In the third quarter of 2024, Netflix continued to assert its leadership in the streaming industry, showcasing significant growth in both revenue and viewership. With a 15% year-over-year increase in revenue and an operating margin of 30%, Netflix has proven its resilience in a competitive sector. This week, the company attributed its success to a diverse slate of content, a growing global audience, and continuous innovation in its business model, including its advertising tier.

Financial overview: Strong growth across the board

Netflix’s Q3 results outperformed expectations, with revenue growing by 15%, slightly higher than the initial forecast. The company saw a significant rise in average paid memberships, which increased by 15% year-over-year, alongside 5.1 million new subscribers. However, this was a decrease from the 8.8 million net additions in Q3 2023. Despite this, Netflix continued to report growth across its major markets.

In the United States and Canada (UCAN), Netflix’s most mature market, revenue increased by 16%, driven by a 10% growth in paid memberships. Europe, the Middle East, and Africa (EMEA) saw a similar revenue increase of 16%, while Asia Pacific (APAC) led the growth with a 19% rise, thanks to strong local content in countries like Japan, Korea, Thailand, and India.

The company doesn’t break out the data for individual countries. However, Telsyte reported that in Australia Netflix had 6.2m subscribers in June 2024. This represented YOY growth of 2%.

In Latin America (LATAM), revenue rose by 9%, although paid net additions slightly dipped due to price changes and a softer content slate. Nevertheless, early signs in Q4 indicate a rebound in this region.

See also: Telsyte SVOD report – Ad-supported tiers grow, Netflix still #1, Total subscriptions up 4% to 25.3m

Engagement and content strategy

Netflix’s engagement metrics remain a core focus, serving as a barometer of member happiness and retention. With over 600 million users globally, the company said it continues to program to meet diverse tastes, cultures, and languages, giving it a competitive edge over other streaming platforms. Netflix has delivered a steady stream of new content, despite challenges posed by last year’s industry strikes.

Netflix emphasised the importance of view hours as a key metric for measuring success. In the first three quarters of 2024, view hours per membership grew year-over-year, especially among “owner households” — those unaffected by paid-sharing restrictions.

Critically acclaimed content also played a pivotal role in Netflix’s strategy. At the 2024 Primetime Emmy Awards, Netflix secured 24 wins from 107 nominations, surpassing competitors in both critical and popular appeal. Notable winners included Ripley, The Crown, Beckham, and Blue Eye Samurai.

Netflix hit TV series and films

Netflix continued to deliver popular TV shows and films that captured global audiences in Q3 2024. The streamer released the following audience data this week.

Television

The Perfect Couple – 65.2 million views

Monsters: The Lyle and Erik Menendez Story – 54.6 million views

Emily in Paris, Season 4 – 51.0 million views

Cobra Kai, Season 6 – 36.5 million views

Nobody Wants This – 37.0 million views

The Accident (Mexico) – 37.2 million views

Simone Biles: Rising – 19.0 million views

Selling Sunset, Season 8 – 10.9 million views

Tokyo Swindlers (Japan) – 10.5 million views

Culinary Class Wars (Korea) – 11.0 million views

Returning fan favourites like Umbrella Academy and Elite also made their mark, with the final seasons of both series performing well. Umbrella Academy had 25.5 million views in its fourth season, while Elite attracted 12.2 million views in its eighth and final season.

Films

The Union – 111.9 million views

Rebel Ridge – 104.7 million views

Beverly Hills Cop: Axel F – 87.5 million views

Vanished into the Night (Italy) – 39.2 million views

Officer Black Belt (South Korea) – 32.8 million views

Maharaja (India) – 22.6 million views

Blame the Game (Germany) – 22.4 million views

Growing ad business and outlook

A significant area of focus for Netflix in Q3 was its growing advertising business. The company’s ad-supported membership grew by 35% quarter-over-quarter, accounting for over 50% of sign-ups in markets where the ads tier is available. Netflix’s first-party ad tech platform is set to launch in Canada in Q4 2024, with broader availability planned for 2025. The platform aims to create new revenue streams while offering advertisers greater engagement opportunities.

Netflix acknowledged its ad business is still in the early stages. The company expects to reach critical scale for advertisers by 2025, though it doesn’t foresee ads becoming a primary driver of revenue growth in the short term.

Netflix is balancing the growth of its ad inventory with overall revenue growth, aiming for a 15% increase in total company revenue in 2024.

What’s next for Netflix?

Looking ahead to the fourth quarter of 2024, Netflix has more strong content slated for release.

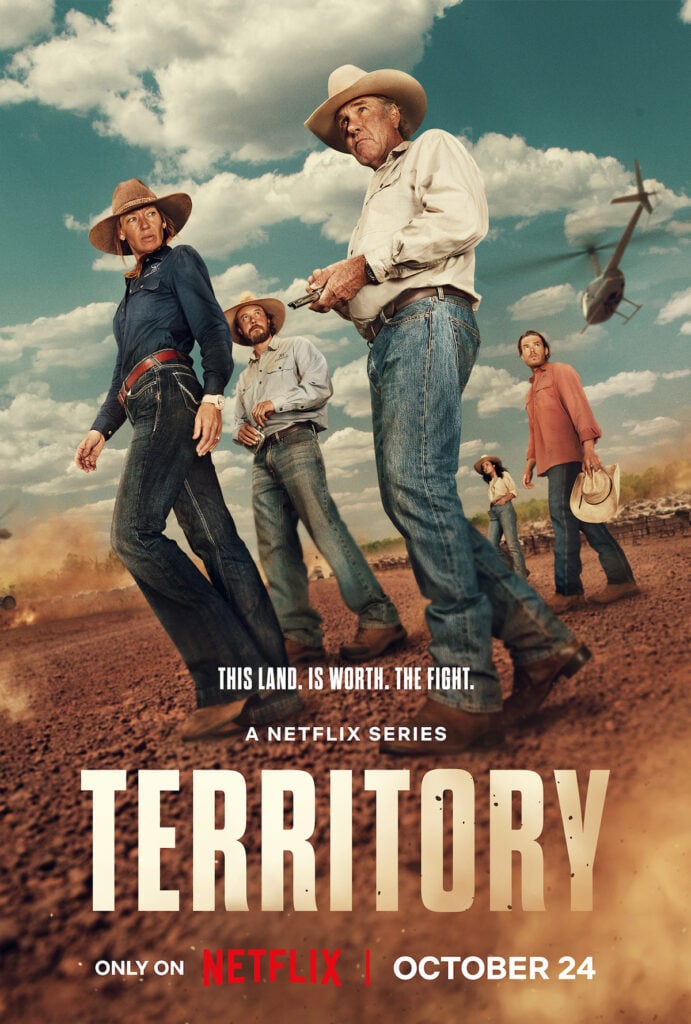

An important release for the company locally in the last week of October is Territory. The series stars Anna Torv, Robert Taylor and Sara Wiseman. Territory is a joint production between Easy Tiger and Ronde, created by Timothy Lee and Ben Davies and produced by Paul Ranford. Executive producers are Ben Davies, Rob Gibson and Ian Collie.

Also coming is the second season of Squid Game which is expected to drive significant engagement, alongside new seasons of Outer Banks and Love is Blind. On the film front, Netflix will premiere Carry-On, an action thriller starring Taron Egerton and Jason Bateman, as well as The Six Triple Eight, a war drama directed by Tyler Perry and starring Kerry Washington.

In Latin America, Netflix will debut two of its most ambitious projects: 100 Years of Solitude, based on Gabriel García Márquez’s iconic novel, and Senna, a biopic about the legendary Formula 1 driver Ayrton Senna.

Additionally, Netflix is expanding into live events, with a Mike Tyson vs. Jake Paul boxing match scheduled for November and two NFL games on Christmas Day, featuring the Kansas City Chiefs, Pittsburgh Steelers, Baltimore Ravens, and Houston Texans.