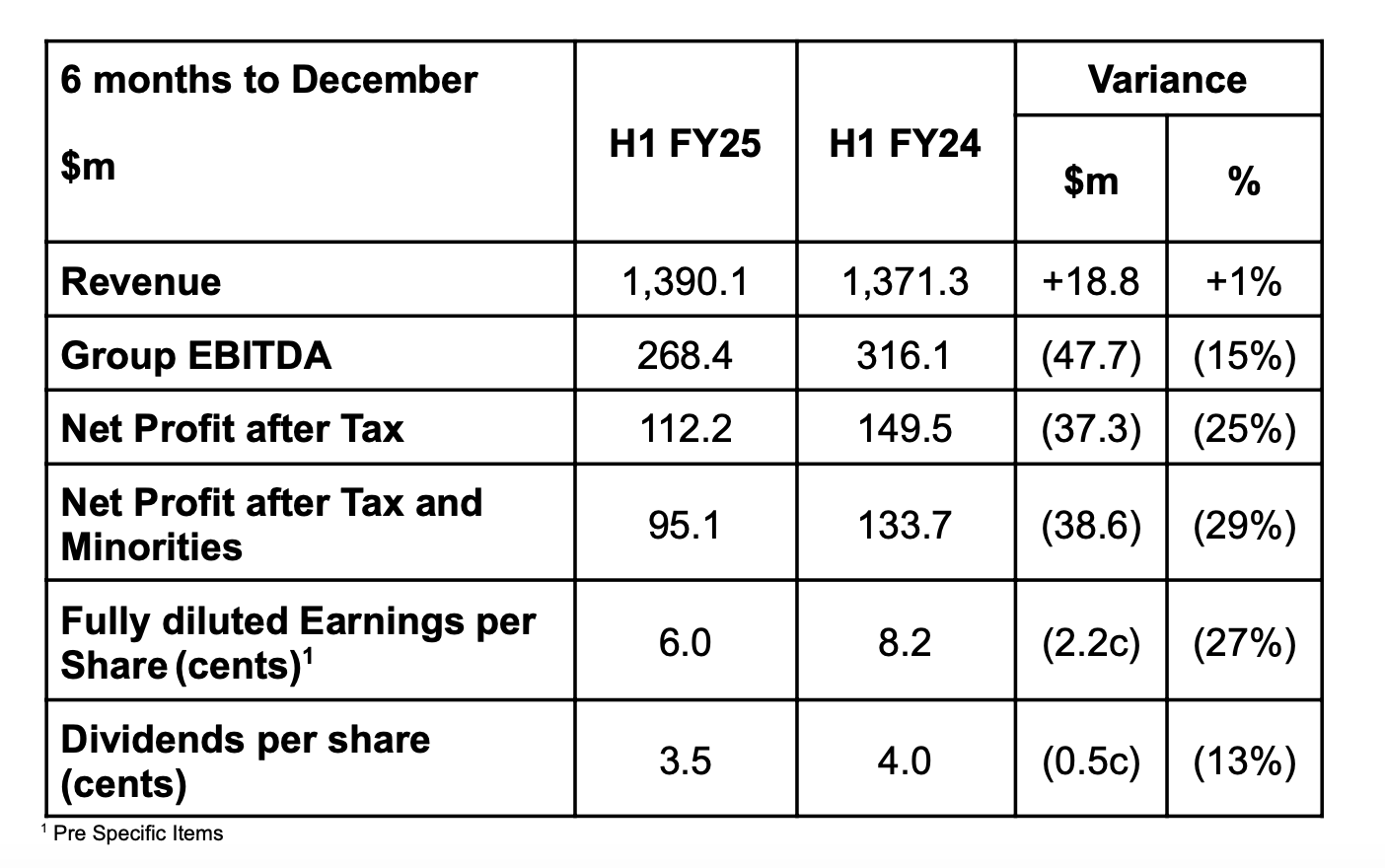

Nine Entertainment Co. (ASX: NEC) has announced its interim financial results for the six months ending 31 December 2024, reporting a revenue of $1.4 billion and a Net Profit After Tax (NPAT) of $96 million. The company’s Group EBITDA, before specific items, stood at $268 million, reflecting a 15% decrease compared to the same period last year. This decline is attributed to challenging economic conditions, a softer advertising market, and the cessation of revenue from Meta.

Key Highlights:

• Olympic coverage success: Nine’s comprehensive broadcast of the Olympic Games enhanced audience engagement across its platforms and proved profitable and positive cash flow for the company’s streaming and broadcast segments.

• Audience and subscription growth: The period saw an increase in streaming and broadcast audiences, with subscription revenues rising by 8% (excluding Domain and the impact of Meta/Google). Notably, the metro mastheads, Australian Financial Review (AFR), and Stan contributed to this growth.

• Domain’s performance: Domain reported a 15% growth in EBITDA contribution to Nine, driven by a 7% increase in new ‘for sale’ listings and a 14% rise in depth revenue.

• Digital audio expansion: Digital revenue in the audio segment grew by 33%, with Nine maintaining industry leadership in live streaming audiences.

• Cost efficiencies: The company achieved $35 million in cost efficiencies during the half-year, surpassing the previously targeted $50 million for FY25.

• Dividend declaration: An interim dividend of 3.5 cents per share, fully franked, has been declared.

The 2025 Interim Financial Results for Nine Entertainment Co. Holdings Limited.

Chair Catherine West said of the results, “In a challenging market environment, we have continued to perform well operationally, while simultaneously strengthening our strategic position and implementing our cultural reset.”

Acting CEO Matt Stanton added, “We have worked together over the past six months to build a roadmap for strategic and cultural transformation. I am proud of the way our people have responded, with strong engagement and an overwhelming spirit of constructive optimism.”

Operational insights:

• Total Television: Despite a 10.1% decline in the Metro Free To Air advertising market, Nine achieved a revenue share of 42.1%, marking an all-time high for any network in the December half. Streaming revenue through 9Now grew by 28%, bolstered by Olympic coverage.

• Stan: The streaming service reported a 7% increase in revenue, with paying subscribers exceeding 2.3 million. EBITDA grew by 16%, reaching a record $29.4 million for the first half.

• Publishing: Digital subscription revenues at the metro mastheads grew by approximately 15%, excluding the impact of Meta and Google. Total subscribers surpassed 500,000, with registered users exceeding 1.8 million.

• Domain: The real estate platform focused on increasing listings coverage, resulting in an 8% growth in digital revenues and a 14% rise in Residential depth revenue.

• Total Audio: The audio segment saw a 2% increase in total revenue, with digital revenues up by 33%. Nine’s radio stations, 2GB and 3AW, maintained their positions as the top stations in Sydney and Melbourne, respectively.

As of 31 December 2024, Nine’s net debt stood at $481 million on a wholly owned basis, equating to a net leverage of approximately 1.4x. The company reported operating cash flow before specific items, interest, and tax of $209 million, representing a cash conversion rate of 109%.