Business of Media

BVOD revenue soars 43%, but TV dollars down 5% in 2019

ThinkTV has announced the total TV advertising revenue figures for the 12 and six months to December 31, 2019.

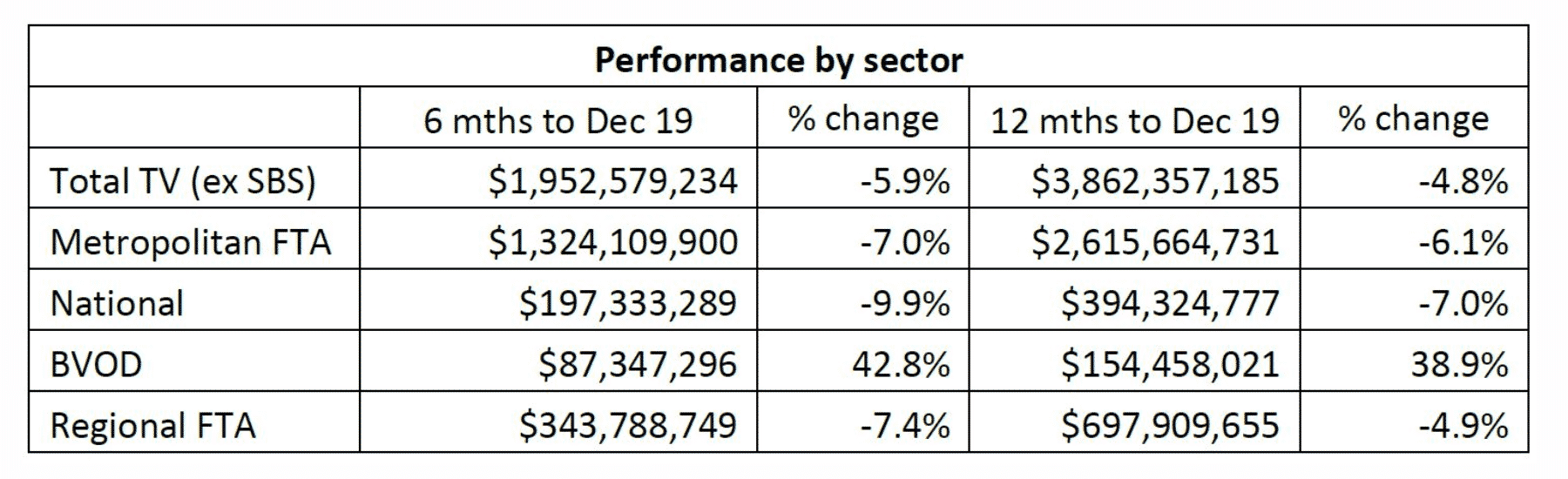

Amidst overall challenging market conditions, for the first half of FY2020, the total TV market – which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) – recorded combined revenue of $1.95 billion for the period, down 5.9% compared to the same period the year prior.

ThinkTV CEO Kim Portrate said: “Changes in the total TV advertising market, the most effective medium for driving business growth, reflect the state of the Australian economy and the impact of weaker consumer and business confidence.”

Growing consumption of content across BVOD platforms 7Plus, 9Now, 10 Play, Kayo and Foxtel Now, saw a rapid revenue increase with BVOD up 42.8% for the six months to December 31, 2019.

“The performance of BVOD continues to buck general market performance trends retaining the title of Australia’s fastest-growing advertising medium which demonstrates a growing list of advertisers who recognise the value and effectiveness multi-platform TV provides. This is an achievement all the more noteworthy given the challenging economic conditions the wider advertising landscape is currently grappling with,” added Portrate.

For the 12 months to December 2019, the total TV market recorded $3.86 billion in advertising revenue, down 4.8% compared to the 12 months to December 2018. For this period, BVOD saw an increase of 38.9%.

Disney+ reveals nearly 29m paid subscribers since launch

During its Q1 FY20 earnings results webcast, The Walt Disney Company announced that Disney has amassed 28.6 million paid subscribers, as of Monday, February 3. The service launched less than three months ago on November 12, 2019.

Additionally, Disney chairman and CEO Bob Iger revealed the paid subscriber numbers for ESPN+ and Hulu, as of Monday, are 7.6 million and 30.7 million, respectively.

“We believe the subscriber growth to date and the overall reaction to Disney+ reflects a variety of factors that include the uniqueness of the service, an excellent user interface and the high quality of our brands and content,” said Iger. “Although our volume will increase, we remain focused on providing quality content from our core franchises and brands, not just quantity, as we continue to build our portfolio.”

Disney+ launched in the U.S., Canada and the Netherlands on November 12, 2019, followed by its debut in Australia, New Zealand and Puerto Rico a week later on November 19.

The service will launch on March 24 in markets across Western Europe – including the UK, Ireland, France, Germany, Italy, Spain, Austria and Switzerland, and today Iger announced that Disney+ will launch in India as well on March 29 through Hotstar. Additional Western Europe markets, including Belgium, the Nordics and Portugal, will follow in summer 2020.

The company said consumers have embraced Disney+’s library of classic movies and shorts, popular series, recent theatrical releases and a growing slate of original content from Disney, Pixar, Marvel, Lucasfilm and National Geographic.

Today, Iger announced that the new original Marvel Studios series The Falcon and The Winter Soldier and WandaVision will premiere on Disney+ in August and December, respectively, and that the highly popular series The Mandalorian, from Lucasfilm, will return to the service in October.

Disney to leave Foxtel as streaming wars heat up

The Disney and Disney Jnr channels will leave Foxtel at the end of February, as content continues to flow back to the US giant following the launch of its own streaming service in Australia, reports AFR’s Max Mason.

It follows the removal of the Disney Movie channel, which included Disney Animation, Pixar, Marvel and most Lucasfilm productions from Foxtel in November last year.

In November, Disney also had its content removed from Stan, a subscription video on-demand service owned by Nine, publisher of The Australian Financial Review.

Disney launched its own streaming service, Disney+, in Australia in November. In Australia, Disney+ is a M15 rated platform, while in the US it is PG13. Disney has an expansive range of other content that sits outside of its core brands Pixar, Disney, Marvel, Star Wars and National Geographic, which it will not put on the Disney+ platform.

Michelle Wood to join News Corp Australia

Michelle Wood is set to join News Corp Australia as its new head of executive communications, reports News Corp’s Leo Shanahan.

In the new role, Wood will be working closely with Michael Miller, News Corp executive chairman Australasia and Damian Eales, chief operating officer, publishing.

Wood will be reporting to Campbell Reid, News Corp’s group executive of corporate affairs, policy and government.

Wood is joining News Corp from Uber where she was previously director of communications in Australia and New Zealand.

Previously, she held a position as general manager of marketing and communications at the Australian Institute of Company Directors. She is deputy-chair of the Australian Republican Movement, co-founder of the Sydney Salon, and a director of the Internet of Things Alliance.

Radio

Michael Clarke to join Big Sports Breakfast radio with Laurie Daley

Former Australian cricket captain Michael Clarke is about to enter the cutthroat world of Sydney’s breakfast radio, taking on the likes of Kyle and Jackie O in his new role, reports News Corp’s Phil Rothfield.

Clarke is tipped to be named as a co-host of the Big Sports Breakfast alongside rugby league legend Laurie Daley on the Sky Sports Radio network.

In a deal that will be finalised this week, Clarke will go up against the likes of 2GB’s Alan Jones and KIIS FM’s Kyle and Jackie O.

Clarke replaces veteran broadcaster Terry Kennedy, who stood down last year after 18 years in the chair.

The show has struggled in the ratings for years although the figures began to improve last year and they beat their now-defunct Macquarie Sports Radio rivals in the ratings.

The Clarke appointment is a shock in that he is such a polarising figure in Australian sport.

However, he has strong opinions and knows his rugby league as a mad Wests Tigers fan.

Michael Hing joins Lewis Hobba for triple j Drive

Comedian Michael Hing has been announced as the permanent replacement for Veronica Milsom on triple j Drive, reports Radio Today.

Lewis Hobba’s long-time co-host Milsom announced last week that she won’t return to triple j once she departs the station to have her second child.

On Tuesday’s Drive show, Veronica & Lewis had intended to tease out the process, but the former accidentally revealed that Hing was the replacement ahead of time.

Hing will step into the role alongside Hobba in two and a half weeks time, after recently departing SBS current affairs show The Feed. He also hosts Good Game on the ABC.

“I’m really excited to be hosting triple j Drive with Veronica,” said Hing.

“She’s a close friend, a great comedian and someone I’ve always looked up to… wait, Veronica’s the one leaving? So I’m hosting with Lewis? Okay, I guess that’s fine.”

Hing has filled in across several triple j slots over the past few years, and is also a stand-up comedian.

“I’ll really miss triple j, but I’m excited about the advertising opportunities once I leave,” said Milsom.

“Sometimes I wonder if collaborating with a major sporting brand will feel disgusting and shameless, but my gut says Just Do It.”

Entertainment

Spotify is buying Bill Simmons’ The Ringer Podcast Network

Spotify, continuing to beef up its podcast offerings and expand its sports coverage, announced Wednesday that it will buy The Ringer, the popular website and podcast network created by Bill Simmons, a former ESPN commentator and sports personality, reports The New York Times.

The terms of the acquisition, which is expected to close in the first quarter of this year, were not disclosed.

Simmons started The Ringer in 2016 after a bitter dispute with ESPN, which he left in 2015 after working for the network for nearly 15 years. The sports and culture website was originally hosted on Medium and switched to Vox Media under a partnership announced in 2017.

The Ringer now has a lineup of more than 30 podcasts, including The Bill Simmons Podcast and The Rewatchables. It also houses a video network, film production division and book imprint.

“We spent the last few years building a world-class sports and pop culture multimedia digital company, and believe Spotify can take us to another level,” Mr. Simmons said in a statement. “We couldn’t be more excited to unlock Spotify’s power of scale and discovery, introduce The Ringer to a new global audience and build the world’s flagship sports audio network.”

Spotify reported on Wednesday a 29 percent rise in paid subscribers to its audio-streaming services in the fourth quarter of 2019, to 124 million as of Dec. 31, giving it a significant lead over its main rival, Apple. The company, which is trying to expand beyond music streaming to all online audio, acquired three podcast companies in 2019, including Gimlet Media, the maker of the popular podcasts Crimetown and Reply All.

Television

Sonia Kruger will host Big Brother on Channel 7 in 2020

Television’s worst-kept secret has been confirmed – Big Brother 2020 will be hosted by a face familiar to the franchise, reports News Corp’s Bella Fowler.

After months of speculation, Channel 7 has confirmed Sonia Kruger will host the long-awaited reboot of Big Brother.

In a 10-second teaser aired during My Kitchen Rules, Kruger – who hosted the wildly popular reality show’s Channel 9 iteration – was revealed as the host of the new-look season.

While we are yet to be given a premiere date for Big Brother 2020 – the teaser confirmed the contestants have been selected.

Big Brother was first hosted by Gretel Killeen on Channel 10 from 2001 – 2007, before Kyle and Jackie O took over for a year until 2008.

When it moved over to Nine, Kruger became the new face of the show, from 2012 to 2015.

Seven’s My Kitchen Rules: The Rivals struggles on 2020 return

Seven Network’s programming boss Angus Ross has defended the early poor television ratings performance of its rebooted My Kitchen Rules: The Rivals, saying it takes time for audiences to adapt to major change, reports News Corp’s Lilly Vitorovich.

The 11th season of the cooking competition show, whose format has been changed in a bid to spice things up, has been thrashed in the television ratings battle by Nine’s reality dating show Married At First Sight and Ten’s Australian Survivor: All Stars.

While the tenth series of MKR last year struggled against MAFS, it is now also trailing Ten’s Survivor in the prime-time evening timeslot, which is key for advertisers.

“For over a decade, My Kitchen Rules has been serving up great entertainment programming, and this year we have refreshed it with MKR: The Rivals,” Ross told The Australian.

“As with any big change to an established format, it takes time for people to adapt.”

The latest season of MKR has dropped its popular “instant restaurants”, where viewers watched contestants cook meals in the kitchens of their owns homes, in favour of a converted warehouse.

Ross said there is “a lot to look forward” to throughout the first quarter of the year, with its new dog grooming reality competition show, called Pooch Perfect, with actress Rebel Wilson and several prime time special events.

“We remain on track to deliver our refreshed and exciting prime time programming line up across all of 2020, including programs such as Big Brother, Farmer Wants a Wife, Plate of Origin and Mega Mini Golf.”

‘Disappointed’: Deaf community flags concerns over pay TV captions

A national advocacy group for Deaf Australians has expressed its disappointment with the rules governing captions and subscription television, reports The SMH’s Broede Carmody.

Australia’s media watchdog has taken the first step in giving Foxtel the green light to temporarily slash its captions quota for the BBC World News. A proposal unveiled this week could result in Foxtel providing captions for 20 percent of the news service’s total broadcast hours instead of 40 percent.

The development comes after a string of preliminary exemptions relating to foreign news, documentaries and religious programs. Video streaming platform Fetch TV has asked the Australian Communications and Media Authority (ACMA) to waive quotas for Channel News Asia, France 24, Nat Geo Wild and the Australian Christian Channel, according to documents published by the watchdog.

The media watchdog has acknowledged pay TV providers incur “significant financial costs” due to caption quotas. ACMA has also suggested it is better for a program to provide some captions than for that program to be removed altogether so as not to be penalised under the relevant legislation.

Deaf Australia’s chief executive Kyle Miers says the watchdog’s leniency, however, will have an impact on the Deaf community. He said he has been “very disappointed” with ACMA’s recent exemptions and target reduction orders.

“Access to information is a human right,” he said. “The Broadcasting Services Act is designed to protect the broadcaster’s interest not the consumer’s. The percentage of captioning and requesting for exemptions is a legal way to discriminate against us. We have advocated for this to be removed.”

Sport

Optus scores goal in soccer push with Japanese Football League rights

Optus Sport has secured a three-year exclusive deal for the Japanese Professional Football League as the streaming service chalks up 800,000 subscribers and positions itself as the home of soccer, reports The SMH‘s Zoe Samios.

The deal, which will fill the telecommunication provider’s content schedule for the year, is the first for Optus Sport in the Asian market. Up to four matches per round will be broadcast live and on demand for viewers as part of the arrangement.

Optus’ head of TV and content, Corin Dimopoulos, said the new rights deal solidified the company’s position as home of the world’s “best football”.

“We’re excited to be announcing the acquisition of the J League rights as we commence our 2020 campaign and to really solidify our position as the home of the best football from around the world,” Dimopoulos said.

The J League – which includes top club Yokohama F. Marinos coached by former Socceroos coach Ange Postecoglou – will add to Optus’ existing football offering, which includes the English Premier League, UEFA Champions League, UEFA Europa League and the FA Women’s Super League. Postecoglou’s team were the 2019 champions and will defend the title once the competition starts in February.

V8 Supercars in talks with broadcasters over rights deal

V8 Supercars is in negotiations with commercial broadcasters for a new sports rights deal as its existing arrangement with Network Ten and Foxtel comes to an end, reports The SMH’s Zoe Samios.

CBS-owned Network Ten, Seven West Media and Foxtel are among the broadcasters in discussions with the motorsports organisation, sources close to negotiations said. Ten, Foxtel and Seven declined to comment. V8 Supercars was unavailable for comment.

In 2013, under former V8 Supercars boss and current Seven chief executive James Warburton, the business signed a six-year, $241 million media deal across Foxtel and Ten for the 2015-2020 seasons.

The existing deal includes the Adelaide 500 – formerly known as the Clispal – Townsville 400, Sydney 500 and the Supercheap Auto Bathurst 1000. It was the biggest rights deal landed for the sport in its history. Warburton has a stake in the business.

V8 Supercars’ discussions, which started last year, came after Seven West Media announced a multi-year deal with Australian Racing Group, which includes the TCR Australia Series, S5000 and categories from the Shannons Motorsport Australia Championships. Warburton is a non-executive director of Australian Racing Group and has a stake in the business.

But Seven has a long history with the Supercars, as broadcaster from 1963 to 1993, and from 2007 to 2014. A deal with V8 Supercars would extend its current offering which includes the cricket, AFL and the Tokyo 2020 Olympics.

Meanwhile, Network Ten currently has the rights to the Melbourne Cup carnival and a deal currently in place with Rugby Australia, which is about to go to tender.

Foxtel’s exclusive Formula One rights, which it took from Network Ten in 2017, will expire in 2022.

Shute for the stars: club rugby rights battle set to shape $1b TV deal

Rugby’s billion-dollar, four-nation broadcast deal is being held up by a battle over the future of the Sydney club competition, reports The SMH’s Georgina Robinson.

Once the forlorn, forgotten gem in the crown of Australian rugby, the Shute Shield has emerged as the prized bargaining chip in the fraught negotiations over the sport’s next broadcast deal.

On one side is Rugby Australia, which wants to elevate the Sydney and Brisbane club competitions to greater prominence on the rugby calendar, and wants to sell a five-year, exclusive club-to-Wallabies package to the highest-bidding broadcaster.

On the other side is Fox Sports, RA’s long term broadcast partner, which, concerned RA could have its head turned by rival Optus, appears to be moving to secure what rugby content it can.

The outcome is a stalemate set against a backdrop of unprecedented tension over the rights negotiations for Super Rugby and the Wallabies from 2021.

Of the four-nation SANZAAR joint venture, which operates Super Rugby and the Test-level Rugby Championship, Australia is the last major partner to finalise its deal, having chosen to enter into a competitive market process for the first time in the history of the game.

RA wants to have the new deal announced by the end of March, but it cannot start the bidding process without knowing whether it is selling the Shute Shield or not.

Fox, meanwhile, fuming that RA did not accept its initial offer to extend their 25-year partnership, is trying to cut the governing body out of the process and secure some presence in the sport. News Corp reported late on Wednesday that Fox had decided not to bid for the 2021-2025 rights. An RA spokesman said the governing body had not been notified of any such decision.

Some observers noted the broadcaster could be interested in disrupting RA’s plan to pitch a whole-of-game offering, potentially reducing the value of the overall rights package RA might sell to a rival such as Optus.