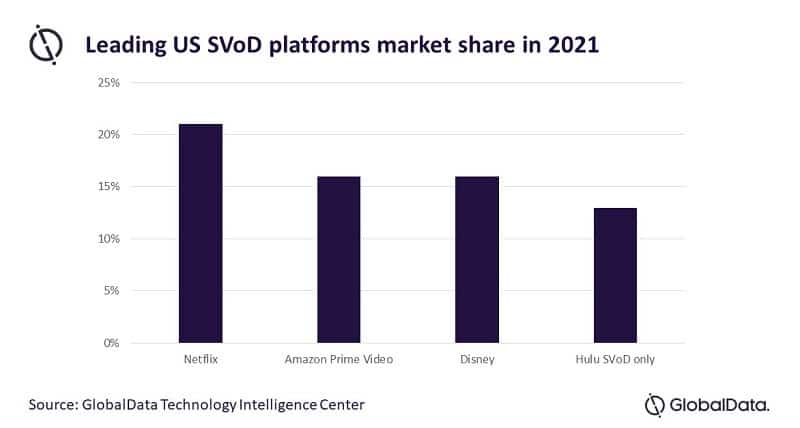

While Netflix remains the undisputed leading streaming platform, with a 21% share of the US subscription video on demand (SVoD) market in 2021, GlobalData reports that the giant is showing signs of slowing.

With more and more competitors arriving, the data and analytics company says streaming platforms will not only have to provide evocative content but will either have to find an effective niche or build partnerships with other entertainment providers to become an entertainment all-rounder and stand out in the crowd.

The commentary below from GlobalData comes just before Netflix reports on Q4 2021 and after a recent US and Canada price hike. Netflix increased its prices in the US by $1 and $2, lifting the cost of its cheapest plan by $1 to $10 a month. The standard plan went up from $14 a month to $15.50. Netflix’s premium lifts $2 a month, up from $18 to $20.

Francesca Gregory, associate analyst at GlobalData, commented: “We have already started to see Netflix branching out to different areas, with the launch of Netflix Games in November 2021 and a co-streaming partnership with Twitch. Reaching different audiences will continue to be a key strategy. I wouldn’t be surprised if the company looked to experiment with more gaming streaming platforms in the future.

“Subscribers can look forward to having a more rounded service and seeing large franchises converted into shows. This may, at the same time, leave subscribers torn between different platforms.”

Besides partnerships, content portfolios will be the key determiner of any streaming services’ survival moving forward, and strategic content spending will be essential for streaming services to retain their market position, said GlobalData.

Gregory continued: “Netflix experienced a slow start to 2021, following a light slate of content as pandemic production problems came to the fore. Although fresh content in its third quarter boosted subscribers to 214 million, competing platforms are experiencing explosive growth. Disney+ amassed 118 million subscribers by November 2021, just two years after its launch. Bezos also boasted that 175 million Amazon Prime subscribers had streamed content last year. Although subscriber accounting across platforms varies, it is clear that 2022 will be characterized by increased competition.

“As the number of streaming platforms increases, and the market approaches peak fragmentation, SVoD platforms will use content portfolios to differentiate themselves. The trend of huge content spending will continue, with franchises that are likely to attract a loyal fanbase standing to benefit in the next year.

“This trend is already in motion with Amazon committing $1 billion on its Lord of the Rings series before a single episode has hit viewers’ screens. Meanwhile, SVoD services with smaller budgets will target niche audiences. For example, Paramount+ will aim to serve the long-neglected Gen X audience with its content selection. Companies that fail to secure a market niche will have a limited shelf life in the crowded SVoD market.

“The ‘all you can eat’ business model has proven popular with streamers so far. However, this means that to grow revenues, streaming platforms will need to seek new audiences. A series of strategic partnerships between video streaming, gaming, and podcast companies will take place. The launch of Netflix Games in November 2021 and a co-streaming partnership with Twitch for select content is evidence of some of the ways this diversification will take place.”

Information based on GlobalData’s report: “Tech, Media, & Telecom (TMT) Predictions 2022 – Thematic Research”