No media company has yet to spell out exactly how much a hit revenue is expected to take. Some have talked about the foggy future and the difficulty of forecasting future revenues which makes predictions impossible.

Nine further updated the market yesterday with operational initiatives in response to the COVID-19 pandemic.

With regard to revenues, Nine explained to the ASX and the JP Morgan Virtual Conference: Consistent with Nine’s release of 19th March 2020, group revenues in Q3 were in line with previous guidance. However, the advertising market is increasingly uncertain with likely material negative impact from April.

Nine also reported how it has managed to stay operation yet safeguard the health of its staff: Nine has successfully transitioned the majority of its workforce to work at home with minimal interruption. Notwithstanding, Nine’s crucial newsrooms across the country remain open and will continue to provide premium news coverage to all Australians.

For advertisers contemplating halting their messaging, Nine pointed out: Audiences across all of Nine’s platforms are showing strong growth, including linear audience growth on core news and current affairs content – Nine News (+30%), A Current Affair (+13%) and the Today show (+26%) vs levels recorded in late February-early March, as well as across Nine’s digital mast-heads.

The company added both Stan and 9Now are reporting accelerating growth in active subscribers/users and usage.

In response to the current global crisis, Nine said it is focused on major short and long-term cost initiatives across all of its businesses, as well as expediting part of the $100m, 3-year linear cost out that was announced with Nine’s interim results in February.

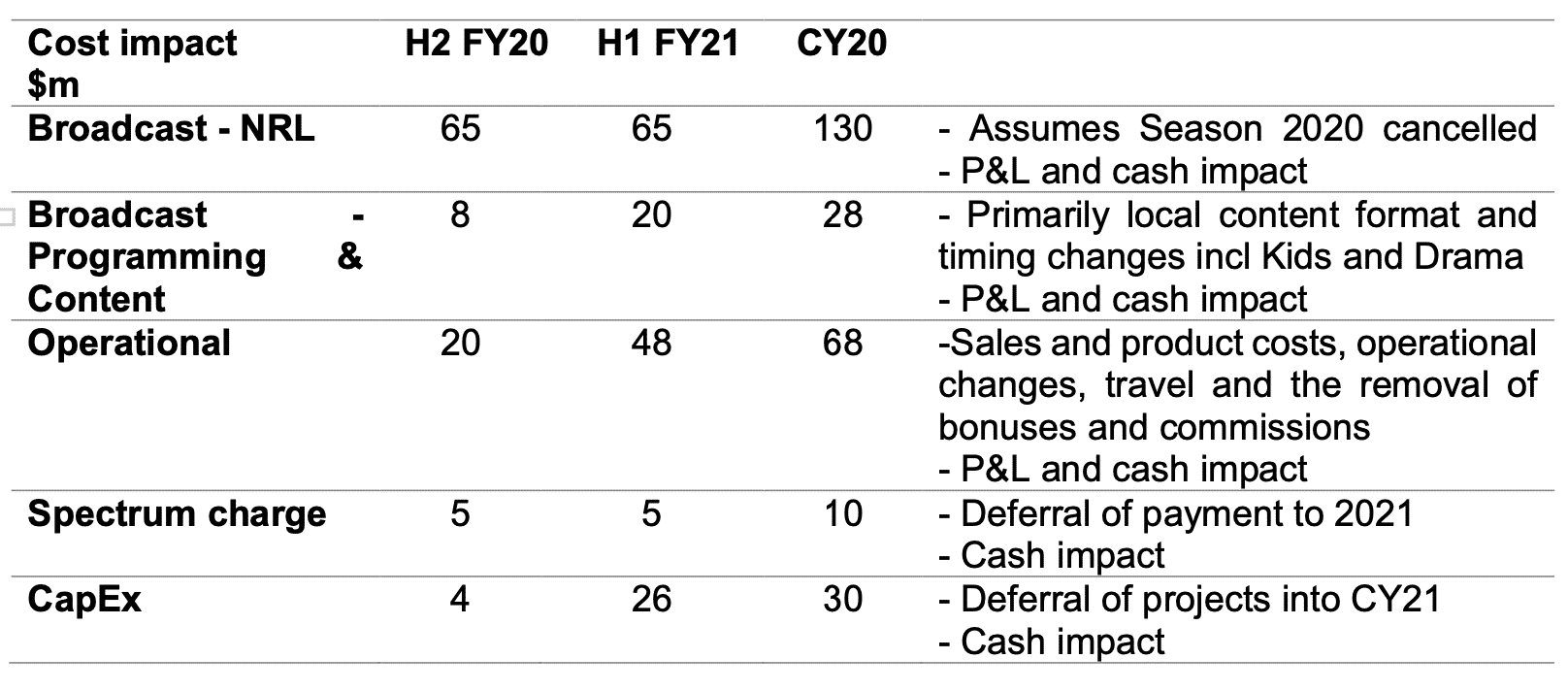

The table below broadly highlights the first round of these initiatives, premised on the crisis continuing for the duration of calendar 2020. Any earlier (or later) recovery will change the magnitude and/or timing of these metrics, with a prolonged economic impact likely to result in further initiatives.

The chart reveals that if the 2020 NRL season is cancelled, the company will save $130m – $65 in this financial year and $65m in the next.

As detailed in the ASX release dated 31 January 2020, Nine recently completed the refinancing of its corporate debt facilities. The new facilities comprise (equally) 3 and 4 year revolving cash advance facilities of $545 million and a one year $80 million working capital facility. As of today, Nine retains undrawn debt and cash of around $300m.

Nine’s CEO Hugh Marks said, “This is a very difficult time for all Australians, on many levels. Notwithstanding an expected significant impact on our business as conditions continue to evolve, we are confident that with our enhanced audience position, our mix of assets and the commitment of the Nine team, we will emerge from this period a stronger and more competitive company.”