News Corp has released its financial results for Q1 FY2025 – a three-month period ending September 30, 2024.

Performance headlines

• First quarter revenues were the highest for a first quarter since separation at $2.58 billion, a 3% increase compared to $2.50 billion [all amounts US$] in the prior year, driven by growth at the Digital Real Estate Services, Book Publishing and Dow Jones segments

• Net income in the quarter was $144 million, an improvement compared to net income of $58 million in the prior year

• REA Group posted record revenues for the quarter of $318 million, a 22% increase compared to the prior year, primarily driven by robust Australian residential performance

• Dow Jones’ growth continued to be underpinned by robust performance in its professional information business, where revenue increased 8%, driven by growth of 16% at Risk & Compliance and 11% at Dow Jones Energy

• Book Publishing revenues grew 4% in the quarter, while Segment EBITDA increased 25%, driven by record digital book sales, which grew 15%, and strong backlist performance

Commenting on the results, News Corp chief executive Robert Thomson said: “We have begun fiscal 2025 robustly, with record first-quarter revenue, strong net income and record first-quarter profitability. Revenue rose three per cent year-over-year to $2.58 billion, while our net income jumped 148 per cent to $144 million. Total Segment EBITDA surged 14 percent to $415 million, and our EPS were 21 cents compared to 5 cents in same quarter last year. That we have achieved these record first quarter results in macro-conditions which are far from auspicious is compelling evidence of the successful transformation of News Corp over the past decade.

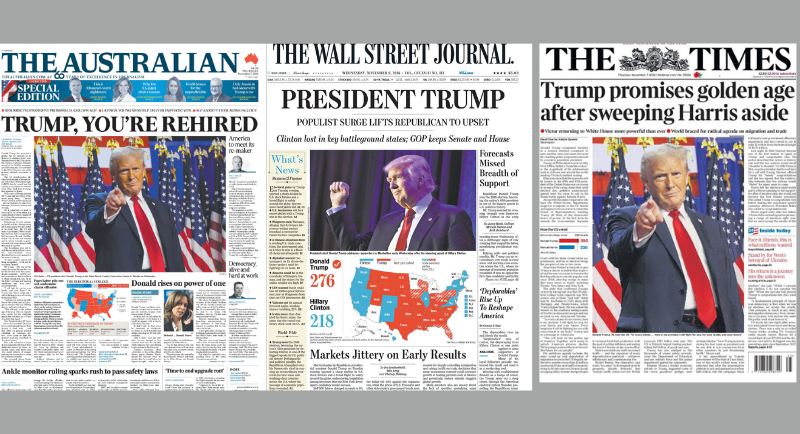

“Meanwhile, the just-completed election has highlighted the importance of trusted journalism in a media maelstrom in which some journalists mistake virtue signalling for virtue. Artificial intelligence recycles informational infelicities and it is critical that journalistic inputs have integrity, which is why our partnership with OpenAI is so crucial and why we intend to sue AI companies abusing and misusing our trusted journalism.

“Dow Jones and the New York Post have started proceedings against the perplexing Perplexity, which is selling products based on our journalism, and we are diligently preparing for further action against other companies that have ingested our archives and are synthesizing our intellectual property.”

News Corp CEO Robert Thomson

Dow Jones

Revenues in the quarter increased $15 million, or 3%, compared to the prior year, driven by continued growth in the professional information business, as well as higher content licensing revenue. Digital revenues at Dow Jones in the quarter represented 82% of total revenues compared to 81% in the prior year. Adjusted Revenues increased 2%.

Circulation and subscription revenues increased $23 million, or 5%, primarily driven by an 8% increase in professional information business revenues, led by 16% growth in Risk & Compliance revenues to $81 million and 11% growth in Dow Jones Energy revenues to $68 million. Circulation revenues increased 1% compared to the prior year, as the continued growth in digital-only subscriptions was mostly offset by lower print volume. Digital circulation revenues accounted for 72% of circulation revenues for the quarter, compared to 70% in the prior year.

During the first quarter, total average subscriptions to Dow Jones’ consumer products were over 5.9 million, an 11% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 15% to over 5.3 million. Total subscriptions to The Wall Street Journal grew 7% compared to the prior year, to nearly 4.3 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 10% to over 3.8 million average subscriptions in the quarter, and represented 90% of total Wall Street Journal subscriptions.

Advertising revenues decreased $6 million, or 7%, primarily due to a 10% decline in print advertising revenues and a 5% decline in digital advertising revenues driven by lower advertising spend in the technology and finance sectors. Digital advertising accounted for 67% of total advertising revenues in the quarter, compared to 66% in the prior year.

Segment EBITDA for the quarter increased $7 million, or 6%, primarily as a result of the higher revenues discussed above and lower newsprint, production and distribution costs, partially offset by higher marketing and employee costs. Adjusted Segment EBITDA increased 5%.

Digital Real Estate Services

Revenues in the quarter increased $54 million, or 13%, compared to the prior year, driven by strong performance at REA Group. Segment EBITDA in the quarter increased $18 million, or 15%, compared to the prior year, due to higher contribution from REA Group, despite $12 million of deal costs related to the withdrawn offer to acquire Rightmove, and included a $3 million, or 3%, positive impact from foreign currency fluctuations. The increase was partly offset by modestly lower contribution from Move. Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note 2) increased 11% and 13%, respectively.

Book Publishing

Revenues in the quarter increased $21 million, or 4%, compared to the prior year, primarily driven by higher digital and backlist book sales and improved returns. Key titles in the quarter included Hillbilly Elegy by J.D. Vance, A Death in Cornwall by Daniel Silva and The Au Pair Affair by Tessa Bailey. Bible sales were also strong. Adjusted Revenues increased 3%.

Subscription Video Services

Revenues of $501 million in the quarter increased $15 million, or 3%, compared with the prior year, primarily driven by higher revenues from Kayo and Binge from increases in both volume and pricing, and an $11 million, or 2%, positive impact from foreign currency fluctuations, partly offset by the impact from fewer residential broadcast subscribers. Adjusted Revenues of $490 million increased 1% compared to the prior year. Foxtel Group streaming subscription revenues represented 34% of total segment circulation and subscription revenues in the quarter, as compared to 30% in the prior year.

See also: Foxtel reveals latest Kayo Sports, Binge subscriber numbers, no reveal of how many Hubbl devices have been sold

News Media

Revenues in the quarter decreased $27 million, or 5%, as compared to the prior year, including a positive $12 million, or 2%, impact from foreign currency fluctuations, primarily driven by lower other revenues from the transfer of third-party printing revenue contracts to News UK’s joint venture with DMG Media and lower advertising revenues. Adjusted Revenues for the segment decreased 7% compared to the prior year.

Circulation and subscription revenues decreased $4 million, or 1%, compared to the prior year, primarily due to lower print volumes, partially offset by cover price increases and the $6 million, or 3%, positive impact from foreign currency fluctuations.

Advertising revenues decreased $10 million, or 5%, compared to the prior year, primarily due to lower print advertising revenues at News Corp Australia and lower digital advertising revenues at News UK mainly driven by a decline in traffic at some mastheads due to algorithm changes at certain platforms, partially offset by a $5 million, or 2%, positive impact from foreign currency fluctuations.

In the quarter, Segment EBITDA increased $2 million, or 14%, compared to the prior year, driven by cost savings at News UK as a result of the combination of its printing operations with those of DMG Media and other cost savings initiatives, including lower Talk costs, largely offset by the lower revenues discussed above. Adjusted Segment EBITDA increased 7%.

Digital revenues represented 39% of News Media segment revenues in the quarter, compared to 37% in the prior year, and represented 37% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarised below:

• Closing digital subscribers at News Corp Australia as of September 30, 2024 were 1,127,000 (979,000 for news mastheads), compared to 1,049,000 (937,000 for news mastheads) in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of September 30, 2024 were 600,000, compared to 572,000 in the prior year (Source: Internal data).

• The Sun’s digital offering reached 80 million global monthly unique users in September 2024, compared to 134 million in the prior year (Source: Meta Pixel)

See also: Susan Panuccio standing down from News Corp CFO role in 2025 after two decades with company