News Corp has released its fourth quarter and full-year earnings for the financial year 2024, ending 30 June 2024.

The release of the figures was followed by an earnings call with News Corp chief executive Robert Thomson and chief financial officer Susan Panuccio. An edited summary of the earnings release is published below.

News Corp earnings highlights

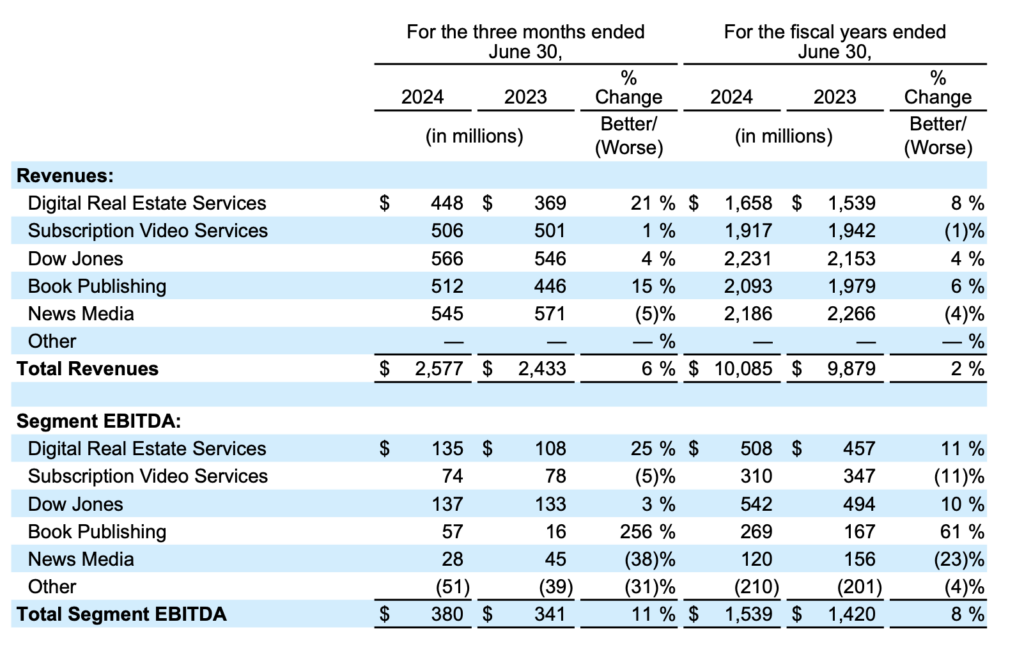

• Fourth quarter revenues were US$2.58 billion, a 6% increase compared to $2.43 billion in the prior year, driven by growth at the Digital Real Estate Services, Book Publishing and Dow Jones segments (all figures in this report US$)

• Net income in the quarter was $71 million, a significant improvement compared to a net loss of $(32) million in the prior year

• Total Segment EBITDA was the highest for a fourth quarter since separation at $380 million compared to $341 million in the prior year

• Potential partnership transaction for Foxtel Group as streaming numbers reach an all-time high

• News Corp announced a multi-year global partnership with OpenAI

• Announcement of JD Vance as Republican VP candidate boosted sales of Harper Collins’ Hillbilly Elegy – 150,000 sold in 24 hours after appointment

Thomson on potential Foxtel transaction: ‘Evaluating options’

In his introductory remarks, Robert Thomson said: “Fiscal 2024 was an outstanding year for News Corp, as we not only delivered robust earnings growth and created substantial shareholder value, but took a significant step to prepare the company to prosper in the AI age.

“Our landmark agreement with OpenAI is not only expected to be lucrative, but will enable us to work closely with a trusted, pre-eminent partner to fashion a future for professional journalism and for provenance. Meanwhile, we have begun to take legal steps against AI aggressors, the egregious aggregators, who are predatory in the confiscation of our content. ‘Open source’ can never be a justification for ‘open slather.’

“For the quarter, revenues grew 6 percent to almost $2.6 billion, while net income improved significantly and profitability advanced by 11 percent to a fourth-quarter record. Our core pillars of growth – Book Publishing, Digital Real Estate Services and Dow Jones – inspired the increasing profitability, and their strength augurs well for Fiscal 2025.

“We are confident in the company’s long-term prospects and are continuing to review our portfolio with a focus on maximizing returns for shareholders. That review has coincided recently with third-party interest in a potential transaction involving the Foxtel Group, which has been positively transformed in recent years. We are evaluating options for the business with our advisors in light of that external interest.”

Emancipation of Wall Street Journal’s Evan Gershkovich

Thompson also added: “I would like to express our sincere gratitude to all who contributed to the emancipation of Evan Gershkovich. His freedom was made possible by the concerted efforts of concerned, principled people who recognized that his incarceration was unjust and immoral.

“Many thanks to our leaders at Dow Jones and News Corp, who campaigned vigorously for Evan, and to the U.S. government and other enlightened governments, whose divine interventions played a pivotal role in his release.”

News Corp segment review

Full-year results summary

News Corp reported fiscal 2024 full-year total revenues of $10.09 billion, a 2% increase compared to $9.88 billion in the prior year, driven by higher Australian residential revenues at REA Group, improved returns combined with higher digital sales at the Book Publishing segment and continued growth in the professional information business at the Dow Jones segment.

The increase was partly offset by lower advertising revenues at the News Media segment and lower revenues at Move due to ongoing challenging housing market conditions in the U.S., in addition to a $37 million negative impact from foreign currency fluctuations. Adjusted Revenues increased 2%.

Net income for the full year was $354 million, a $167 million, or 89%, increase compared to $187 million in the prior year. The increase was primarily driven by improved losses from equity affiliates due to the absence of a non-cash write-down of REA Group’s investment in PropertyGuru in the prior year and higher Total Segment EBITDA.

Total Segment EBITDA for the full year was $1.54 billion, a $119 million, or 8%, increase compared to $1.42 billion in the prior year primarily driven by improved performance at REA Group and the Book Publishing and Dow Jones segments primarily as a result of higher revenues, as discussed above, in addition to gross cost savings related to the announced 5% headcount reduction initiative and savings due to lower production costs at News UK and Book Publishing.

The increase was partially offset by higher costs related to the launch of Hubbl and higher sports programming rights costs due to contractual increases at the Subscription Video Services segment, higher employee costs at the Book Publishing segment and REA Group, increased marketing costs at Move, increased technology and marketing costs at the Dow Jones segment and a $17 million, or 2%, negative impact from foreign currency fluctuations. Adjusted total segment EBITDA increased 8%.

Subscription Video Services

Fourth Quarter Segment Results

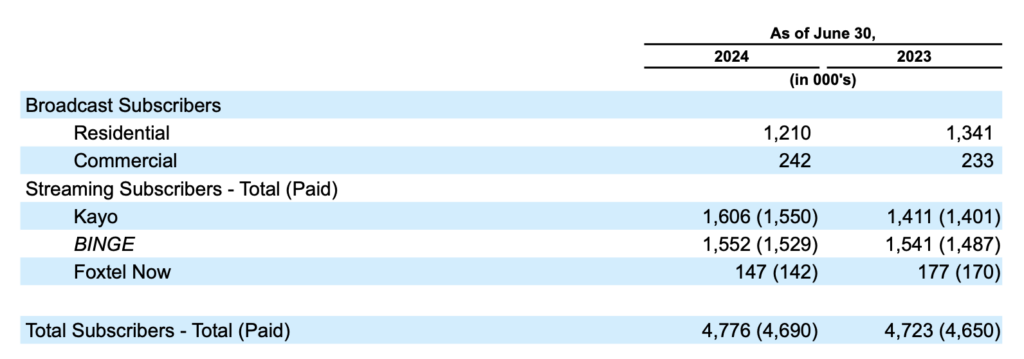

Revenues of $506 million in the quarter increased $5 million, or 1%, compared with the prior year, primarily driven by higher revenues from Kayo and Binge from increases in both volume and pricing, mostly offset by the impact from fewer residential broadcast subscribers and a $7 million, or 1%, negative impact from foreign currency fluctuations. Adjusted Revenues of $513 million increased 2% compared to the prior year.

Foxtel Group streaming subscription revenues represented 32% of total circulation and subscription revenues in the quarter, as compared to 29% in the prior year.

As of June 30, 2024, Foxtel’s total closing paid subscribers were nearly 4.7 million, a 1% increase compared to the prior year, driven by growth in Kayo and Binge subscribers, partly offset by fewer residential broadcast subscribers. Broadcast subscriber churn in the quarter was 11.7% compared to 11.1% in the prior year partly driven by the price and packaging simplification. Broadcast ARPU for the quarter increased 6% year-over-year to A$90 (US$59).

Segment EBITDA of $74 million in the quarter decreased $4 million, or 5%, compared with the prior year, primarily due to $28 million of Hubbl launch costs, partially offset by lower entertainment programming rights and transmission costs and the higher revenues discussed above. Adjusted segment EBITDA decreased 4%.

Full Year Segment Results

Fiscal 2024 full year revenues declined $25 million, or 1%, compared with the prior year, due to a $52 million, or 2%, negative impact from foreign currency fluctuations. Adjusted revenues increased 1% compared to the prior year. Higher streaming revenues, primarily from Kayo and Binge, and higher advertising revenues more than offset the revenue declines from lower residential broadcast subscribers. Foxtel Group streaming subscription revenues represented approximately 30% of total circulation and subscription revenues in the fiscal year compared to 27% in the prior year.

Segment EBITDA for fiscal 2024 decreased $37 million, or 11%, compared to the prior year, primarily due to $51 million of costs related to the launch of Hubbl, higher sports programming costs due to contractual increases and the $9 million, or 3%, negative impact from foreign currency fluctuations, partly offset by the revenue drivers discussed above and declines in other costs including lower technology, entertainment programming rights and marketing. Adjusted segment EBITDA decreased 8%.

Dow Jones

Fourth Quarter Segment Results

Revenues in the quarter increased $20 million, or 4%, compared to the prior year, driven by growth in circulation and subscription revenues underpinned by the professional information business. Digital revenues at Dow Jones in the quarter represented 81% of total revenues compared to 79% in the prior year. Adjusted revenues increased 4%.

Circulation and subscription revenues increased $17 million, or 4%, primarily driven by an 8% increase in professional information business revenues, led by 12% growth in Risk and compliance revenues to $76 million and 14% growth in Dow Jones Energy revenues to $65 million. Circulation revenues increased 1% compared to the prior year, as the continued growth in digital-only subscriptions was mostly offset by lower print volume. Digital circulation revenues accounted for 71% of circulation revenues for the quarter, compared to 70% in the prior year.

During the fourth quarter, total average subscriptions to Dow Jones’ consumer products were over 5.8 million, an 11% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 16% to over 5.2 million. Total subscriptions to The Wall Street Journal grew 7% compared to the prior year, to nearly 4.3 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 11% to almost 3.8 million average subscriptions in the quarter, and represented 89% of total Wall Street Journal subscriptions.

Advertising revenues increased $2 million, or 2%, primarily due to 12% growth in digital advertising revenues, partly offset by a 13% decline in print advertising revenues. Digital advertising accounted for 66% of total advertising revenues in the quarter, compared to 60% in the prior year.

Segment EBITDA for the quarter increased $4 million, or 3%, primarily as a result of the higher revenues discussed above, partially offset by higher marketing costs and higher employee costs, which includes a retroactive payment related to the ratification of a new union agreement. Adjusted segment EBITDA increased 3%.

Full Year Segment Results

Fiscal 2024 full year revenues increased $78 million, or 4%, compared to the prior year, primarily driven by growth in professional information business revenues and a $7 million, or 1%, positive impact from foreign currency fluctuations. Adjusted revenues grew 3% compared to the prior year. Digital revenues at Dow Jones represented 80% of total revenues for the year compared to 78% in the prior year.

Circulation and subscription revenues increased $82 million, or 5%, which includes a $7 million, or 1%, positive impact from foreign currency fluctuations. Professional information business revenues grew 11%, driven by 16% growth in Risk & Compliance products, which reached nearly $300 million in revenues in fiscal 2024, and 16% growth in Dow Jones Energy. Circulation revenues grew 1% compared to the prior year, reflecting continued strong growth in digital-only subscriptions at The Wall Street Journal, offset by lower print volumes. Digital circulation revenues accounted for 71% of circulation revenues for the year, compared to 69% in the prior year.

Advertising revenue decreased $8 million, or 2%, primarily due to a 10% decrease in print advertising, partly offset by a 4% increase in digital advertising. Digital advertising revenues accounted for 64% of total advertising revenues for the year, compared to 61% in the prior year.

Segment EBITDA for fiscal 2024 increased $48 million, or 10%, compared to the prior year, primarily due to higher revenues, as noted above, and lower newsprint, production and distribution costs, partially offset by higher technology and marketing costs. Adjusted Segment EBITDA increased 10%.

News Media

Fourth Quarter Segment Results

Revenues in the quarter decreased $26 million, or 5%, as compared to the prior year, primarily driven by lower advertising revenues and lower circulation and subscription revenues. Within the segment, revenues at News Corp Australia decreased 5%, driven by lower circulation and subscription revenues, and included a $4 million, or 1%, negative impact from foreign currency fluctuations, while News UK revenues decreased 5% driven by lower advertising revenues. Adjusted revenues for the segment decreased 4% compared to the prior year.

Circulation and subscription revenues decreased $9 million, or 3%, compared to the prior year, primarily due to lower print volumes and lower digital circulation and subscription revenue at News Corp Australia due to the expiration of the Meta content licensing deal, partially offset by price increases and digital subscriber growth at News UK.

Advertising revenues decreased $11 million, or 5%, compared to the prior year, primarily due to lower print advertising at News UK and News Corp Australia and lower digital advertising mainly driven by a decline in traffic at some mastheads due to platform-related changes, partly offset by growth in digital advertising at Wireless Group.

In the quarter, segment EBITDA decreased $17 million, or 38%, compared to the prior year, driven by lower contribution from News Corp Australia. Adjusted segment EBITDA decreased 38%.

Digital revenues represented 37% of News Media segment revenues in the quarter, compared to 36% in the prior year, and represented 35% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarized below:

* Closing digital subscribers at News Corp Australia as of June 30, 2024 were 1,117,000 (968,000 for news mastheads), compared to 1,059,000 (943,000 for news mastheads) in the prior year (Source: Internal data)

* The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of June 30, 2024 were 594,000, compared to 565,000 in the prior year (Source: Internal data).

* The Sun’s digital offering reached 112 million global monthly unique users in June 2024, compared to 159 million in the prior year (Source: Meta Pixel)

* New York Post’s digital network reached 117 million unique users in June 2024, compared to 145 million in the prior year (Source: Google Analytics)

Full Year Segment Results

Fiscal 2024 full year revenues decreased $80 million, or 4%, compared to the prior year, which includes a $20 million positive impact from foreign currency fluctuations. Within the segment, revenues at News Corp Australia decreased 7%, driven by lower advertising and a $25 million, or 3%, negative impact from foreign currency fluctuations, while revenues at News UK were flat, reflecting a $39 million, or 5%, positive impact from foreign currency fluctuations.

Circulation and subscription revenues increased $10 million, or 1%, compared to the prior year, primarily due to a $15 million, or 1%, positive impact from foreign currency fluctuations, as cover price increases and digital subscriber growth were more than offset by print volume declines.

Advertising revenues decreased $73 million, or 8%, compared to the prior year, driven by lower print and digital advertising at both News Corp Australia and News UK.

Segment EBITDA for fiscal 2024 decreased $36 million, or 23%, compared to the prior year, which includes $6 million of one-time costs at News UK pertaining to the combination of printing operations with DMG Media. The decrease is primarily due to the lower contribution from News Corp Australia. Adjusted segment EBITDA decreased 24% compared to the prior year.

See also: News Corp Q3 23-24: Group revenue flat, Foxtel Group steady, news media dips again