Nine Entertainment Co has posted a net profit after tax of $213m for the half-year. In results for the six months ending December 2021, the company reported revenue of $1.3b, a lift of 15% year-on-year.

Nine listed key highlights for the period:

• Strength of audience across all platforms – FTA, 9Now, publishing, radio and Stan

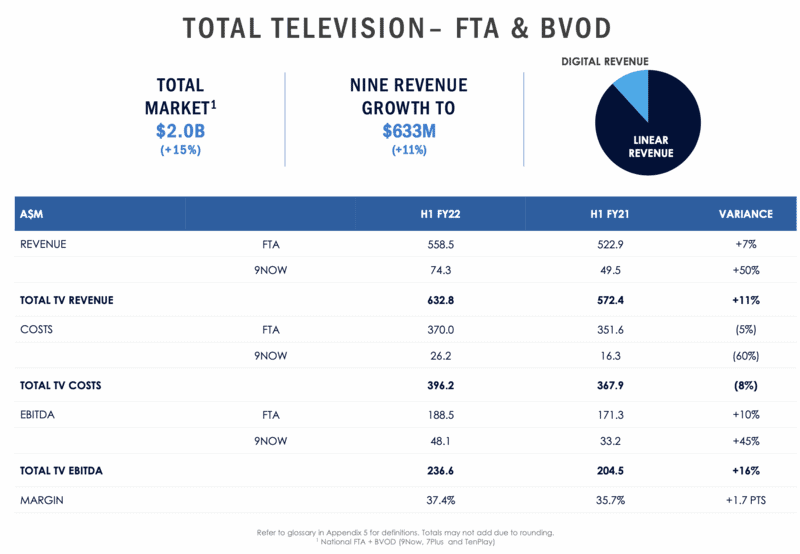

• Record revenue year for calendar 2021 in total television (FTA + BVOD)

• Strong results in total television – EBITDA +16%, revenue +11%

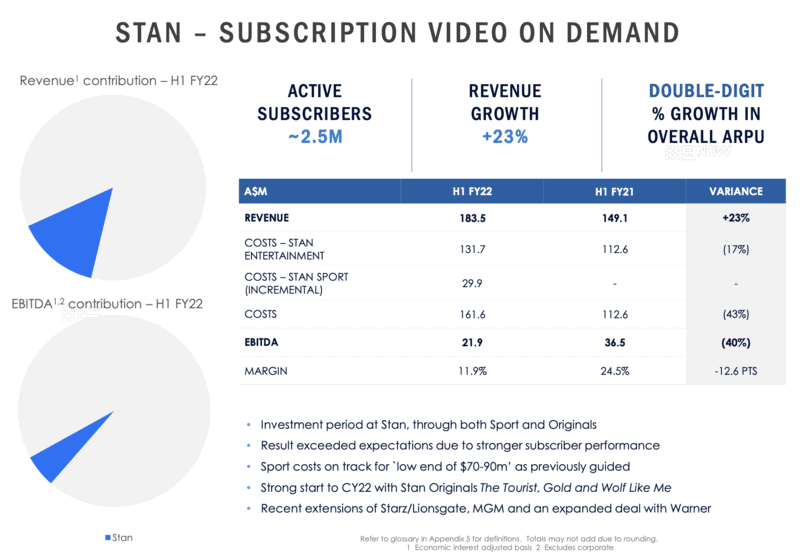

• Stan subscribers grow to 2.5m+, pushing revenue 23% higher

Nine Entertainment CEO comments

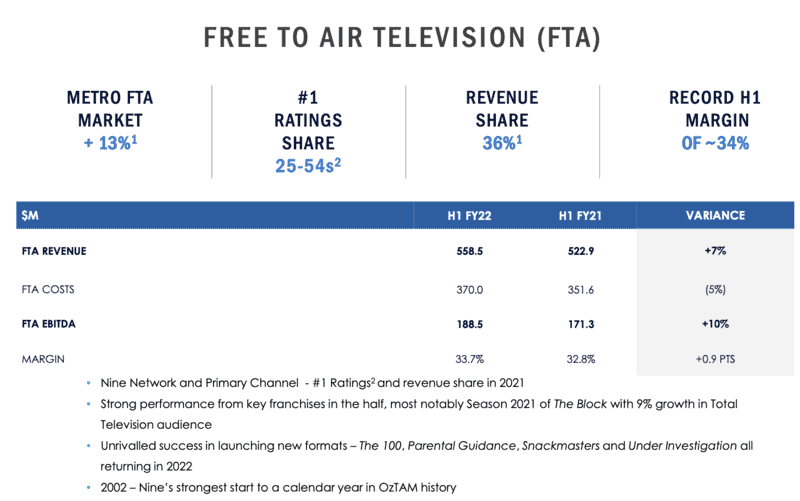

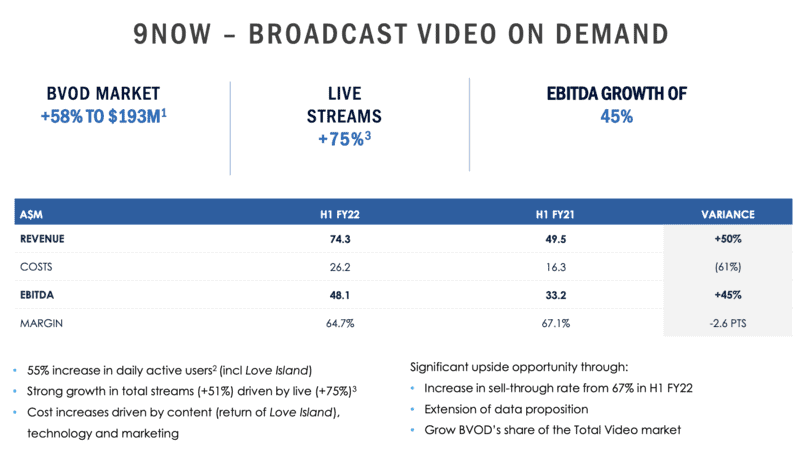

Chief executive Mike Sneesby commented: “Nine’s opportunity has never been clearer. In total television, we have balanced our programming decisions across broadcast and streaming, and carefully invested in and expanded the reach of 9Now, resulting in record total television revenues in calendar 2021, more than any year in Nine’s history.

“At Stan we continue to grow revenue and subscribers while expanding our annual volume of Stan Originals as we take greater control of our premium content pipeline and continue to invest in Stan Sport.

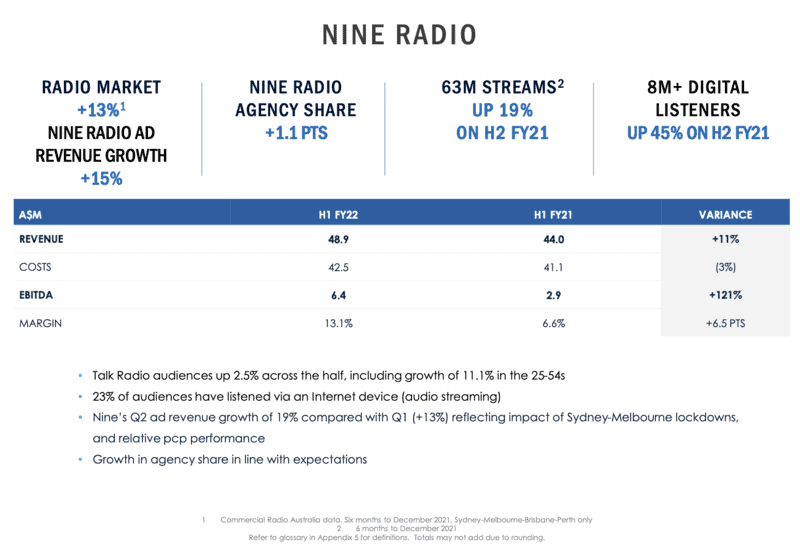

“In radio, we have been strengthening our underlying business, while building our audiences, and with 23% of our listeners now live-streaming our content, there is a real opportunity to further expand our digital revenues.

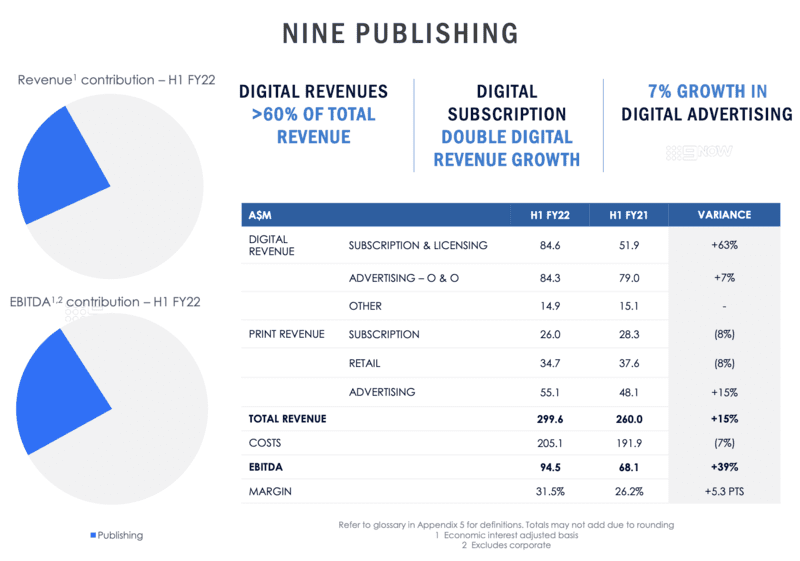

“In publishing, we will continue to invest in the product, ensuring greater audience reach and higher subscriber numbers, of course augmented by the licensing agreements with Google and Facebook.”

Nine Entertainment Outlook

The company reported calendar 2022 has started strongly, in terms of audiences across all platforms, and advertisers across all major categories.

Nine is claiming leadership in all key demographics, more than 10% ahead of Seven in primetime on a primary channel basis with viewers 25-54 and around 7% ahead in total people.

Nine is calling the new TV ratings year its best start to a calendar year in OzTAM history.

Nine’s metro ad revenue is expected to be up around 10% on the same quarter last year. Forward bookings remain ahead of last year at the same time.

9Now is expecting to post growth of 35%+ for the March quarter YOY. This will lead to an expected growth of 20% in total television EBITDA for FY22.

Nine is predicting FY22 EBITDA of $25m-$30m for Stan. The company is forecasting radio revenue growth in the current quarter of mid-single digits.

The company is forecasting growth of more than $55m in publishing EBITDA for FY22 YOY.

Overall, the business is forecasting group EBITDA to grow 22% in FY21’s $565m.