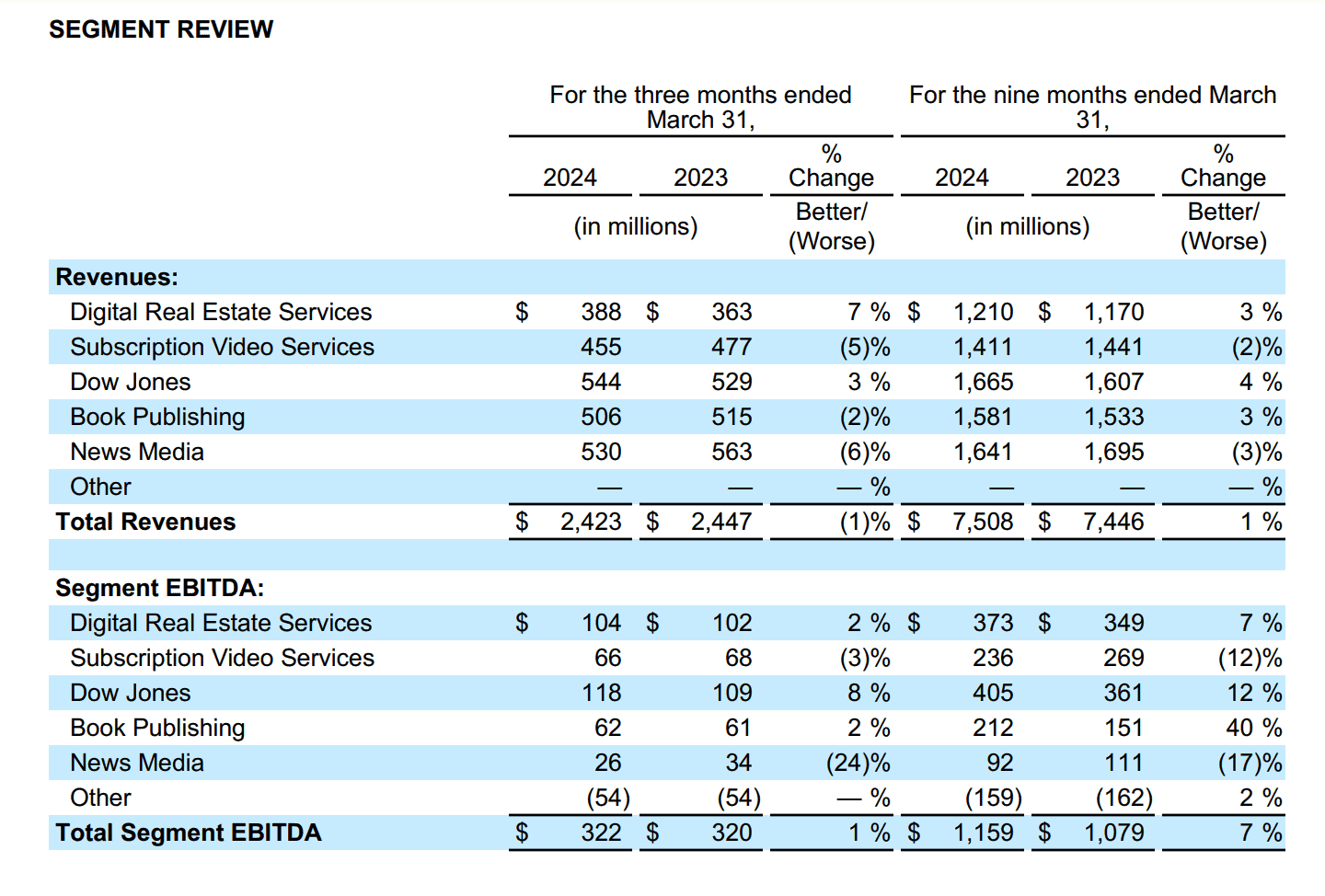

News Corp has revealed third quarter revenues were $2.42 billion [all figures US$], a 1% decrease compared to $2.45 billion in the prior year. Adjusted revenues were flat compared to the prior year. Below are selected summaries released to the market by the publisher.

News Corp Q3 highlights

Dow Jones/The Wall Street Journal achieved its highest sequential quarterly net additions for digital subscriptions of 322,000, reaching over 5 million Dow Jones digital subscriptions for the quarter.

REA Group posted strong results with quarterly revenues of compared to the prior year, primarily driven by strong Australian residential performance.

Commenting on the results, News Corp chief executive Robert Thomson said:

“News Corp has again made substantial progress on our strategic imperative to transform the company and increase value for all shareholders.

“News Corp’s profitability rose slightly in the third quarter as compared to the prior year, continuing our growth this fiscal year – and that increase, which gathered pace in April, follows the three most profitable years since the company was reincarnated in 2013.

“We are in the midst of an exponential digital revolution, and our own company has continued to change significantly and profitably. Importantly, we are working to promote our quality journalism in the age of Generative AI and are gratified that the most enlightened leaders in the industry appreciate the commercial and social value of that content.

“As mentioned previously, we have been reviewing our company’s structure – and that work is intense and ongoing – and we have made underlying changes to provide maximum flexibility.

“Separately, we have this week extended our existing partnership with Google.”

News Corp CEO Robert Thomson

News Corp Q3 by division

Digital Real Estate Services

Revenues in the quarter increased $25 million, or 7%, compared to the prior year, driven by performance at REA Group partly offset by lower revenues at Move.

In the quarter, revenues at REA Group increased $34 million, or 15%, to $256 million, primarily driven by higher Australian residential revenues due to price increases, increased depth penetration, favourable geographic mix and an increase in national listings.

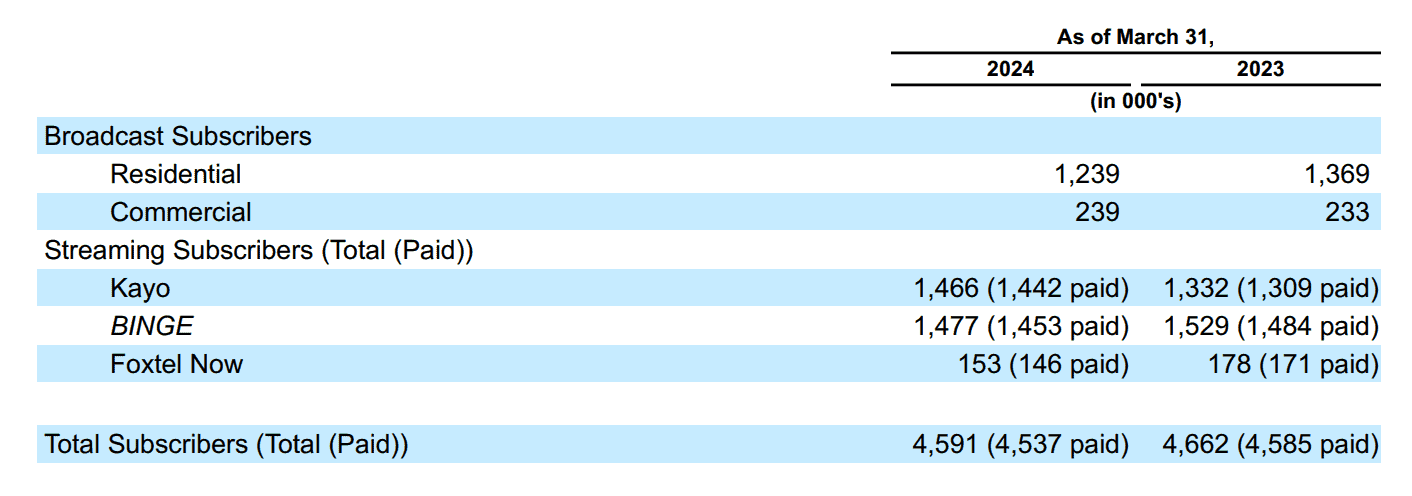

Subscription Video Services

Revenues of $455 million in the quarter decreased $22 million, or 5%, compared with the prior year, primarily driven by an $18 million, or 4%, negative impact from foreign currency fluctuations.

The impact from fewer Foxtel Group residential broadcast subscribers was mostly offset by higher revenues from Kayo from increases in both volume and pricing and higher Binge revenues from an increase in pricing.

Adjusted revenues of $473 million decreased 1% compared to the prior year. Foxtel Group streaming subscription revenues represented approximately 29% of total circulation and subscription revenues in the quarter, as compared to 26% in the prior year.

As of March 31, 2024, Foxtel’s total closing paid subscribers were over 4.5 million, a 1% decrease compared to the prior year, driven by fewer residential broadcast subscribers and lower Binge subscribers partly offset by strong growth in Kayo subscribers.

Broadcast subscriber churn in the quarter was 13.3% compared to 12.3% in the prior year partly driven by the recent broadcast price increase. Broadcast ARPU for the quarter increased 2% year-over-year to A$85 (US$56).

Adjusted segment EBITDA of $69 million increased 1% compared to the prior year, primarily due to lower marketing, entertainment programming rights and technology costs partially offset by $13 million of costs related to the launch of Hubbl in the quarter.

$13m was spent in the quarter on the launch of Hubbl

Dow Jones/The Wall Street Journal

Revenues in the quarter increased $15 million, or 3%, compared to the prior year, driven by growth in circulation and subscription revenues underpinned by the professional information business. Digital revenues at Dow Jones in the quarter represented 81% of total revenues compared to 79% in the prior year. Adjusted revenues increased 3%.

Circulation and subscription revenues increased $19 million, or 4%, primarily driven by a 10% increase in professional information business revenues, led by 15% growth in risk & compliance revenues to $76 million and 15% growth in Dow Jones Energy revenues to $63 million.

Circulation revenues were flat compared to the prior year, as the continued growth in digital-only subscriptions, which partially benefited from an increase in bundle offers, was offset by lower print volume. Digital circulation revenues accounted for 70% of circulation revenues for the quarter, compared to 69% in the prior year.

During the third quarter, total average subscriptions to Dow Jones’ consumer products were over 5.7 million, a 12% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 17% to over 5 million. Total subscriptions to The Wall Street Journal grew 8% compared to the prior year, to over 4.2 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 13% to over 3.7 million average subscriptions in the quarter, and represented 88% of total Wall Street Journal subscriptions.

Advertising revenues decreased $2 million, or 2%, primarily due to an 11% decline in print advertising revenues partly offset by 4% growth in digital advertising revenues. Digital advertising accounted for 63% of total advertising revenues in the quarter, compared to 59% in the prior year.

News Media

Revenues in the quarter decreased $33 million, or 6%, as compared to the prior year, primarily driven by lower advertising revenues. Within the segment, revenues at News Corp Australia decreased 10%, driven by lower advertising revenues, and included an $8 million, or 4%, negative impact from foreign currency fluctuations, while News UK was flat as lower advertising revenues were offset by a $10 million, or 5%, positive impact from foreign currency fluctuations and higher circulation and subscription revenues. Adjusted revenues for the segment decreased 6% compared to the prior year.

Circulation and subscription revenues increased $1 million compared to the prior year, primarily due to price increases, digital subscriber growth and a $3 million, or 1%, positive impact from foreign currency fluctuations, partially offset by lower print volumes.

Advertising revenues decreased $28 million, or 13%, compared to the prior year, primarily due to lower print advertising at News Corp Australia and lower digital advertising mainly driven by a decline in traffic at some mastheads due to platform related changes.

In the quarter, Segment EBITDA decreased $8 million, or 24%, compared to the prior year, driven by lower revenues, as discussed above, partially offset by lower production costs at News UK driven by lower print volume and newsprint prices and a $1 million, or 2%, positive impact from foreign currency fluctuations. Adjusted Segment EBITDA decreased 26%.

Digital revenues represented 38% of News Media segment revenues in the quarter, compared to 36% in the prior year, and represented 36% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarised below:

• Closing digital subscribers at News Corp Australia as of March 31, 2024 were 1,113,000 (966,000 for news mastheads), compared to 1,043,000 (937,000 for news mastheads) in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of March 31, 2024 were 582,000, compared to 554,000 in the prior year (Source: Internal data). The previously disclosed methodology change resulted in a 59,000 and 60,000 increase to the closing digital subscriber number at March 31, 2024 and 2023, respectively

• The Sun’s digital offering reached 126 million global monthly unique users in March 2024, compared to 199 million in the prior year (Source: Meta Pixel)

• New York Post’s digital network reached 125 million unique users in March 2024, compared to 147 million in the prior year (Source: Google Analytics)

See also: News Corp results Q2 2024 – Australian News Media ad revenues dip 9%