experiences for viewers. We will be able to activate 1PD and 3PD in a data safe environment, providing advertisers with the ability to work with Media Mix Modelling and results in real time. It will allow us to evaluate the elements of our screens strategy to identify which are the strongest, allowing us to take key learnings like ROI, persuasion, relevance, ultimately creating the ideal campaign.

Paramount’s upfront inspired us with plenty of local and high budget global content, and ready to go solutions to generate personalised advertising in 2024. Paramount emphasised their strength of global stature combined with local knowledge which promises an opportunity for some increases in audience share during 2024.