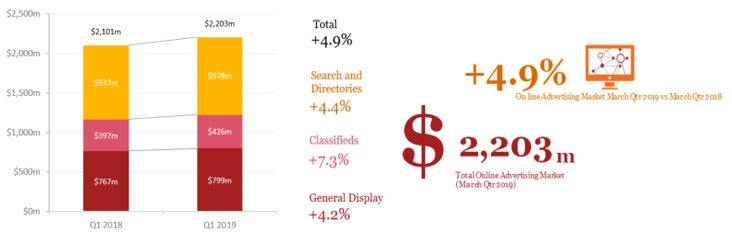

Online advertising has continued to climb in Australia with revenues increasing 4.9% year on year to reach $2.2billion for the first quarter of 2019. The data which was drawn from the IAB Australia Online Advertising Expenditure Report (OAER) published today by PwC, also showed that video, mobile and classified advertising were the stand out performers, increasing year on year by 15%, 26% and 7% respectively.

Consistent with previous years, online advertising expenditure in the first quarter of 2019 softened slightly compared to the seasonally more active December 2018 quarter, decreasing by 4.3% overall. Within this, whilst the general display and search and directories segments contracted, classifieds grew 6% in the March quarter 2019 compared to the December 2018. This classifieds growth was experienced across all three reported sectors – recruitment, real estate and automotive.

Gai Le Roy, CEO of IAB Australia commented: “There is little doubt that the advertising market is tough across all platforms, but within the breadth of digital advertising there were still bright spots. The classifieds sector again had a strong March quarter and the display market saw an increased share for government/political spend which will continue into the June quarter numbers. Yet again video continues to gain share in the display sector.”

Search and directories maintained its overall share of online advertising expenditure at 44% to reach $977.6m for the quarter, while classifieds reached $426.2m, a 20% share of spend and general display advertising is now 36% of spend at $799m.

Video represented the largest share of general display expenditure in March 2019 quarter at 46%, followed by content, native and infeed at 35% and standard display formats at 18%. Each of these segments has a component of mobile advertising expenditure with mobile advertising making up 66% of total general display expenditure, an increase from the December 2018 quarter.

Media agencies were the preferred buying method for display advertising viewed on content publishers’ inventory with some 58% bought via media agencies via an IO / non-programmatic method. 29% of general display advertising was bought programmatically with either fixed CPM and guaranteed inventory (6%) or with a variable CPM based on real time bidding via an exchange or private market place (23%). The share of general display advertising bought programmatically decreased 5% compared to the prior quarter.

The report also found that 32% of video advertising expenditure for content publishers was driven by viewing via a connected TV in the March quarter, with 39% viewed on a desktop and 29% via mobile.

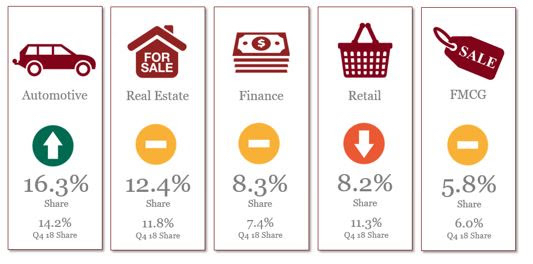

Automotive, Real Estate and Finance lead the General Display advertising market revenue, representing 37.0% of the reported General Display advertising market for the March quarter. The same three industry categories made up 33.4% of General Display in December 2018 quarter. Government’s share of general display increased to 5.0% from 3.1% in the lead up to the May 2019 federal election.