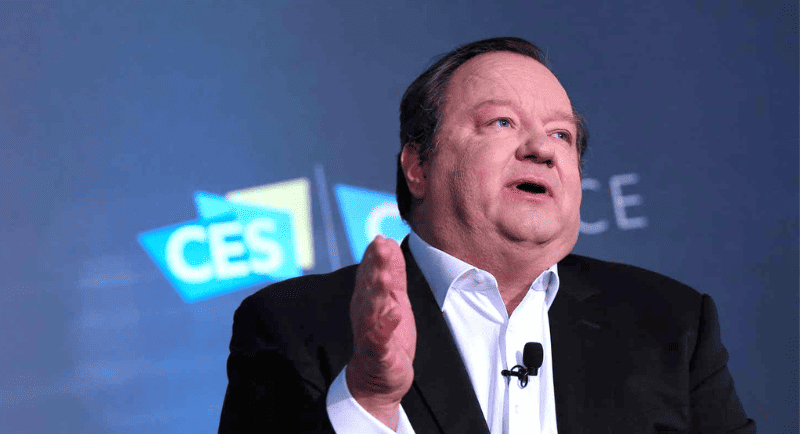

Paramount president and chief executive Bob Bakish (above) has delivered the company’s results for Q2 2023. The focus continues to be on direct-to-consumer via Paramount+ and Pluto TV.

Overall TV continues to deliver the lion’s share of dollars – US$5.157b in Q2 versus US$1.665b for direct-to-consumer and $831m for film. [All amounts are in US$.]

Those numbers represent a drop of 2% year-on-year for TV, and 30% for film. The latter mainly because of the comparison to the same quarter last year where Top Gun: Maverick boosted box office.

Tom Cruise impact was less in Q2 2023

The direct-to-consumer (DTC) growth for the quarter year-on-year was an impressive 40%. If that growth trajectory in a little over 12 months DTC revenue could be close to 50% of what TV brings in.

Overall Paramount lost $299m for Q2 2023, down from a profit of $419m in Q2 2022. DTC losses for the quarter were $424m, improving slightly on $445m 12 months ago.

Upon releasing the results, Bakish said: “In Q2, we maintained our focus on scaling our streaming platforms, maximising our traditional business, and building a sustainable business model that will return the company to significant earnings growth in 2024.

“Notably, Paramount+ revenue grew 47%, total DTC ad revenue increased 21%, and global viewing hours on Paramount+ and Pluto TV were up 35% year-over-year. And despite the environment, TV media continued to contribute significant earnings. As we look forward, we will continue to be guided by our content-first approach and seek to maximise its value across platforms and revenue streams, while also operating with the utmost efficiency through this year of peak streaming investment.”

Paramount doesn’t break out details of how its business performs in Australia. The results included a reference to the recent launch of Pluto TV locally. There was also a reference to the launch of ad-supported Paramount+ tiers in certain markets which might include Australia.

Lioness: Special Ops

Paramount library key to growth

Key to much of Paramount’s future is its content library, said Bakish. Those vaults contain over 200,000 TV episodes and 4,000 movies. “That irreplaceable library is a critical driver of Paramount+, Pluto TV, linear and licensing. That is coupled with our production capabilities that span the world. From Hollywood to key global markets including the UK and Australia. In scripted, unscripted, animation and live action.”

When it came to specific mention of product, Bakish referred to the latest Taylor Sheridan production Special Ops: Lioness, calling it Paramount+’s “most-watched global series premiere” in just 24 hours on the service.

International content powerhouse

With short-term US productions on hold due to strike action, Bakish referred to what the company is delivering outside the US. “Our international production capabilities see more than 85 scripted and unscripted Paramount+ originals already produced, in production or greenlit. There are 20 local versions of global unscripted formats slated to debut in 2024.

“The power and quality of our content engine is a key competitive advantage for us.

“We are evolving our streaming content slate to super-serve key target audiences more efficiently. This is based on all we have learned since Paramount+ launched.

Paramount Direct to consumer

The company reported it continues to progress on the path to streaming scale and profitability. In Q2, revenue growth was driven by subscriber growth and improvements in engagement and monetisation. DTC remains on track to drive significant earnings improvement in 2024.

* Revenue increased 40% year-over-year.

Subscription revenue grew 47% to over $1.2b, driven by subscriber growth on Paramount+.

Advertising revenue rose 21%, driven by higher impressions for Paramount+ and Pluto TV.

Paramount+ revenue grew 47%, driven by subscriber growth and increased advertising revenue.

* Paramount+ subscribers reached approximately 61m, with growth of 0.7m additions in the quarter.

TV Media

Paramount reported TV Media contributed “significant revenue and earnings, benefiting from diversification of revenue streams, pricing strategies, and focused cost management. TV Media continues to yield revenue performance that outpaces audience trends.”

* Q2 Revenue was $5.2b:

Affiliate and subscription revenue declined 2%, primarily reflecting the impact from subscriber declines, partially offset by pricing increases.

Advertising revenue decreased 10%, reflecting continued softness.

Filmed Entertainment

The division includes theatrical, streaming, and licensing. Q2 included the extension of the franchise Transformers with the #1 box office debut of Transformers: Rise of the Beasts.

* Revenues decreased 39%, driven by lower theatrical revenues due to the release of Top Gun: Maverick in the prior-year period.

Closing the book on publishing division

Shortly before Bob Bakish delivered the latest financials, Paramount reported the sale of its publishing division Simon and Schuster. The buyer is private equity investor giant KKR and the price was $1.62b.

“We are pleased to have reached an agreement on a transaction that delivers excellent value to Paramount shareholders while also positioning Simon & Schuster for its next phase of growth with KKR,” said Bakish. “The proceeds will give Paramount additional financial flexibility and greater ability to create long-term value for shareholders, while also delivering our balance sheet.”

See also: 10 Play getting 50+ new FAST channels as Paramount launches Pluto TV in Australia