Omnicom Group has shared its Q4 2021 financial results alongside its results for the entirety of 2021.

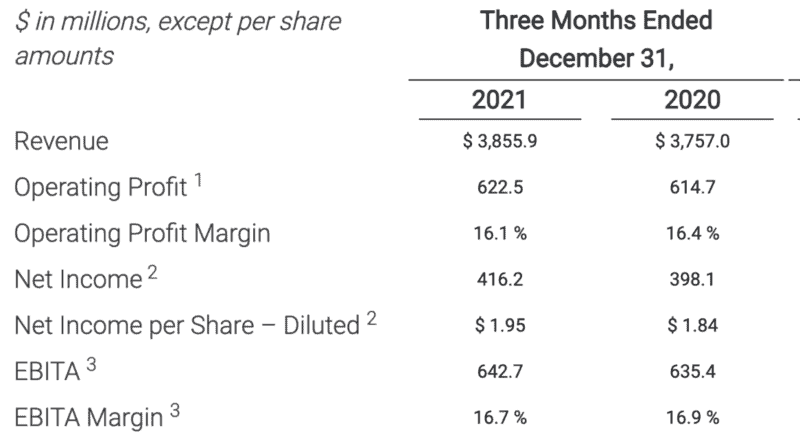

The global leader in marketing and corporate communications reported total revenue of A$5.38 billion (US$3.86 billion) with organic growth of 9.5% in the fourth quarter.

Their worldwide revenue for 2021 increased 8.5%, rising to A$19.9 billion (US$14.3 billion) from A$18.4 billion (US$13.2 billion).

Chairman and CEO John Wren said the group’s global organic revenue growth exceeded expectations.

“Once again, thanks to the efforts of our people across Omnicom, we were pleased to see strong results across all geographies and services, led by our focus on digital, precision marketing and consulting.

“Our teams are working together in powerful new ways – with leading technology and data solutions – to deliver the best client outcomes in a rapidly evolving market. We are optimistic in our 2022 outlook and expect to continue build on our long-term record of improving profitability and sustained value creation,” he said.

Despite the negative effects of COVID-19, the groups worldwide revenue in the fourth quarter continued to improve. The increase in revenue can be accredited to organic growth of 9.5%, a decrease in acquisition revenue, net of disposition revenue of 6.6%, and a decrease in revenue from the negative impact of foreign currency translation of 0.3%.

Omnicom’s organic growth increased across all its fundamental disciplines from Q4 2020 to Q4 2021, including 7.4% for Advertising, 19.6% for Precision Marketing, 12.4% for Commerce & Brand Consulting, 56.7% for Experiential, 5.2% for Execution & Support, 4.4% for Public Relations and 4.5% for Healthcare.

Additionally, the group experienced organic growth across their regional markets, including 7.8% for the United States, 1.8% for Other North America, 10.1% for the United Kingdom, 12.7% for the Euro Markets & Other Europe, 7.8% for Asia Pacific, 7.3% for Latin America and 48.1% for the Middle East & Africa.

Their operating expenses increased 2.9%, while their operating profit increased 1.3% to A$8.7 million (US$6.23 million) The group experienced an operating profit margin of 16.1%.