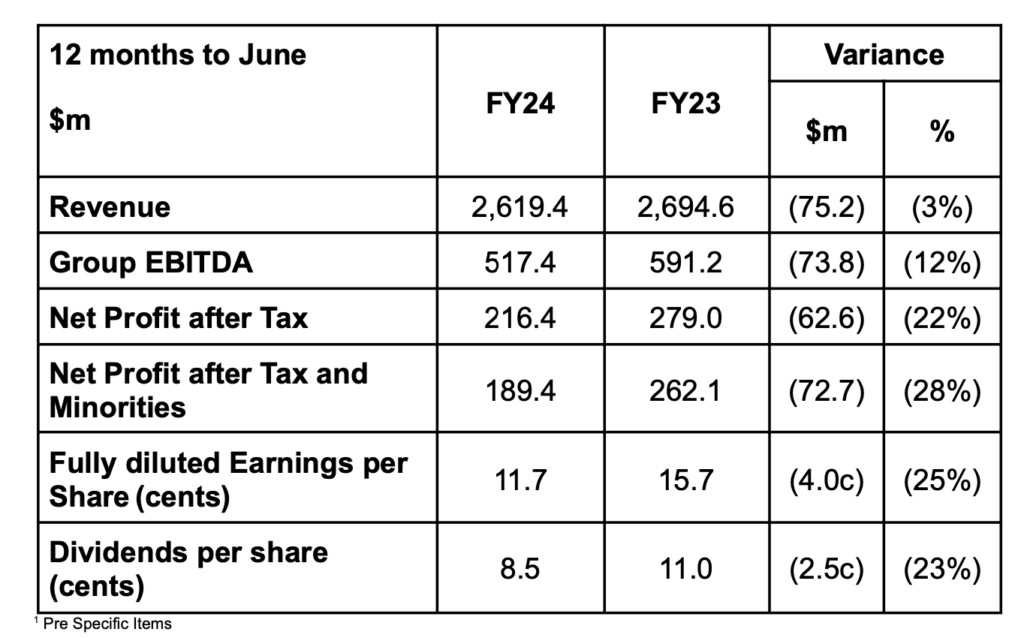

Nine Entertainment Co (NEC) has released its results for the 12 months to 30 June 2024.

Nine reported revenue of $2.6b and a net profit after tax of $134.9m.

The new chair of the company Catherine West commented: “Nine has continued to perform well in a challenging market, remaining focused on delivering the best content to all Australians across multiple platforms.

“This performance reflects the focus and commitment of our people who have worked hard through challenging times to further strengthen our competitive position.”

Chief executive Mike Sneesby said: “In a year of challenging economic and advertising market conditions there were some clear positives in this result.

“We have seen growth in our total television audiences this year as we have continued to invest in our content, standing us in good stead as we approach agency negotiations for CY 25.

“As we continue to focus on the diversification of our revenues. Subscription and Licensing at Nine’s wholly owned businesses, Stan and Publishing, together grew by around 5%, to more than 30% of Group revenue ex-Domain.

“This is a positive performance, particularly against the backdrop of economic and competitive market conditions. Our Metro mastheads grew both overall subscription and digital revenues across the year.

“Over the past couple of years, we have been focused on rebalancing our cost base. In FY24 group costs ex-Domain were down on FY23, notwithstanding underlying inflation, allowing us to continue to invest in the content, data and technology that generates returns and underpins our long-term strategy and competitive position.”

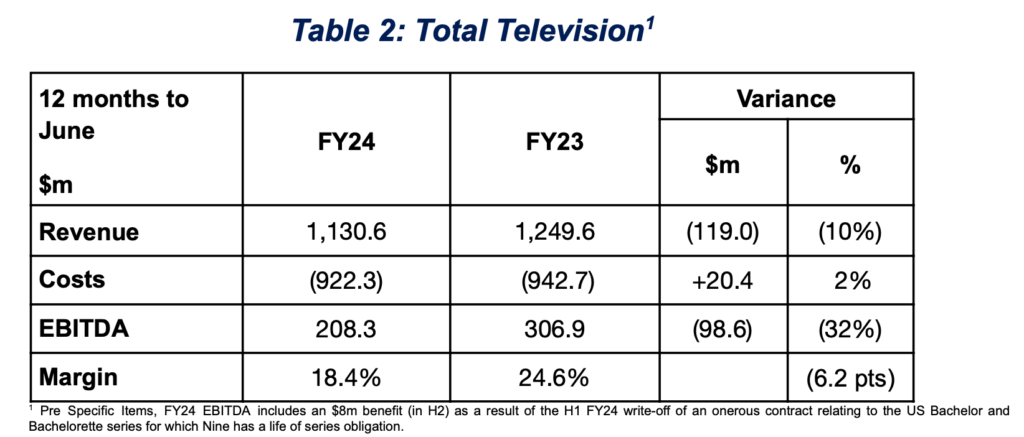

Nine Entertainment: Total Television

The company’s commentary on the sector noted: Nine’s Total Television results were impacted by the weak advertising market which more than offset the positive impacts of audience performance and lower costs.

Across all of television, Nine’s revenue declined by 10% while EBITDA of $208m was down 32% on FY23.

Nine recorded growth in Total Television live audiences for both FTA broadcast and streaming across the full financial year. This was a positive reversal after years of audience fragmentation and a key highlight of Nine’s result.

Reflecting the weaker economic conditions, the Metro Free To Air advertising market declined by 12% for the year, with the rate of decline moderating as the year progressed (Q4 down 9%).

For FY24, Nine attained a full-year revenue share of 40.0% and 41.2% in the second half.

Commenting on regional performance, Nine said revenue from regional markets continued to reflect the strength of content and affiliation with WIN Network.

For the 12 months to June, revenue share for Nine’s content across all regional markets (affiliated and wholly-owned) increased by 0.9 points to 39.2%, as the overall regional ad market declined by 5%.

As a result, and notwithstanding its audience performance, Nine reported a Free to Air (metro plus regional) revenue decline of 12% for the 12 months to $941m.

9Now’s revenue growth of 8% for the year reflected a 46.8% revenue share in the traditional BVOD market which grew by 13%. Live viewing remains the primary growth audience driver for 9Now and is the key component for Nine’s Total Television strategy.

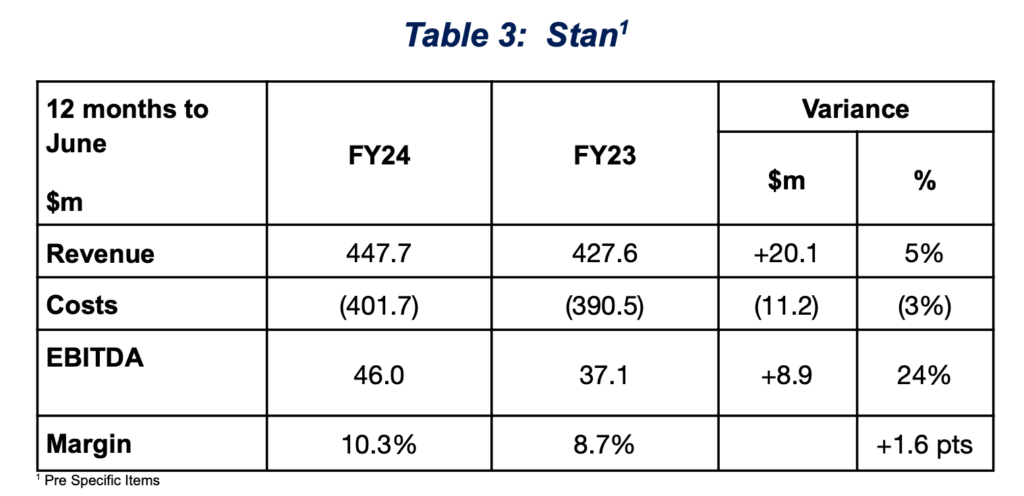

Stan audience growth

Stan recorded 24% EBITDA growth in FY24, with the result driven primarily by 8% growth in ARPU and cost controls, particularly in the second half. EBITDA of $46m was a record result, and marked Stan’s fifth consecutive year of profitability.

The company said the strength of current paying subscribers, at 2.3m, reflected Stan’s differentiated content proposition as well as the positive subscriber uptake due to the recent Olympic Games. Subscribers taking the incremental Sport bundle grew by more than 50% to a record level for Stan Sport subscribers during the Games.

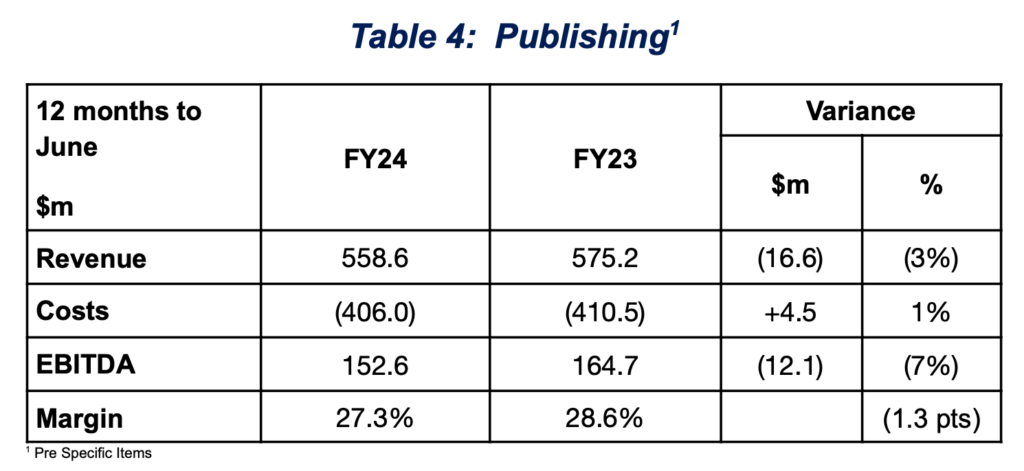

Publishing: Subscribers up 8%

Nine Publishing reported revenue of $559m, down 3% and EBITDA of $153m, down 7%. Within this result, Nine claimed its core metro business outperformed, primarily due to strong subscription performance. A weak digital programmatic advertising market impacted Nine’s other Digital Publishing assets, notably nine.com.au and Pedestrian. In total, around 62% of Publishing revenue is now digital.

Nine’s metro business recorded growth in digital subscription revenue, with increases in subscriber volume and price at The Age, The Sydney Morning Herald and The Australian Financial Review, more than offsetting the decline in print masthead sales. Total subscribers grew to more than 500k (+8%) while registered users increased to 1.7m.

Subscription ARPU increased by around 3.5% across digital and bundle packages.

Nine’s metro mastheads were impacted by the softness in the broader advertising market.

Print advertising held up relatively well, declining 9% across the year while digital advertising revenue declined by 16% across the 12 months.

See also: Cost of living – Nine lifts price of newspapers The Sydney Morning Herald and The Age

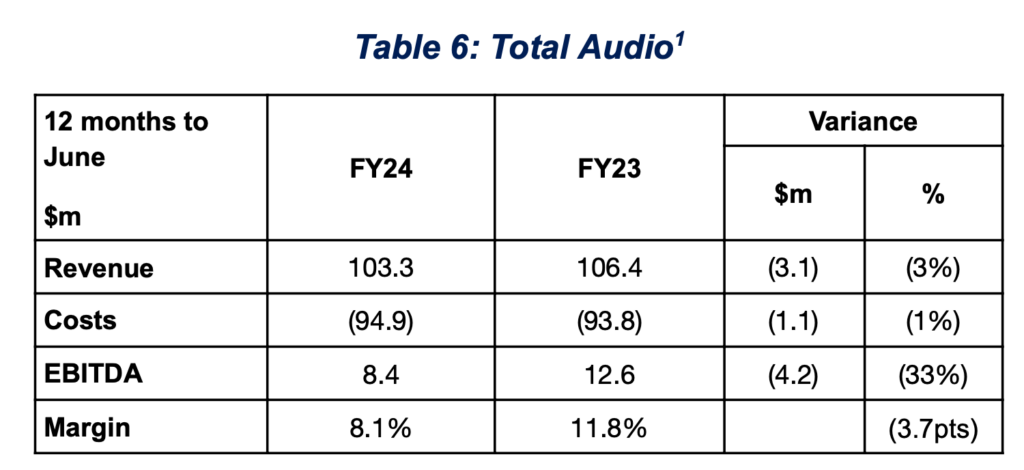

Radio: Earnings down 33%

The four-city Metro linear radio advertising market slowed through Q2 and Q3, before recovering to growth of 2.6% in Q4. Overall, market revenues were down by 3.3% for the year. Inclusive of digital and streaming revenues, which grew by 35% across the year, Nine’s Audio revenue declined by 3%. In the latest survey released yesterday, 2GB and 3AW were the #1 broadcast stations in Sydney and Melbourne respectively.

Nine was also #1 in live streaming commercial share. Costs increased marginally, with the investment in Digital and incremental content offsetting other cost initiatives. For the year, Nine Radio reported EBITDA of $8m.

Current trading environment and outlook

FY25 has started on a positive note said Nine, with strong audience and revenue performances across multiple platforms driven by the Paris Olympic Games.

While the underlying advertising market remains subdued particularly in FTA, digital display and print publishing, Nine is forecasting more positive trends as the year progresses.

Nine currently expects its Q1 Metro FTA revenues to grow by almost 10% on pcp, while 9Now is expected to grow revenue in Q1 by around 50%.

Combined, this equates to Total TV revenue growth in the mid-teens (%) in the current quarter. The Total TV market is currently expected to decline in the low-mid single-digits (on a percentage basis) in Q1 FY25 on pcp.

Excluding the Games impact, Total Television costs are expected to be marginally higher in FY25 on FY24. Increased costs associated with underlying inflation, the new Australian Open contract, as well as the targeted investment in technology and content associated with the growth in 9Now, will be mainly offset by ongoing cost efficiencies across the business.