Online advertising expenditure in Australia has surged 12.1% year-on-year, reaching $4.2 billion for the quarter ending 30th September 2024, according to the latest IAB Australia Internet Advertising Revenue Report prepared by PwC Australia. Robust growth across video, classifieds, search & directories, and audio categories underpinned the increase. See the previous report here.

Video leads the charge with Olympics-driven Growth

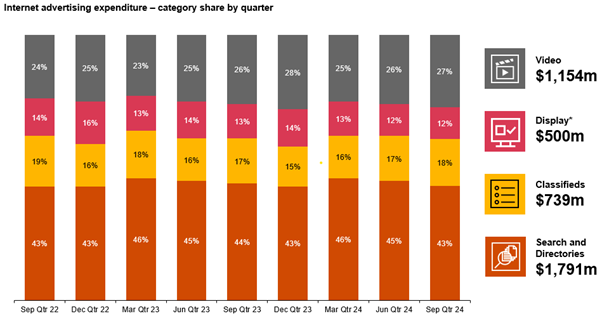

The video advertising market posted an impressive 19.5% year-on-year growth to hit $1.15 billion, buoyed by strong advertising activity around the Summer Olympics. Classifieds also experienced a notable rise, up 13.8% to $700 million, while search advertising grew 9.8% to $1.8 billion, accounting for 43 cents of every internet advertising dollar. Audio advertising jumped 16.2% to $79 million, while display advertising saw a modest increase of 2.5% year-on-year to reach $500 million.

Gai Le Roy, CEO of IAB Australia, highlighted the impact of the Olympics on ad spend. “While the advertising investment market is still mixed, the strength of an audience engagement driver like the Olympics can have a major impact on ad spend. For the September quarter, this was a key contributor to the year-on-year growth for video inventory. Search and social continue to experience solid growth, putting the calendar year for the digital ad market on track for low double-digit growth,” she said.

Internet advertising expenditure — category share per quarter.

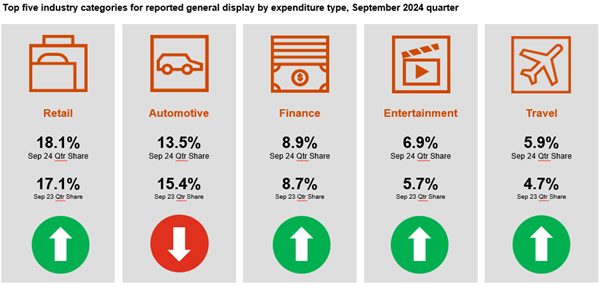

Top five industry categories for reported general display by expenditure type — September 2024 quarter.

Retail dominates general display advertising

Retail continued to dominate general display advertising expenditure, representing 16.7% of the category, followed by travel, finance, and entertainment, which also saw increased spend. Automotive remained in the top five categories, though its share declined compared to the same quarter last year. Telecommunications experienced the largest increase in share this quarter, driven by the launch of new mobile devices. Meanwhile, home products, services, and utilities showed the strongest preference for video advertising.

Shifts in video advertising platforms

Video advertising overtook audio as the fastest-growing general display sub-sector this quarter. Desktop devices increased their share of video advertising expenditure to 45%, while connected TV fell slightly to 44%, and mobile video dropped to 11%. Social platform video now accounts for one-third of total video ad spend.

Podcasting powers audio growth

Within internet audio advertising, podcast advertising recorded a standout performance, capturing 40% of total internet audio advertising, up 26.5% year-on-year.

Outlook for digital advertising

With consistent growth across key categories and solid engagement drivers like the Olympics, the digital ad market is on track to close the calendar year with low double-digit growth. The continued rise of video and audio advertising, especially in emerging formats like social video and podcasts, highlights the evolving landscape of online advertising in Australia.