Speaking at the Deutsche Bank Media, Telecom and Business Service Conference in Palm Beach, Florida this week, News Corp CEO Robert Thomson has spoken about turmoil and upheaval in the media space.

Thomson started by noting that News Corp results “contrast quite sharply with those of other media companies”.

He said that the strategy News Corp adopted when the company was split in two – to be more digital, global and more focused – has helped grow the business.

“Rupert and Lachlan Murdoch and I are adamant the ecosystem has to change – not only for ourselves, but for media companies generally. [The old way] was distinctly dysfunctional – not only in a commercial sense, but in a societal sense.”

There is continuing upheaval in print advertising, with Thomson noting December was up YOY in the UK, but not the US.

As to what News Corp might do with regard to investing its cash balance, he said: “We are very conscious to create a long-term return for shareholders.

“We have made a couple of significant investments since the split. One was to buy publisher Harlequin for HarperCollins to make it a much more global and potentially digital company. [The other was growing publisher Thomas Nelson.] We are not going to pay for overvalued assets.

“Our value is being able to use our media platforms to turn around companies and enhance their value.”

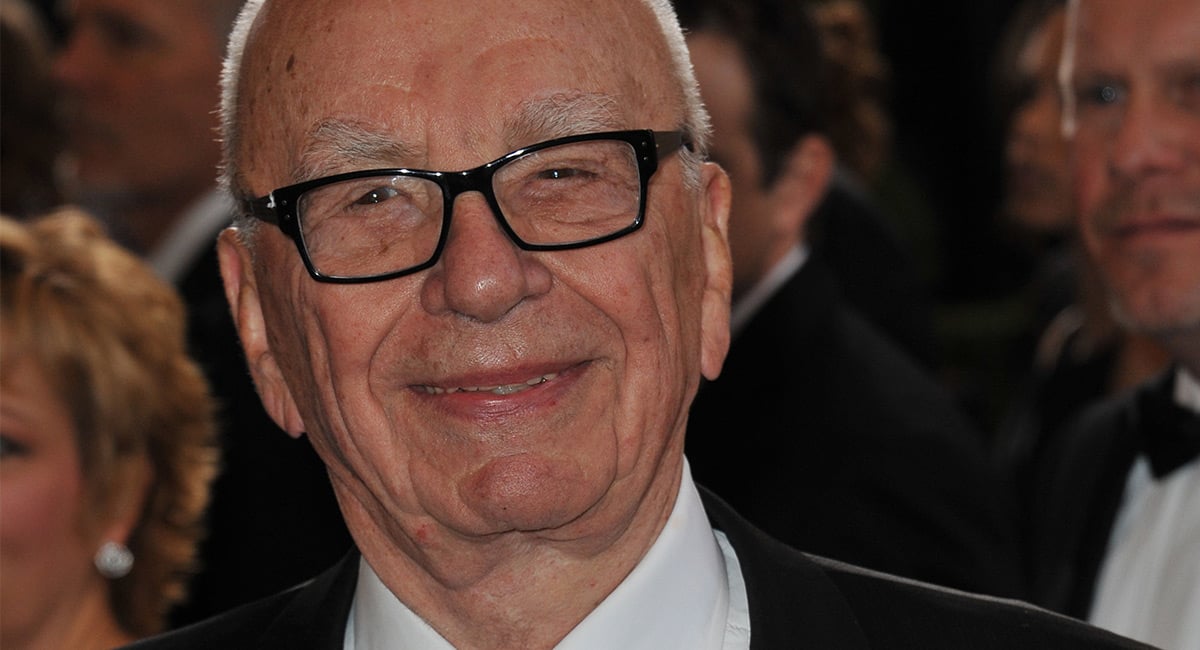

News Corp Executive Chairman Rupert Murdoch (c Shutterstock)

When asked about competing with the “digital duopoly” of Google and Facebook, Thomson said: “We have obviously been the most outspoken media company globally on this issue for many, many years.

“We are in the middle of a profoundly important dialogue that is going to have an impact on not only our news sites which should benefit from this debate, but really on the way we think about news in the contemporary world.

“Our executives have been so articulate on this issue when others have shown a great degree of cowardice.”

When asked about the newspaper business, Thomson started talking the quality newspapers – The Times, The Wall Street Journal and The Australian.

“They are rapidly transitioning to high-end digital products with a high-end digital advertising audience. The amount of credit our great journalism deserves is not yet reflected in the digital environment. The advertising varies country by country and platform by platform.

“The Dow Jones subscription audience is 2.8m with The Wall Street Journal itself on 2.3m. The digital audience is an ideal platform for upsell. But we must get better, and we are getting better, on the upsell of information to people who need it.”

When asked about the Foxtel-Fox Sports merger, Thomson said: “We have a real opportunity to use our platforms in a more creative, consistent and intense way to aid Foxtel and Fox Sports, at the same time help the mastheads. The sports rights we have in Australia are unique and we purposely bought them long term.

“We have full confidence in Patrick Delany’s ability to transform the business. We have to prove to the Australian audience we have the best content and deliver in a way that makes sense in the contemporary environment.”

Thomson said with football codes starting their 2018 seasons, the next three months will be an important indicator of how the team at Foxtel is faring.

When asked about cricket rights, he noted they would not be paying a ridiculous price. “Are we interested? Absolutely. Do we think our involvement would help the sport in Australia? Cricket authorities should be aware we not only commit to the sport, but to the sport’s community.”