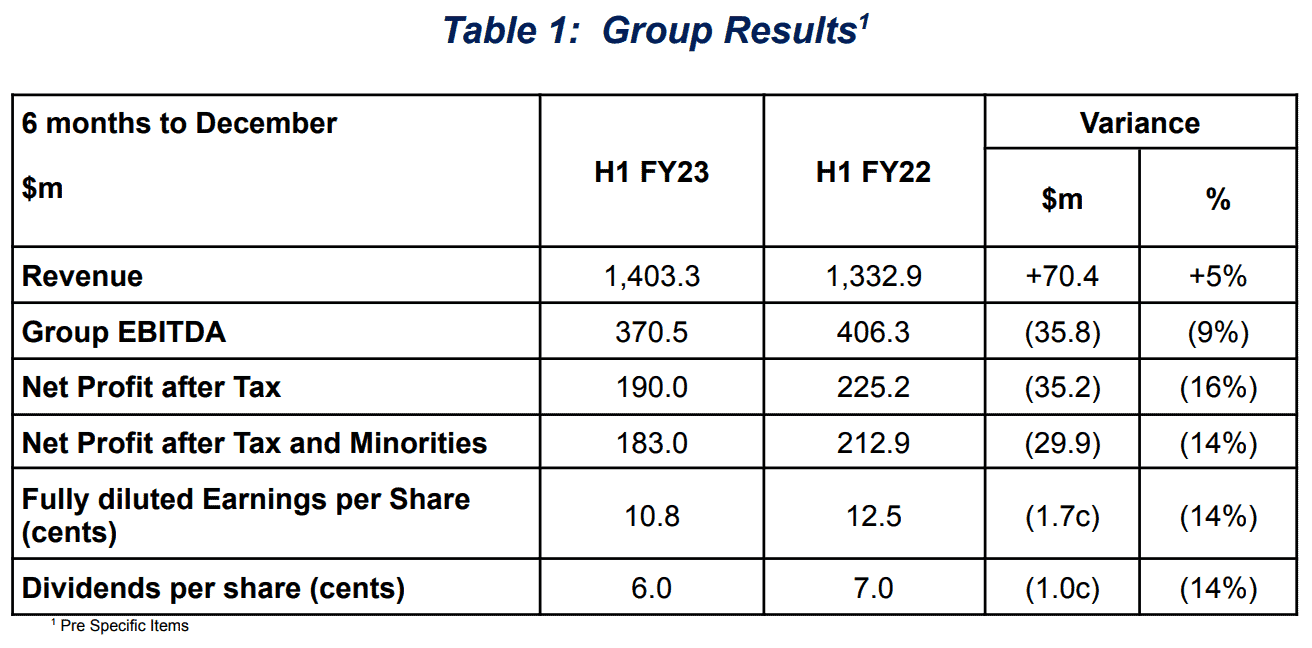

Nine Entertainment has released its revenue report for the first half of FY2023. The company saw revenue lift 5% to $1.405b, up from $1.333b for the first half of FY2022.

The group reported consolidated net profit after tax of $189m, down from $213m for the previous first half.

EBITDA was also down, from $406m to $370m.

Nine directors noted one major event after the end of the six months was the decision by the International Olympic Committee to award Nine rights for all audio-visual platforms for Summer and Winter Olympics between 2024 and 2032 inclusive for a cash cost to Nine of $305m plus $10m in contra advertising.

Nine results: highlights

• Growth in subscription revenues (wholly owned, ex Domain)

• Market-leading revenue share in both FTA and BVOD, with growth of 5% in Total Television revenues

• Overall revenue share growth in Radio, including 122% growth in digital revenues

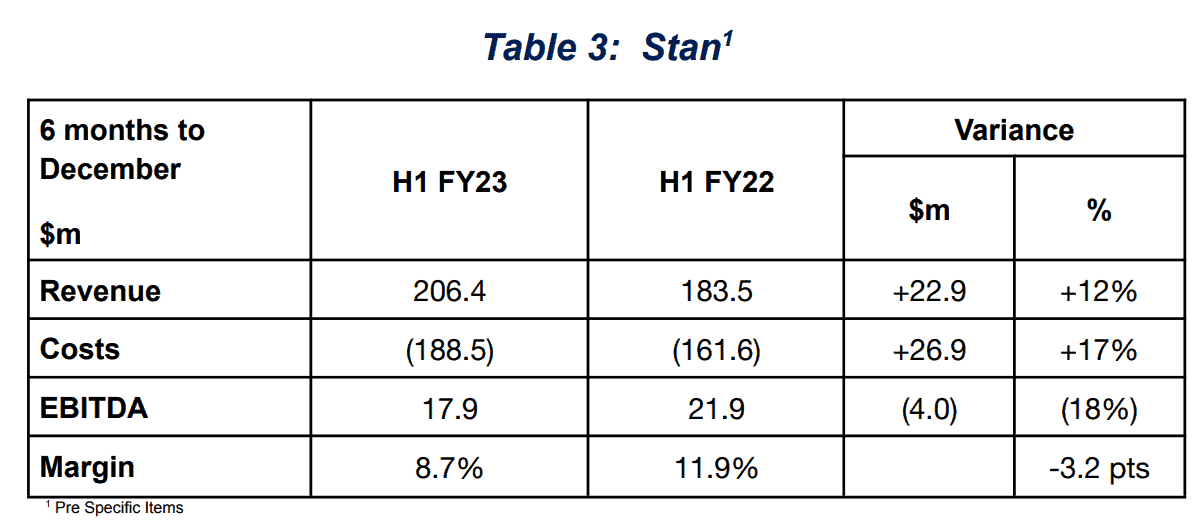

• Stan Originals drive 12% revenue growth at Stan, with active Stan subscribers now approaching 2.6m

Nine revenue report

Nine group advertising revenue was $927m for the six months, compared to $921m for the first half of FY 2022.

The revenue split for the six months ending December 31, 2022 was broadcasting $653m, digital and publishing $131m, and Domain group $142m.

Subscription revenue was $109m for digital and publishing (up from $106m period-on-period).

Commenting on revenue performance, the company noted:

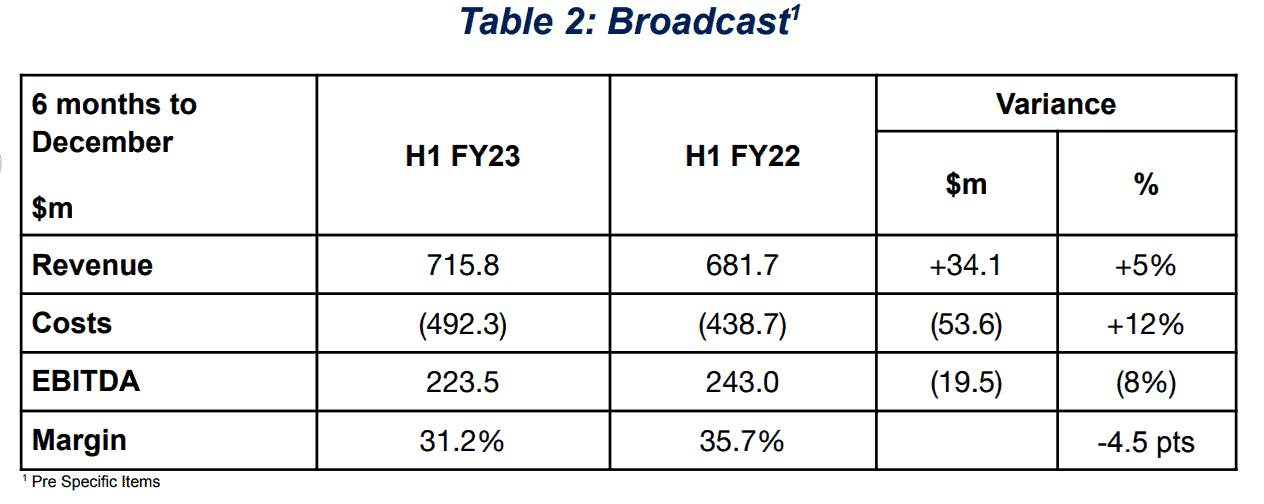

Total Television costs increased by 12% as Nine continued to invest in its market leading schedule, with the significant growth in Nine’s revenue share reflecting the payback from this investment.

Across the half, there were a number of programming one-offs in, which in total added up to around $20m. Included in this, were a larger-than-normal season of The Block, the T20 World Cup Cricket and costs associated with coverage of the death of the Queen. Other incremental investments included drama After the Verdict and dating series My Mum, Your Dad while changes to Ninja timing, also impacted.

The Metro radio ad market gained momentum, and finished the half up 5% on the previous corresponding period. Nine also gained share momentum, both on an audience and revenue basis, with ad revenues up 7% for the half. Digital revenues grew by more than 120%, which included a more than 10-fold increase in streaming revenues, as Nine’s focus on Total Audio gathers momentum. Nine Radio reported EBITDA of $6m, reflecting growth in revenues, coupled with investment in Digital and Sales.

Stan’s content has continued to engage audiences over the period, with key licensed titles including Yellowstone, Gangs of London and The Resort supporting a growing slate of Stan Original series including Bali 2002, Poker Face and Last Light as well as two feature films, Poker Face and Christmas Ransom, and a new reality format, Love Triangle. Over summer, the performance of Stan Originals has been particularly strong with the latest season of Bump, Black Snow and Poker Face (the series) all ranking in the Top 10 shows across the last 12 months, while the feature film Transfusion made up the top three films alongside Poker Face (the feature film) and Gold.

Stan Sport continued to extend its consumer proposition, securing the rights to the Rugby World Cup and successfully broadcasting the Women’s tournament, as well as the UCI World Championship cycling event in Wollongong. These sports complement Stan’s already strong line-up.

Revenue growth of 12% for the period was underpinned by both positive subscriber momentum, with current active subscribers approaching 2.6m, and a further 8% growth in ARPU 1.

The 17% increase in costs primarily reflected the investment in Stan Sport. Ex Sport, costs were up by ~14%, primarily reflecting the increased roll out of Stan Originals, and the launch of a number of new licensed titles, including the first titles from the new Sony output deal.

Overall, EBITDA of $18m was marginally down on H1 FY22, reflecting a period of strategic investment – in Originals to build a long-term library asset, and in live content, primarily Sport, as a key differentiator to other streaming platforms in Australia.

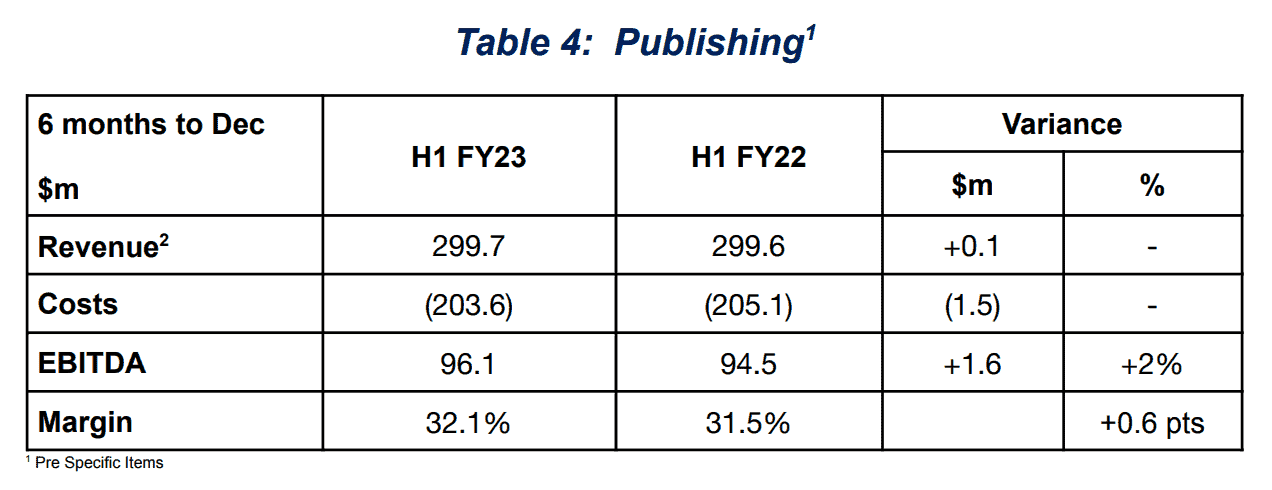

Nine’s Publishing division includes the core Metro Media business, as well as nine.com.au,

Pedestrian Group and Drive. Together, Publishing reported revenue of $300m and a combined EBITDA of $96m, marginally up on H1 FY22.

In total, Digital now accounts for almost 61% of Publishing revenue.

Notwithstanding a relatively quiet news cycle, strong readership across each of The Sydney

Morning Herald, The Age and The Australian Financial Review continued to translate to economic audiences, with mid-single digit (%) growth in digital subscriptions over the past 12 months.

Total subscribers held firm at ~450k while registered users grew to more than 1.1m. While print subscription and retail sale revenue slipped slightly across the half, this was more than offset by digital subscription and licensing revenue growth.

Digital advertising revenue declined by 8% across the half, reflecting softness in programmatic advertising late in the half. Print advertising however, grew by 9%, with Travel bouncing back strongly and Luxury continuing to grow.

H1 FY23 Publishing costs were broadly flat, with higher average wages partially offset by a higher vacancy rate. Increases in paper and distribution costs were offset by other staff savings, and some timing-related benefits.

In total, Publishing EBITDA increased by 2% to ~$96m for the half.

Domain’s result (ASX: DHG, announced 16th February 2023) reflected the challenging property environment, particularly in Sydney and Melbourne, and was marginally above guidance given in December 2022. On an adjusted basis, Domain reported EBITDA of $49m, down 28%, or down 19% on a reported basis.

Core digital revenue increased by 8%. Residential listings revenue was broadly unchanged with growth in controllable yield, inclusive of the impact of Social Boost, offsetting the 9.5% listing volume decline. Domain’s Media, Developers and Commercial business recorded a 3% revenue decline, reflecting the weak underlying property market. Revenue from Agent Solutions more than doubled, in part due to the acquisition of RealBase in April 2022, while Domain Insights recorded revenue growth of 28%, boosted by a full period contribution from IDS. In a difficult property market, Domain has made clear progress diversifying its revenue base, and building on the foundations of its

Marketplace Strategy. Ongoing costs increased by 29%, or $31m, with around 40% of the increase relating to Domain’s acquisitions of IDS and RealBase. Late in the period, and reflecting the prevailing market conditions, Domain undertook a broad ranging review of its cost base. As a result, cost saving initiatives were identified and implemented, underpinning expectations for FY23 H2 costs to reduce $15-20m versus H1.

Nine CEO Mike Sneesby

Nine Entertainment: CEO comments

Mike Sneesby, Chief Executive Officer of Nine Entertainment Co. said: “We are really pleased with how Nine closed calendar 2022, with strong audience and share performance across all businesses, both subscription and advertising. Nine’s strategic focus on content investment has resulted in clear revenue share growth across all of our advertising mediums.

“Subscription and licensing revenues at Nine’s wholly owned businesses, Stan and Publishing, together grew by around 9%, to 26% of total revenue ex Domain, as Nine continues to successfully diversify its revenue base.

“Against the backdrop of rationalising investment by international streamers, Stan’s strategic positioning in Originals and Sport, together with its strong licensed content lineup, has underpinned a growing subscriber base and strong P&L, and stands it in good stead. Stan’s expansion of its Originals slate delivered excellent results over the past 12 months, which has been reflected in growth in active subscribers, now approaching 2.6m, and enabled Stan to successfully lift pricing.

“Nine’s broad portfolio of leading platform assets enables an unparalleled distribution proposition for our premium content. Sport remains key to this strategy, and, over the past six months, we have locked in significant content agreements across our television platforms – extending our agreement with Tennis Australia through to 2029 and bringing the Olympics back to Nine through until Brisbane 2032 – adding to our long-term agreement with the NRL.

“We have started 2023 with great momentum. Our programming team has again delivered us a strong start to the new ratings year across Total Television, with our lead further widening. Stan has benefitted from a strong Summer of content, with sustainable profit and a growing active subscriber base. Our digital audiences across all of our platforms are continuing to grow, and as the monetisation of those audiences evolves and matures, we expect Nine’s competitive position to further strengthen.

“I’m excited about the opportunities for Nine in 2023. Our team is focussed on delivering and monetising Australia’s best content, as we continue to define what it means to be Australia’s Media Company.”

See also:

“Nothing sells itself”: Nine’s Michael Stephenson on the commercial impact of the Olympic Games deal

“It will be absolutely huge”: Mike Sneesby on Nine’s Olympic Games deal