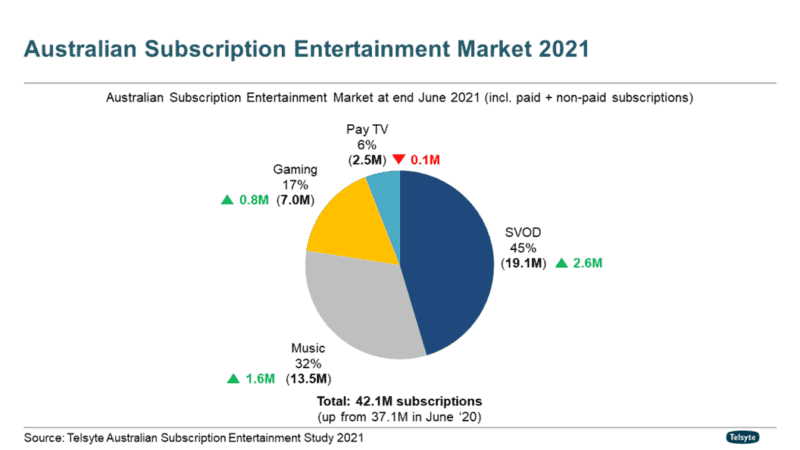

Despite the eased restrictions during early 2021, pandemic-wary Australians are switching on SVOD at a rapid pace and had a total of 42 million subscriptions at the end of June 2021, up from 37 million in June 2020, according to new research from emerging technology analyst firm, Telsyte.

The Telsyte Australian Subscription Entertainment Study 2021 found SVOD, streaming music and games related subscriptions all experienced strong year-on-year growth (16%, 13% and 13% respectively), driven by the demand for home entertainment and greater acceptance of the subscription model.

Most (78%) Australian households had at least one entertainment subscription at the end of June 2021, an increase from 65 per cent three years earlier. Subscribing households now average of 4.3 entertainment services (up from 2.7 in June 2018), largely driven by SVOD subscriptions.

Telsyte forecasts a strong future for consumer subscription services, with many seen as ‘must-have’ services, and not just for entertainment, but also for eCommerce, deliveries, fitness, education and audio.

With entertainment subscriptions set to exceed 60 million by 2025, the games subscription category is expected to enjoy fast growth in coming years, catching up to music and SVOD.

In contrast, Foxtel’s pay TV segment remains under pressure due to the increasing adoption of SVOD. The study found the total pay TV market declined by 2 per cent to 2.5 million in June 2021. Foxtel’s pay TV’s base declined by 4 per cent during the same period while Fetch remained stable.

Fresh content helps spur SVOD growth

As the world recovers from the impact of the Covid-19, video content production and release schedules remained disrupted in 2021, which has left Australians hungry for fresh content, fuelling uptake of multiple services.

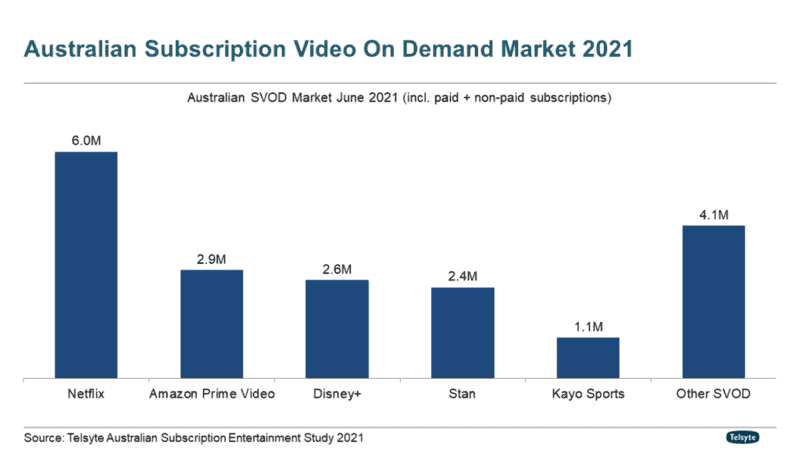

Australian Subscription Video on Demand (SVOD) services reached 19.1 million at the end of June 2021, an increase of 16 per cent from 16.4 million in June 2020. A reliance on SVOD services remained high with 57 per cent of users believing SVOD is an “essential service” (up from 52% a year ago).

The study found Netflix (6.0 million) remained the top SVOD service at the end of June 21, followed by Amazon Prime Video (2.9 million), Disney+ (2.6 million), Stan (2.4 million) and Kayo Sports (1.1 million). Telsyte actively monitors the entire SVOD services market, including more than 30 SVOD services such as Binge, Apple TV+, Hayu, Paramount+, Optus Sport and Britbox.

In pre-Covid 2019, Telsyte reported that Netflix had 4.9m subscriptions with Stan #2 on 1.7m.

Australians’ love of sport has been further highlighted in the past 12 months. The sports category grew 48 per cent year-on-year (once the decommissioned Telstra Live Passes is removed) and the percentage of paid sports subscriptions has also improved significantly, from less than 15 per cent a year ago to over 50 per cent at the end of June 2021.

Sports will remain a critical category for SVOD, as it commands higher monthly rates compared to other services, and is often a battleground for broadcast rights. In fact, the total revenue generated by Sports SVOD services grew by 54 per cent compared to 20 per cent for non-sports services. Kayo Sports is now the largest SVOD service dedicated to Sports as it takes over from Telstra Live Pass in AFL and NRL apps.

The proliferation of SVOD services and new content partnership deals have further fuelled multi-subscriptions across subscribing households. The average number of SVOD subscriptions (in subscribing households) reached 3.1 in June 2021, an increase from 2.8 in June 2020. The research also found 45 per cent of SVOD subscribers are open to subscribing to multiple services to meet their entertainment needs (an increase from 37% a year ago).

The market is well-positioned to facilitate multiple services as platforms, such as Fetch, Apple TV and Foxtel are being more inclusive, allowing easy subscriptions to multiple services and single billing through the one platform. The study found nearly half (46%) of SOVD users are interested in using a one-stop platform.

“Australians are clearly attracted to big production movies, TV shows and sporting codes they follow year on year, and are collecting subscriptions on the way” Telsyte managing director Foad Fadaghi said.

Telsyte estimates total SVOD subscriptions could reach 26 million by June 2025 with higher multiple subscriptions and new services (boosted by new content licencing deals), and potential bundling (what is done with Amazon Prime).

Fetch offers bundling for a number of SVOD providers

Increasing investment in original content will become more important as part of SVOD providers’ growth and retention strategies. Additionally, Australia has been a popular choice as a source of content and content production.

Most (51%) SVOD customers believe it is important to have content that has Australian stories, voices, culture, and values on SVOD services.

Pandemic puts on budget pressure

While consumers are comfortable with subscribing to multiple services, economic pressure due to the pandemic and employment has affected video entertainment budgets.

Telsyte found among people willing to pay for streaming video services, the average monthly budget has decreased slightly (9 per cent) from a year ago to just under $30 in 2021.

Telsyte anticipates consumers will increasingly consider ‘sharing’ the cost of subscriptions with others, in order to access more services in the future. According to the study, half of SVOD users are likely to share services to reduce costs in future. That percentage increases to 61 per cent amongst those already using 3 or more services.

Freely available Broadcasting Video On Demand services (BVOD) (including 7Plus, 9Now, 10Play, ABC iView and SBS On Demand) remained popular as Australians look for more content beyond just SVOD services. Most BVOD platforms had more than 10 million viewers during FY2021.

The recent Tokyo Olympics coverage saw the 7Plus audience and usage surge with more than 4.7 billion minutes streamed over the event, highlighting the potential for ad-supported video streaming.

Games subscriptions shoot higher

In keeping with more time spent at home, video gaming subscriptions are set to grow three times faster than SVOD and streaming music during the next four years.

The study found Australians had taken up a total of 7 million games-related subscriptions at the end of June 2021 (up 13% from 6.2 million a year ago) and video games service subscriptions have been the primary growth vehicle (up 30% y-on-y to 3.1 million in June 2021) with greater than 1 in 4 (28%) of gamers more open to the idea of accessing games through subscriptions.

Telsyte found Australian gamers have an average budget that rivals streaming video services – at around $360 per annum (about $30 per month), with hardcore gamers (those playing 3 or more hours a day) having a budget significantly higher. Telsyte believes spending on video games will increasingly shift to subscriptions, fuelling the growth of multiple video game subscriptions to meet gamers’ entertainment needs (similar to SVOD).

The total number of games related subscriptions could more than double to greater than 16 million by June 2025, especially the video games subscription segment where it has significant potential and is expected to nearly quadruple within the same period.

According to the same research, 1 in 4 (25%) gamers are interested in cloud gaming, especially amongst hardcore gamers (46%)

Cloud gaming, or sometimes being referred to as “streaming gaming” works like SVOD services, where the games are stored and run online with players able to play on different devices without having to download and install the games or buy specific hardware. Cloud gaming has been gathering pace globally with tech giants (Including cloud Hyperscalers) investing heavily in these developing these services (e.g. Microsoft’s xCloud, Google’s Stadia and Amazon’s Luna).

Paid music subscriptions gathering pace

Streaming music is also growing in popularity with the total number of streaming music subscriptions reaching 13.5 million at the end of June 2021, an increase of 13 per cent from a year ago.

The top three streaming music service providers in Australia remained Spotify, Google (incl. YouTube Music and YouTube Premium) and Apple Music. More than half are now paid subscriptions, compared to 42 per cent at the end of June 2019.

Podcasts are increasingly an important part of streaming music providers’ growth strategies. Telsyte found around 1 in 4 Australians aged 16 and over listened to podcasts in 2021, with comedy (up 5%) and news and politics being the most popular podcast genres.

The research also found the availability of celebrity podcasters has become important when it comes to choosing a music subscription service, with one in four (27%) of those with a music subscription saying it is important to have a good variety of celebrity and popular podcasters.

See also: Seven’s opportunities with Olympics, SVOD partnership, shaking up OzTAM