News Corp highlights

• Fourth quarter revenues at the company were $2.43 billion, compared to $2.67 billion in the prior year, reflecting the absence of the extra week in the prior year and the negative impact from foreign currency fluctuations (All amounts US$)

• Net loss in the quarter was $(32) million, inclusive of $166 million related to higher non-cash write-downs and restructuring charges

• Fourth quarter Total Segment EBITDA was $341 million, compared to $315 million in the prior year

• Digital revenues accounted for over 50% of total revenues for the full year, marking a key inflection point in the transformation of the company

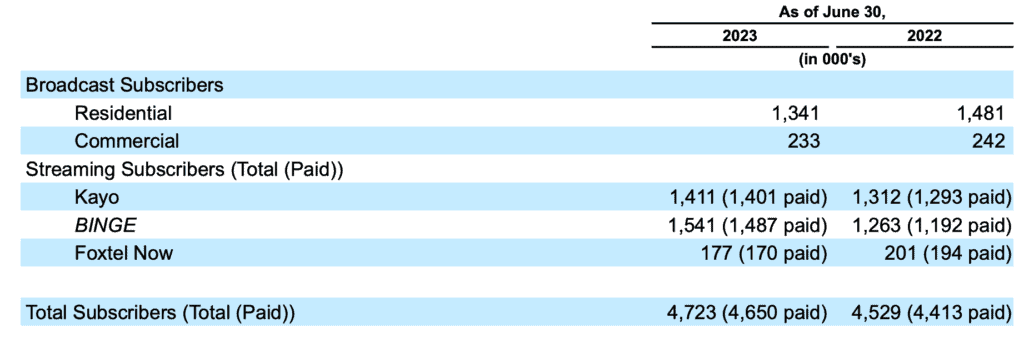

• Foxtel Group saw streaming revenue growth more than offset broadcast declines for the fourth quarter and full year, as total paid streaming subscribers reached nearly 3.1 million

News Corporation’s CEO Robert Thomson and CFO Susan Panuccio have delivered financial results for Q4 and the fiscal year ended June 30, 2023 (includes 13 and 52 weeks, respectively, compared to 14 and 53 weeks in the three months and fiscal year ended June 30, 2022, respectively).

Robert Thomson

In opening remarks, Robert Thomson explained the results marked a decade since the launch of News Corp in its current form. He noted in that time the revenue base had changed dramatically. The changes included:

• Digital real estate revenue has grown from 5% to 15%

• Digital video revenues from Foxtel Group have grown from 6% to 20%

Thomson continued: “News Corp’s Fiscal 2023 results highlighted the durability and depth of our revenue streams and the impact of stringent cost controls as we navigated challenging macro conditions, supply chain pressures and currency headwinds. We achieved full year Fiscal 2023 revenues of $9.9 billion and profits of over $1.4 billion – the second highest profitability ever recorded by the company.

“Our results showed marked improvement in the second half, so with inflation abating, interest rates plateauing and incipient signs of stability in the housing market, we have sound reasons for optimism about the coming quarters.

“For the first time, digital accounted for over 50% of News Corp’s revenues for the full year, marking a profound transformation during the past decade. That momentum is surely gathering pace in the age of generative AI, which we believe presents a remarkable opportunity to create a new stream of revenues, while allowing us to reduce costs across the business. We are already in active negotiations to establish a value for our unique content sets and IP that will play a crucial role in the future of AI.

The Wall Street Journal record profits

“Dow Jones posted its highest profitability for both the quarter and the full year since we acquired the company – helped, in particular, by impressive results in the burgeoning professional information business. Not only has Dow Jones doubled its profitability over the past four years but it is also nearing a landmark moment with our lucrative B2B offerings expected to be the largest contributor to profitability in Fiscal 2024 and a key driver of future growth.

Foxtel growth and loan repayment plan

“At Subscription Video Services, while revenues and profit were impacted by foreign currency headwinds, we achieved growth for the fourth quarter and full year on an adjusted basis – a remarkable turnaround from the recent past and a tribute to the team in Australia. And that turnaround is underscored by Foxtel’s imminent completion of a refinancing, which is expected to facilitate repayments of our outstanding shareholder loans beginning in fiscal 2024.”

Thomson also spoke about the opportunities that AI offered the company. He also revealed the company was focussing on international growth for The Wall Street Journal where revenues are heavily anchored in the US.

Of the new look Foxtel Group, he said: “We have created a model that streamers around the world are trying to emulate.” Susan Panuccio noted that the anticipated launch of the Sky Glass TV product in Australia would now be later in 2024.

News Corp: Overall Fourth Quarter Results

The company reported fiscal 2023 fourth quarter total revenues of $2.43 billion, a 9% decrease compared to $2.67 billion in the prior year period, including the absence of the $110 million, or 4%, benefit from the additional week in the prior year quarter and the $72 million, or 3%, negative impact from foreign currency fluctuations.

The decline was largely driven by lower revenues at the Book Publishing segment primarily due to lower book sales and lower revenues at the Digital Real Estate Services segment driven by continued challenging housing market conditions in the U.S. and Australia.

The decline was partially offset by higher revenues at the Subscription Video Services segment on a constant currency basis.

News Corp: Overall Full-Year Results

News Corp reported fiscal 2023 full-year total revenues of $9.88 billion, a 5% decrease compared to $10.39 billion in the prior year, including a $494 million, or 5%, negative impact from foreign currency fluctuations and the absence of the $110 million, or 1%, benefit from the additional week in the prior year.

The decrease was driven by lower revenues at the Book Publishing segment primarily due to lower book sales and lower revenues at the Digital Real Estate Services segment primarily due to continued challenging housing market conditions in the U.S. and Australia.

The decline was partially offset by growth at the Dow Jones segment, which includes the acquisitions of OPIS and Chemical Market Analytics (“CMA”), and at the Subscription Video Services and News Media segments on a constant currency basis. Adjusted Revenues decreased 2%.

Full Year Segment Results: Real Estate

In the fiscal year, REA Group’s revenues decreased $92 million, or 9%, to $937 million, primarily driven by a $74 million, or 7%, negative impact from foreign currency fluctuations. Lower Australian residential revenues due to the decline in national listings, most notably in Sydney and Melbourne, and lower financial services revenues due to declines in settlement activity and the adverse impact from a valuation adjustment related to expected trail commissions, were partially offset by price increases, increased depth penetration in the Australian residential products due to the contribution of Premiere Plus, increased depth penetration for commercial products and higher revenues from REA India.

Move’s revenues in the fiscal year decreased $110 million, or 15%, to $602 million, primarily due to lower real estate revenues and the absence of the $14 million, or 2%, benefit from the additional week in the prior year, partially offset by 11% growth in advertising revenues. Move’s real estate revenues, which represented 82% of total Move revenues, declined 20%, primarily due to declines in both the traditional lead generation product and the referral model.

Foxtel Group

As of June 30, 2023, Foxtel’s total closing paid subscribers were over 4.6 million, a 5% increase compared to the prior year, primarily due to the growth in streaming subscribers driven by BINGE and Kayo, partially offset by lower residential broadcast subscribers. Broadcast subscriber churn in the quarter improved to 11.1%, the lowest level since Fiscal 2016, compared to 13.8% in the prior year. Broadcast ARPU for the quarter increased 2% year-over-year to A$84 (US$56).

Fiscal 2023 full-year revenues declined $84 million, or 4%, compared with the prior year, due to a $157 million, or 8%, negative impact from foreign currency fluctuations. Adjusted Revenues increased 4% compared to the prior year. Higher streaming revenues, primarily from Kayo and BINGE, higher commercial revenues and higher advertising revenues in constant currency more than offset the revenue declines from lower residential broadcast subscribers. Foxtel Group streaming subscription revenues represented approximately 27% of total circulation and subscription revenues in the fiscal year compared to 20% in the prior year.

Segment EBITDA for fiscal 2023 decreased $13 million, or 4%, compared to the prior year, due to the $29 million, or 8%, negative impact from foreign currency fluctuations. Adjusted Segment EBITDA increased 4%. Higher sports programming costs due to contractual increases across AFL, NRL and Cricket Australia and higher entertainment programming costs were more than offset by the revenue drivers discussed above, as well as lower transmission and marketing costs.

The company revealed that advertising revenue at Binge saw modest incremental revenue.

Dow Jones and The Wall Street Journal

During the fourth quarter, total average subscriptions to Dow Jones’ consumer products reached over 5.2 million, a 7% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 12%. Total subscriptions to The Wall Street Journal grew 6% compared to the prior year, to over 3.9 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 10% to 3.4 million average subscriptions in the quarter, and represented 86% of total Wall Street Journal subscriptions.

Circulation and subscription revenues increased $173 million, or 11%, which includes higher contributions from the acquisitions of OPIS and CMA. The results also reflect the negative impact from the absence of a $31 million, or 2%, benefit from the additional week in the prior year and an $18 million, or 2%, negative impact from foreign currency fluctuations. Circulation revenues were flat compared to the prior year, reflecting continued strong growth in digital-only subscriptions at The Wall Street Journal, offset by lower print volumes and the absence of an additional week in the prior year.

Digital circulation revenues accounted for 69% of circulation revenues for the year, compared to 67% in the prior year.

Advertising revenue decreased $36 million, or 8%, primarily due to a 12% decrease in print advertising and a 5% decrease in digital advertising, which include the absence of the benefit from the additional week in the prior year. Digital advertising revenues accounted for 61% of total advertising revenues for the year, compared to 59% in the prior year.

Book Publishing at Harper Collins

Fiscal 2023 full-year revenues decreased $212 million, or 10%, compared to the prior year, primarily driven by lower book sales due to lower consumer demand industry-wide, weak front list performance and Amazon’s reset of its inventory levels and rightsizing of its warehouse footprint, which was mostly reflected in the first half. The decline also reflects a $58 million, or 3%, negative impact from foreign currency fluctuations and the absence of the $20 million, or 1%, benefit from the additional week in the prior year. Adjusted revenues decreased 8% compared to the prior year. Digital sales decreased 5% compared to the prior year, driven by lower e-book sales. Digital sales represented 22% of Consumer revenues for the year compared to 21% in the prior year. Backlist sales represented approximately 60% of total revenues in the year.

News Media in Australia, US and UK

Digital subscribers and users across key properties within the News Media segment are summarized below:

* Closing digital subscribers at News Corp Australia as of June 30, 2023 were 1,059,000 (943,000 for news mastheads), compared to 964,000 (882,000 for news mastheads) in the prior year (Source: Internal data)

* The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of June 30, 2023 were 565,000, compared to 508,000 in the prior year (Source: Internal data). During the fourth quarter of fiscal 2023, News UK updated its methodology for counting subscribers receiving a print and digital bundle to begin allocating these subscribers between print and digital based on the number of print copies served during the week instead of wholly to print. This change resulted in a 59,000 and 63,000 increase to the closing digital subscriber number at June 30, 2023, and 2022, respectively

* The Sun’s digital offering reached 159 million global monthly unique users in June 2023 (Source: Meta Pixel; prior year comparable statistic unavailable due to source change)

* New York Post’s digital network reached 145 million unique users in June 2023, compared to 198 million in the prior year (Source: Google Analytics)

Fiscal 2023 full-year revenues decreased $157 million, or 6%, compared to the prior year, which includes a $187 million, or 7%, negative impact from foreign currency fluctuations and the absence of a $36 million, or 1%, benefit from the additional week in the prior year.

Within the segment, revenues at News Corp Australia and News UK decreased 8% and 7%, respectively, as both were impacted by negative foreign currency fluctuations and the absence of the additional week in the prior year, while the New York Post saw higher revenues of 4%.

Circulation and subscription revenues decreased $68 million, or 6%, compared to the prior year, primarily due to a $93 million, or 8%, negative impact from foreign currency fluctuations, print volume declines and the absence of a $19 million, or 2%, benefit from the additional week in the prior year, partially offset by cover price increases, digital subscriber growth and higher content licensing revenues.

Advertising revenues decreased $98 million, or 10%, compared to the prior year, driven by a $70 million, or 7%, negative impact from foreign currency fluctuations, lower print advertising at News UK, the absence of the additional week in the prior year and lower digital and print advertising at News Corp Australia, partially offset by growth in digital advertising at News UK.

See also: Michael Miller tells publishers how News Corp Australia had best year in a decade